Get the free Life Insurance Needs Analysis - bsoundwealthbbcab

Show details

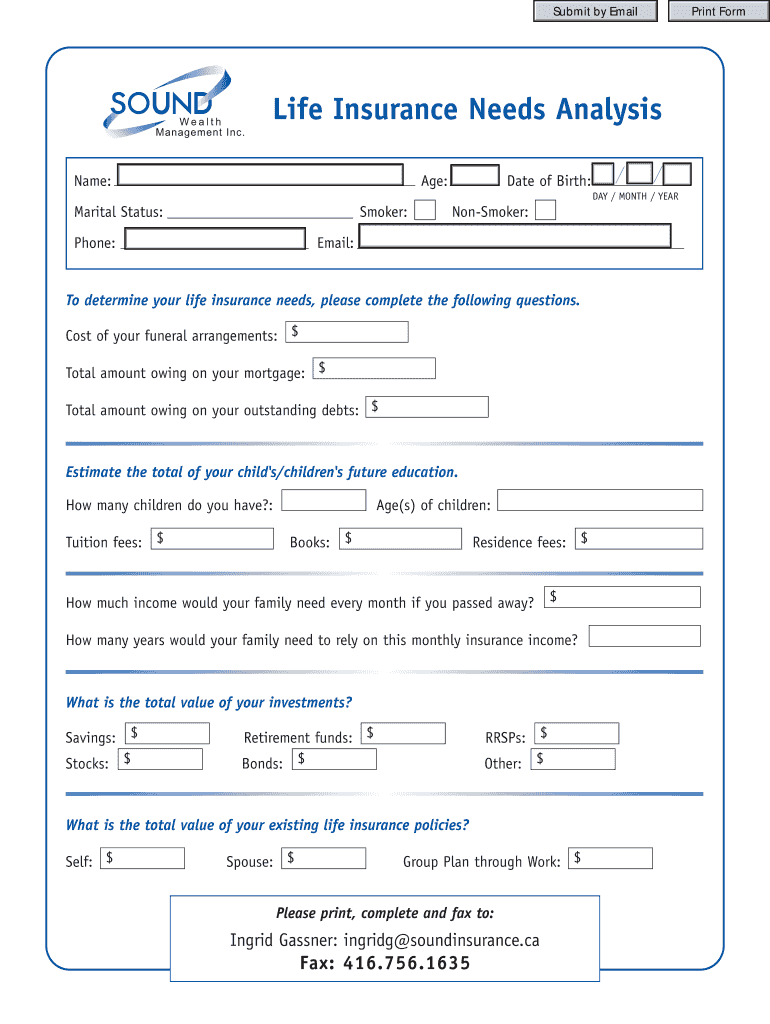

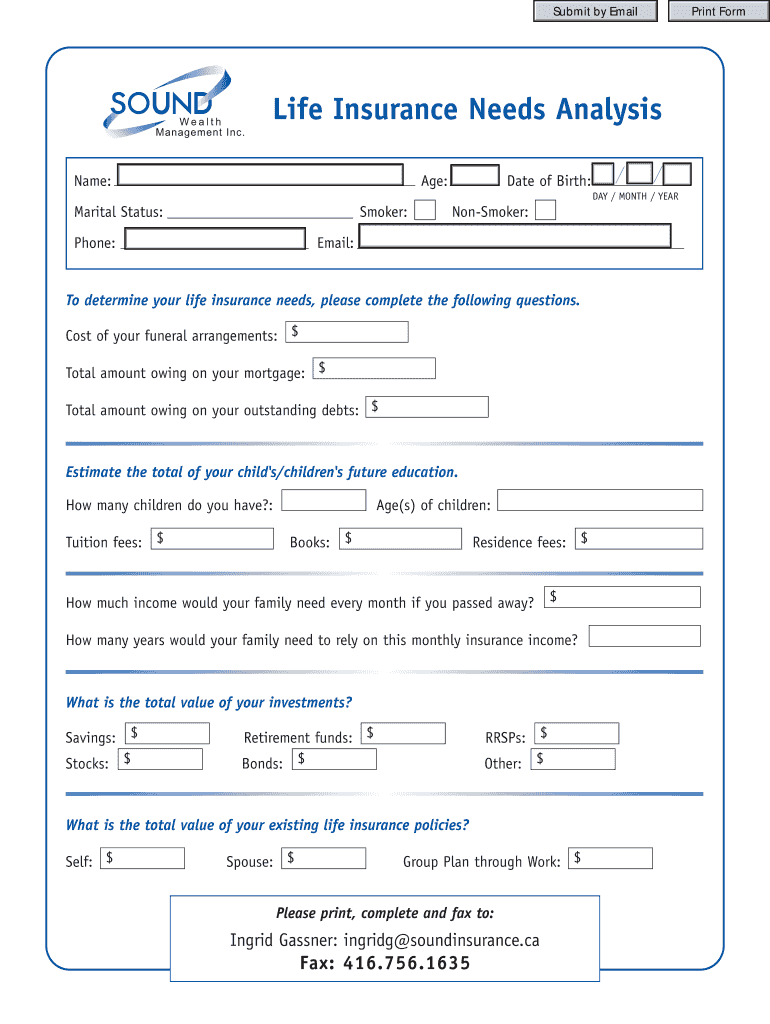

Submit by Email Life Insurance Needs Analysis Name: Age: Date of Birth: DAY / MONTH / YEAR Marital Status: Smoker: Phone: NonSmoker: Email: To determine your life insurance needs, please complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance needs analysis

Edit your life insurance needs analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance needs analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance needs analysis online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life insurance needs analysis. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance needs analysis

How to fill out a life insurance needs analysis:

01

Begin by gathering all relevant financial information, including income, debts, expenses, and assets.

02

Assess your current financial situation, taking into account your current income and expenses, as well as any outstanding debts or financial obligations.

03

Consider your future financial needs and goals, including any anticipated expenses such as education costs for children, mortgage repayments, or retirement savings.

04

Evaluate the financial impact of your absence on your dependents and loved ones. Consider how much money would be needed to replace your income and maintain their current standard of living in your absence.

05

Evaluate any existing life insurance coverage you may have, including group life insurance policies provided by your employer, to determine if additional coverage is needed.

06

Consider the length of time you will need life insurance coverage. For example, if you have a mortgage that will be paid off in 20 years, you may only need coverage for that period.

07

Take into account any medical conditions or lifestyle factors that may affect the cost of life insurance or the ability to obtain coverage.

08

Consult with a licensed insurance professional who can help you assess your needs accurately and guide you through the process.

09

Regularly review and update your life insurance needs analysis as your circumstances change, such as getting married, having children, or reaching important milestones in your life.

Who needs life insurance needs analysis?

01

Individuals who have dependents or loved ones who rely on their income to maintain their standard of living.

02

People with outstanding debts, such as mortgages, car loans, or student loans, that would burden their loved ones if they were to pass away.

03

Individuals who have financial goals or obligations that they wish to fulfill even in the event of their untimely demise, such as funding their children's education or leaving behind an inheritance.

04

Individuals with significant assets that may be subject to estate taxes upon their death, as life insurance can help cover these costs.

05

Anyone who wants to ensure their loved ones are financially protected and can cope with the expenses and challenges that may arise after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in life insurance needs analysis?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your life insurance needs analysis and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the life insurance needs analysis in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your life insurance needs analysis in seconds.

Can I create an electronic signature for signing my life insurance needs analysis in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your life insurance needs analysis and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is life insurance needs analysis?

Life insurance needs analysis is a process of evaluating an individual's financial situation and determining the amount of life insurance coverage needed to protect their loved ones financially.

Who is required to file life insurance needs analysis?

Individuals who are looking to purchase or update their life insurance policy are required to conduct a life insurance needs analysis.

How to fill out life insurance needs analysis?

To fill out a life insurance needs analysis, one must gather information about their current financial situation, including income, expenses, debts, savings, and future financial goals. This information is then used to calculate the amount of life insurance coverage needed.

What is the purpose of life insurance needs analysis?

The purpose of life insurance needs analysis is to ensure that an individual's loved ones are financially protected in the event of their death, by determining the appropriate amount of life insurance coverage needed.

What information must be reported on life insurance needs analysis?

Information such as income, expenses, debts, savings, and future financial goals must be reported on a life insurance needs analysis.

Fill out your life insurance needs analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Needs Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.