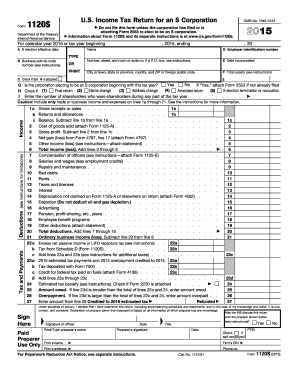

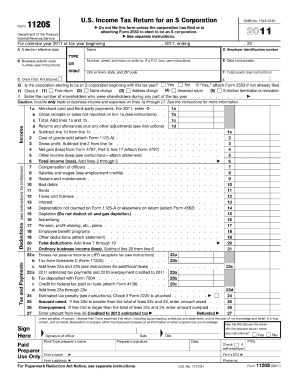

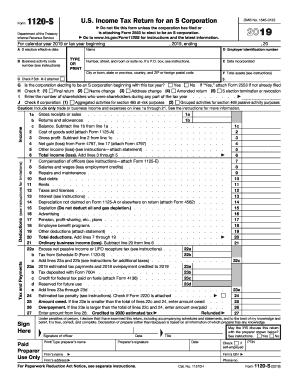

IRS 1120S - Schedule K-1 2011 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

About IRS 1120S - Schedule K-1 2011 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I notice an error after filing my IRS 1120S - Schedule K-1?

If you find an error after filing, you can submit an amended IRS 1120S - Schedule K-1 to correct any mistakes. It is essential to file the amendment as soon as possible to avoid issues with tax reporting for your shareholders.

How can I verify the status of my filed IRS 1120S - Schedule K-1?

To verify the status of your filed IRS 1120S - Schedule K-1, you can contact the IRS directly or use their online tools if available. Keeping track of your submission allows you to ensure that it has been processed without issues.

Are e-signatures accepted for the IRS 1120S - Schedule K-1?

E-signatures are generally accepted for IRS 1120S - Schedule K-1 forms, provided that they meet the IRS guidelines for electronic signatures. It is vital to follow proper protocols to ensure the validity of the signature used.

What documentation should I prepare if I receive an audit notice related to my IRS 1120S - Schedule K-1?

If you receive an audit notice regarding your IRS 1120S - Schedule K-1, prepare documentation such as your filed forms, supporting records, and any relevant correspondence. Being organized can help address any inquiries effectively.

What are some common errors when filing an IRS 1120S - Schedule K-1, and how can they be avoided?

Common errors include incorrect taxpayer identification numbers and misreported income. To avoid these mistakes, double-check all entries for accuracy and ensure consistency with other tax documents before submission.

See what our users say