Get the free Expense Reporting - smu

Show details

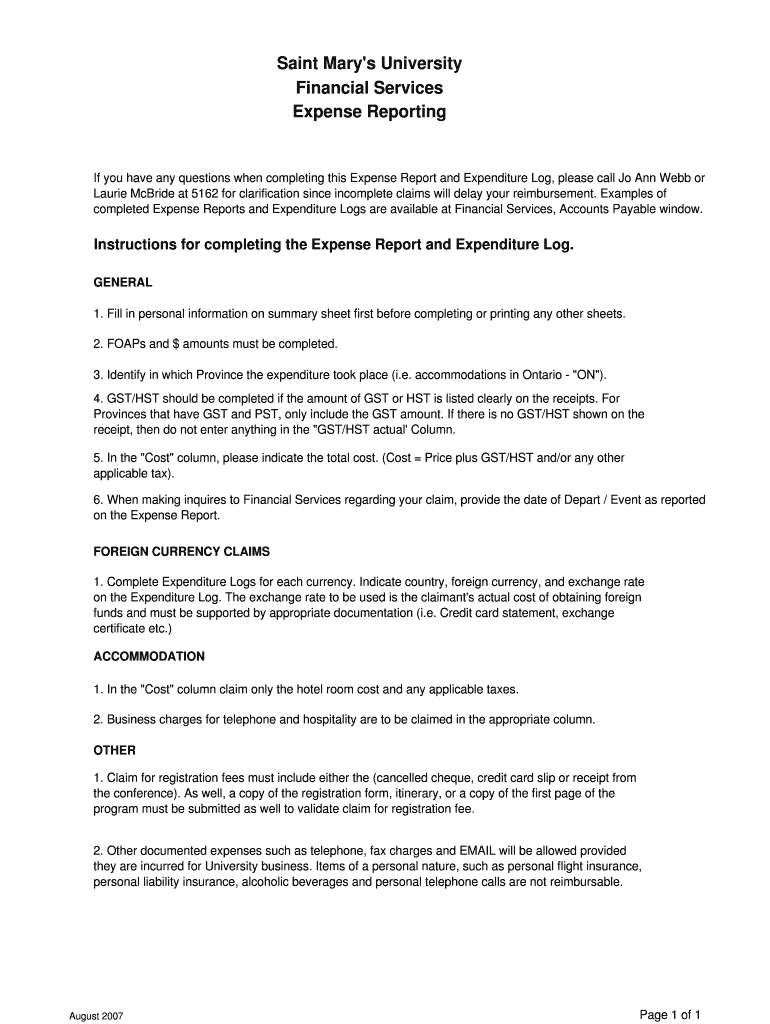

This document provides instructions and a format for reporting expenses incurred during university-related activities, including accommodation, transportation, and meals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expense reporting - smu

Edit your expense reporting - smu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expense reporting - smu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing expense reporting - smu online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit expense reporting - smu. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expense reporting - smu

How to fill out Expense Reporting

01

Gather all receipts and invoices related to your expenses.

02

Open the Expense Reporting form provided by your company.

03

Fill in your personal information, including your name and department.

04

Enter the date of each expense, along with its category (e.g., travel, meals, lodging).

05

List the amount spent for each expense and provide a brief description.

06

Attach scanned copies or photos of your receipts to the report.

07

Review the completed report for accuracy.

08

Submit the form along with the attached receipts to your supervisor or the finance department.

Who needs Expense Reporting?

01

Employees seeking reimbursement for work-related expenses.

02

Managers approving and tracking team expenses.

03

Finance departments for budget management and expense auditing.

04

Organizations aiming to maintain financial accountability.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between an invoice and an expense report?

What is the difference between an invoice and an expense report? An invoice is a request for payment from an external vendor or contractor. An expense report, on the other hand, is submitted by an employee to get reimbursed for business costs they've already paid out-of-pocket.

What is the T&E process?

Broadly speaking, corporate travel and expense management is the process of managing any expenses involved in business travel. This includes making travel bookings, managing budgets for business trips, recording expenses, and reimbursing employees who had to make out-of-pocket expenses during their travels.

How do I write an expense report?

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

How should expenses be reported?

Provide a brief description of the business purpose of the expenses submitted for reimbursement. Enter the date, type, and amount of each expense in the related column. Attach receipts paid by credit card or cash, or submit images of receipts for each expense.

What is an expense report in English?

An expense report can include the following information: Information about who made the purchase, and in the case that the report is being submitted on behalf of someone else, that person's information, such as the person's name, department, job title , employee identification number and contact information.

What is an expense in simple words?

An expense is a cost that a business experiences in running its operations. Expenses include wages, maintenance, rent, and depreciation. There are nonoperating expenses as well. Expenses are deducted from revenue to arrive at profits. Businesses are allowed to deduct certain expenses to help alleviate their tax burden.

What is an expenses report?

An expense report is a form used by employees to report all business expenses incurred by them on behalf of the organization. Typically these expenses are organized into various categories like: Utilities. Office Supplies. Business trip expenses.

How do you write an expense report?

6 Steps To Create An Expense Report Choose a Template (or Software) To make an expense report, you should use either a template or expense-tracking software. Edit the Columns. Add Itemized Expenses. Add up the Total. Attach Receipts, If Necessary. Print or Send the Report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Expense Reporting?

Expense Reporting is the process of documenting and submitting expenses incurred by employees for reimbursement or record-keeping purposes.

Who is required to file Expense Reporting?

Generally, all employees who incur work-related expenses and seek reimbursement from their employer are required to file Expense Reporting.

How to fill out Expense Reporting?

To fill out Expense Reporting, an employee typically needs to complete an expense report form detailing the expenses, attach receipts, and submit the report to their supervisor or the finance department.

What is the purpose of Expense Reporting?

The purpose of Expense Reporting is to ensure transparency in the reimbursement process, maintain accurate financial records, and manage organizational budgets effectively.

What information must be reported on Expense Reporting?

Expense Reporting must include information such as the date of the expense, the type of expense, the amount, purpose or details of the expense, and any supporting documentation like receipts.

Fill out your expense reporting - smu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expense Reporting - Smu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.