Get the free Standard Probate Form 24.0 Representation of Insolvency - trumbullprobate

Show details

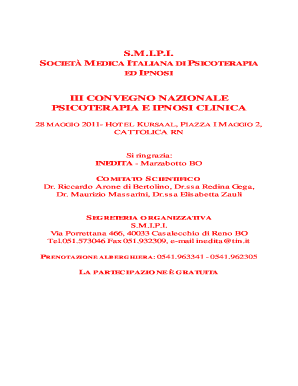

PROBATE COURT OF COUNTY, OHIO THOMAS A. SWIFT, JUDGE ESTATE OF, DECEASED CASE NO. REPRESENTATION OF INSOLVENCY R.C. 2117.15 The fiduciary states that the decedent died on. The fiduciary states that:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard probate form 240

Edit your standard probate form 240 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard probate form 240 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard probate form 240 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard probate form 240. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard probate form 240

01

Gather all necessary information: Before starting to fill out standard probate form 240, gather all the required information. This may include the decedent's personal details, such as full name, date of birth, date of death, social security number, and address.

02

Identify the assets: List all the assets that are part of the probate estate. This can include real estate, bank accounts, investments, vehicles, and any other valuable possessions owned solely by the deceased.

03

Determine the debts and expenses: Identify any outstanding debts or expenses related to the estate. This may include mortgages, credit card debts, utility bills, funeral expenses, and any other obligations that need to be settled.

04

Complete the personal representative section: Provide the necessary information about the personal representative of the estate. This individual is responsible for managing and distributing the assets according to the decedent's wishes and applicable laws.

05

Fill out the beneficiary information: Specify the beneficiaries who are entitled to receive a share of the estate. Include their full names, addresses, and the portion of the estate they are entitled to inherit.

06

Provide asset details: For each asset listed, provide specific details such as the property's address, bank account numbers, vehicle identification numbers, and any other relevant information.

07

Calculate the value of the estate: Determine the total value of the estate by adding up the appraised value of each asset and subtracting any outstanding debts or expenses. This will help in determining any potential estate taxes or distribution plans.

08

Sign and date the form: Once all the necessary information has been filled out correctly, sign and date the form in the designated areas. Make sure to check for any additional requirements or forms that need to be submitted along with probate form 240.

Who needs standard probate form 240?

01

Executors or personal representatives: The personal representative responsible for managing the probate process and distributing the assets of the deceased's estate would typically need to fill out standard probate form 240.

02

Beneficiaries: The beneficiaries entitled to receive a share of the estate may also need to be aware of form 240, as it declares their inheritance and provides necessary details for the distribution process.

03

Legal professionals: Attorneys or legal professionals involved in assisting with the probate process may need to be familiar with and assist in filling out standard probate form 240.

It is important to note that the specific requirements for filling out form 240 may vary depending on the jurisdiction and the complexity of the estate. It is recommended to consult with a legal professional or seek guidance from the relevant probate court for accurate and jurisdiction-specific instructions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is standard probate form 240?

Standard probate form 240 is a legal document used in the probate process to gather and report information about the decedent's estate and assets.

Who is required to file standard probate form 240?

Executors or administrators of an estate are required to file standard probate form 240 during the probate process.

How to fill out standard probate form 240?

Standard probate form 240 can be filled out by providing accurate information about the decedent's assets, debts, beneficiaries, and other required details as specified in the form. It is recommended to seek legal advice or consult the probate court for guidance on accurately completing the form.

What is the purpose of standard probate form 240?

The purpose of standard probate form 240 is to assist in the administration of the decedent's estate by gathering important information for the probate process, including asset valuation and distribution details.

What information must be reported on standard probate form 240?

Standard probate form 240 typically requires reporting information such as the decedent's assets, debts, beneficiaries, estate valuation, real estate holdings, financial accounts, insurance policies, and other relevant details as specified in the form.

How can I manage my standard probate form 240 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign standard probate form 240 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit standard probate form 240 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing standard probate form 240.

How do I fill out the standard probate form 240 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign standard probate form 240 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your standard probate form 240 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Probate Form 240 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.