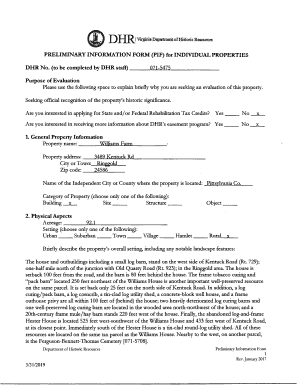

Get the free suitability statement for self managed superannuation funds (SMSFs) entering into li...

Show details

This document provides a comprehensive understanding of the suitability of Limited Recourse Borrowing Arrangements for Self Managed Superannuation Funds, assisting trustees in making informed decisions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign suitability statement for self

Edit your suitability statement for self form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your suitability statement for self form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing suitability statement for self online

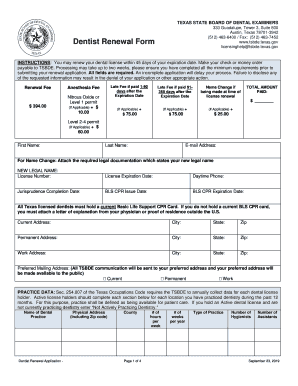

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit suitability statement for self. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out suitability statement for self

How to fill out suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)

01

Understand the regulatory requirements for SMSFs and LRBAs.

02

Gather all relevant financial information about the SMSF and its members.

03

Assess the investment strategy of the SMSF to ensure it aligns with the LRBA.

04

Evaluate the members' needs and objectives to ensure suitability.

05

Complete the suitability statement by detailing why the LRBA is suitable for the SMSF.

06

Include considerations such as risks, benefits, and potential impacts on retirement savings.

07

Review the statement for compliance with legal and regulatory standards before submission.

Who needs suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

01

Trustees of self managed superannuation funds (SMSFs) that are considering entering into limited recourse borrowing arrangements (LRBAs).

02

Financial advisers providing services to SMSF trustees.

03

Compliance officers or auditors reviewing SMSFs involved in LRBAs.

Fill

form

: Try Risk Free

People Also Ask about

Can I withdraw money from a self-managed super fund?

If your super benefits are categorised as unrestricted you can withdraw your super benefits at any time but you may be subject to personal tax if you are under 60.

What is limited recourse borrowing SMSF?

An LRBA is an arrangement where the: SMSF trustee obtains a loan that is used to purchase an acquirable asset. asset is held in a separate trust from the SMSF, known as a holding trust. SMSF acquires beneficial interest in the asset and after repaying the loan has the right to legal ownership of the asset.

Can self-managed super funds borrow money?

Your SMSF can borrow money for a maximum of 90 days to meet an outstanding superannuation surcharge liability. The amount you borrow can't exceed 10% of your SMSF's total assets.

How much can I borrow through SMSF?

Features Features Minimum loan amount $150,000 Maximum loan amount $2,000,000 Maximum loan term Principal & Interest: Variable – 15 years (Commercial) 20 years (Residential); Fixed - 5 years Interest Only: Variable - 5 years; Fixed - 5 years Interest type Variable or Fixed10 more rows

How do you borrow money in a self managed super fund?

SMSF Trustees can borrow to invest by using a Limited Recourse Borrowing Arrangement (LRBA). To set up an LRBA, your SMSF will take out a loan with a lender and invest the borrowed money in the investments you want to acquire. The lender/security trustee manages all the loan administration.

What is a self-managed superannuation fund?

A self-managed super fund (SMSF) is a way of saving for retirement. The members run it for their own benefit.

How to set up LRBA?

Steps To Structure A LRBA Review Your SMSF's Trust Deed And Investment Strategy. Establish A Bare Trust. Choose A Lender And Comply With Safe Harbour Rules. Execute Legal Documentation. Purchase The Asset.

How do I access self managed super funds early?

Early Access Preservation Age. Severe Financial Hardship - Under Preservation Age. Severe Financial Hardship - Over Preservation Age and 39 weeks. Compassionate Grounds. Permanent Incapacity. Temporary Incapacity. Terminal Illness. Penalties for Early Access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

A suitability statement for SMSFs entering into LRBAs is a written document that assesses whether a borrowing arrangement is appropriate for the SMSF's members, considering their financial situation, investment objectives, and the risks involved.

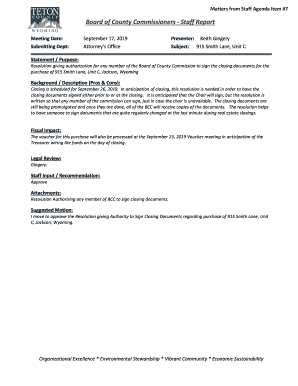

Who is required to file suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

The trustee of the SMSF is required to prepare and file the suitability statement before entering into LRBAs.

How to fill out suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

To fill out the suitability statement, the trustee must gather relevant financial information, assess the members' risk tolerance and investment goals, and document this analysis in the statement, ensuring compliance with regulatory requirements.

What is the purpose of suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

The purpose of the suitability statement is to ensure that the SMSF members fully understand the risks and benefits of the borrowing arrangement, ensuring that it meets their investment needs and safeguards the fund's assets.

What information must be reported on suitability statement for self managed superannuation funds (SMSFs) entering into limited recourse borrowing arrangements (LRBAs)?

The suitability statement must report information such as members' financial situation, investment objectives, risk tolerance, analysis of the borrowing arrangement, ongoing costs, and the potential impact on their retirement savings.

Fill out your suitability statement for self online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Suitability Statement For Self is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.