Get the free CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY

Show details

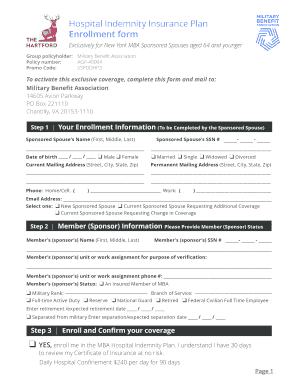

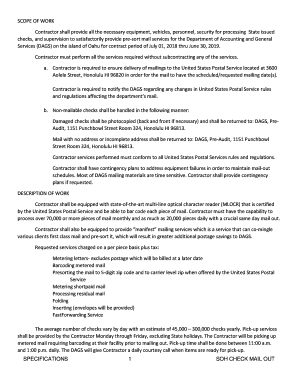

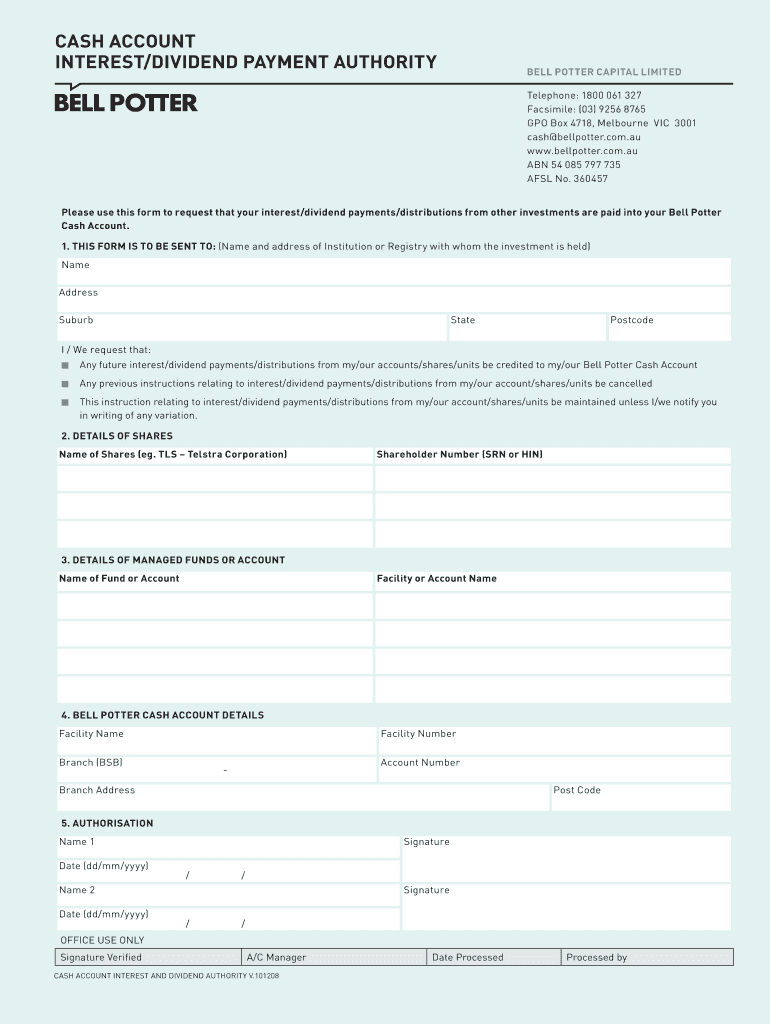

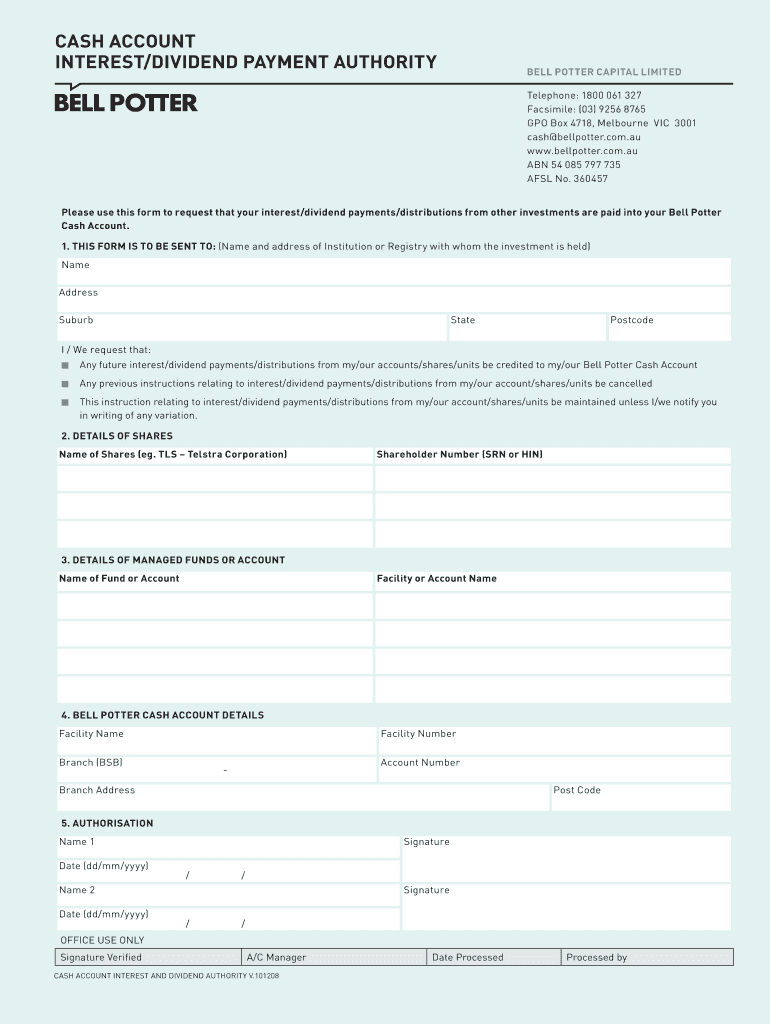

This form is used to request that interest/dividend payments from investments are paid into a Bell Potter Cash Account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash account interestdividend payment

Edit your cash account interestdividend payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash account interestdividend payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash account interestdividend payment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cash account interestdividend payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash account interestdividend payment

How to fill out CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY

01

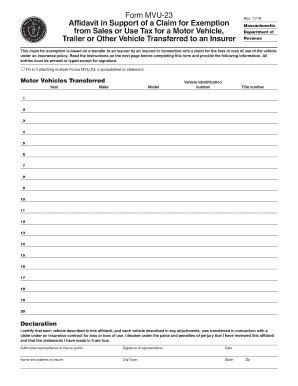

Start with your personal information at the top of the form, including your name and contact details.

02

Provide your account number where indicated.

03

Specify the type of payment you are authorizing, whether interest or dividend payments.

04

Fill in the payment distribution method (e.g., bank transfer, check).

05

If opting for bank transfer, provide your bank account details carefully.

06

Read the terms and conditions related to the payments.

07

Sign and date the form to authorize the payment.

Who needs CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

01

Anyone who has a cash account that generates interest or dividends and wants to receive these payments directly.

02

Investors who prefer to manage their payment methods for better cash flow.

03

Clients of financial institutions looking to streamline their interest and dividend payments.

Fill

form

: Try Risk Free

People Also Ask about

Why doesn't Warren Buffett pay a dividend?

Unlike many stocks in Berkshire's blue-chip investment portfolio, Berkshire itself doesn't pay dividends to shareholders. Buffett has consistently used the money that would have been paid to shareholders to invest, making more money than they would have received in dividend income.

How to record the payment of a cash dividend?

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

What happens when a company pays a cash dividend?

Cash dividends occur when companies pay shareholders a portion of their earnings in cash. When this happens, the company's share price drops by roughly the same amount as the dividend amount, since the economic value is simply transferring from the company to shareholders instead of being reinvested in the company.

What is cash dividend payment?

A cash dividend is a payment that a corporation makes to its shareholders, typically drawn from the company's earnings or profits. These distributions, paid on a per-share basis, give investors a tangible return on their investment.

What is a cash dividend payment?

A cash dividend is a payment made by a company to its shareholders in the form of cash. This distribution is typically drawn from the company's profits and is paid on a per-share basis. For example, if a company declares a $2 cash dividend and you own 100 shares, you will receive $200.

What is cash dividend with an example?

A cash dividend is typically expressed on a per-share basis. For instance, a company may declare a dividend of ₹5 per share, meaning that shareholders would get ₹5 for every share they own.

How does cash dividend work?

Cash dividend - This is the most common type of dividend. Shareholders receive a cash payment for each share of a company they own. Cash dividends are usually paid on a regular basis, such as half-yearly or annually. Stock dividend - Instead of a cash payment, shareholders receive additional shares in a company.

Who has the authority to declare a cash dividend?

The board of directors issues the declaration stating how much will be paid out in dividends to shareholders and over what timeframe. The declaration date is the first of four important dates in the dividend payout process. The three remaining key dates are the ex-date, the record date, and the payment date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY is a form that allows individuals or entities to authorize the payment of interest or dividends directly into their cash accounts. This typically applies to dividends from stocks or interest from savings and investment accounts.

Who is required to file CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

Individuals or entities receiving interest or dividend payments that wish to have these payments deposited directly into their cash accounts are required to file the CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY.

How to fill out CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

To fill out the CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY, you need to provide details such as your name, account number, and the financial institution where the account is held. You may also need to provide tax identification information and signature for authorization.

What is the purpose of CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

The purpose of the CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY is to streamline the process of receiving interest and dividend payments by allowing for direct deposits, which can provide quicker access to funds and reduce the need for paper checks.

What information must be reported on CASH ACCOUNT INTEREST/DIVIDEND PAYMENT AUTHORITY?

The information that must be reported includes the recipient's name, address, account number, financial institution details, tax identification number, and any relevant signatures required for authorization.

Fill out your cash account interestdividend payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Account Interestdividend Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.