Get the free Singapores leading motor insurer lets you

Show details

Servomotor InsuranceSingapores leading motor insurer lets you

drive with confidence.

That is the Income difference.

Benefits at a glance

Orange Force Accident

Response Team at your

service 24×7

24hour

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign singapores leading motor insurer

Edit your singapores leading motor insurer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your singapores leading motor insurer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing singapores leading motor insurer online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit singapores leading motor insurer. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out singapores leading motor insurer

How to fill out Singapore's leading motor insurer:

01

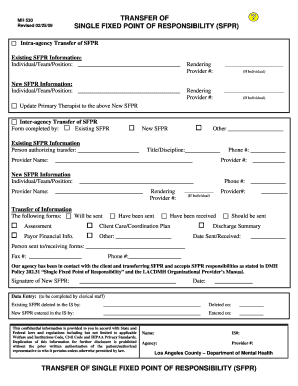

Gather necessary information: Start by collecting all the required information, such as your personal details, vehicle information, driving history, and any previous insurance coverage details. Ensure you have all the relevant documents and records ready.

02

Research insurance policies: Familiarize yourself with the different insurance policies offered by Singapore's leading motor insurer. Compare the coverage, benefits, and premiums of each policy to find the one that best suits your needs.

03

Contact the insurer: Reach out to Singapore's leading motor insurer through their website, customer care hotline, or visit their local branch. Ask for guidance on the specific steps and documentation required to fill out their insurance application.

04

Fill out the application form: Once you have the necessary paperwork and information, fill out the application form accurately and thoroughly. Ensure all the details provided are correct and up to date. Double-check for any errors or incomplete sections.

05

Provide supporting documents: Along with the application form, you will need to attach supporting documents. This may include a copy of your identification documents, driving license, vehicle registration documents, and any additional documents as specified by the insurer.

06

Review the application: Before submitting the completed application, carefully review all the information provided. Make sure there are no mistakes or missing data. Taking this step will help minimize any potential delays or issues in the application process.

07

Submit the application: Once you are satisfied with the application, submit it according to the instructions provided by Singapore's leading motor insurer. This may involve online submission, mailing the documents, or visiting their branch in person.

Who needs Singapore's leading motor insurer?

01

Vehicle owners: Anyone who owns a vehicle, whether it is a car, motorcycle, or other motorized vehicles, may need the insurance coverage provided by Singapore's leading motor insurer.

02

Drivers: Individuals who regularly operate vehicles, whether they are the owner or a designated driver, should consider obtaining insurance from Singapore's leading motor insurer to protect themselves and others in the event of an accident.

03

Businesses with a vehicle fleet: Companies that have a fleet of vehicles for various purposes, such as delivery services or transportation, can benefit from the comprehensive coverage offered by Singapore's leading motor insurer.

In summary, filling out the application for Singapore's leading motor insurer involves gathering necessary information, researching insurance policies, contacting the insurer, filling out the application form, providing supporting documents, reviewing the application, and finally submitting it. Anyone who owns a vehicle, regularly drives, or operates a vehicle fleet may require the insurance coverage provided by Singapore's leading motor insurer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is singapores leading motor insurer?

Singapore's leading motor insurer is NTUC Income.

Who is required to file singapores leading motor insurer?

All motor insurers operating in Singapore are required to file Singapore's leading motor insurer.

How to fill out singapores leading motor insurer?

To fill out Singapore's leading motor insurer, insurers need to provide specific information about their motor insurance policies and coverage.

What is the purpose of singapores leading motor insurer?

The purpose of Singapore's leading motor insurer is to provide data on the motor insurance market in Singapore for regulatory and monitoring purposes.

What information must be reported on singapores leading motor insurer?

Information such as premium income, claims data, and policy details must be reported on Singapore's leading motor insurer.

How can I edit singapores leading motor insurer from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including singapores leading motor insurer. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in singapores leading motor insurer without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your singapores leading motor insurer, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the singapores leading motor insurer electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your singapores leading motor insurer in seconds.

Fill out your singapores leading motor insurer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Singapores Leading Motor Insurer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.