Get the free Assessment - Non Individual

Show details

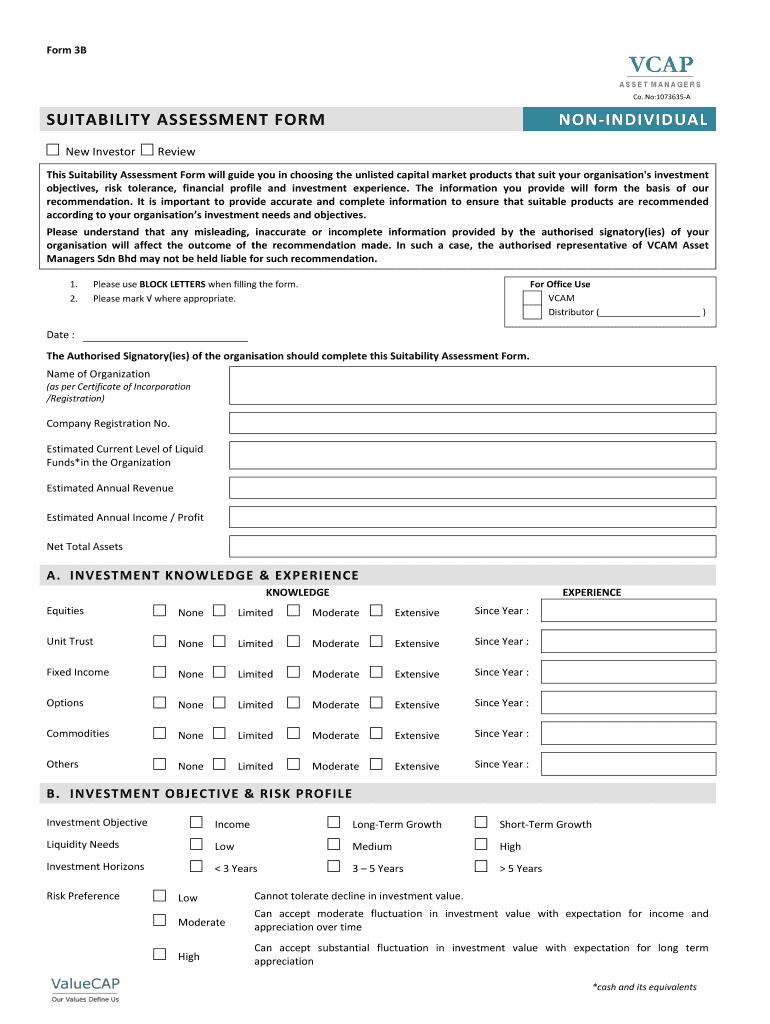

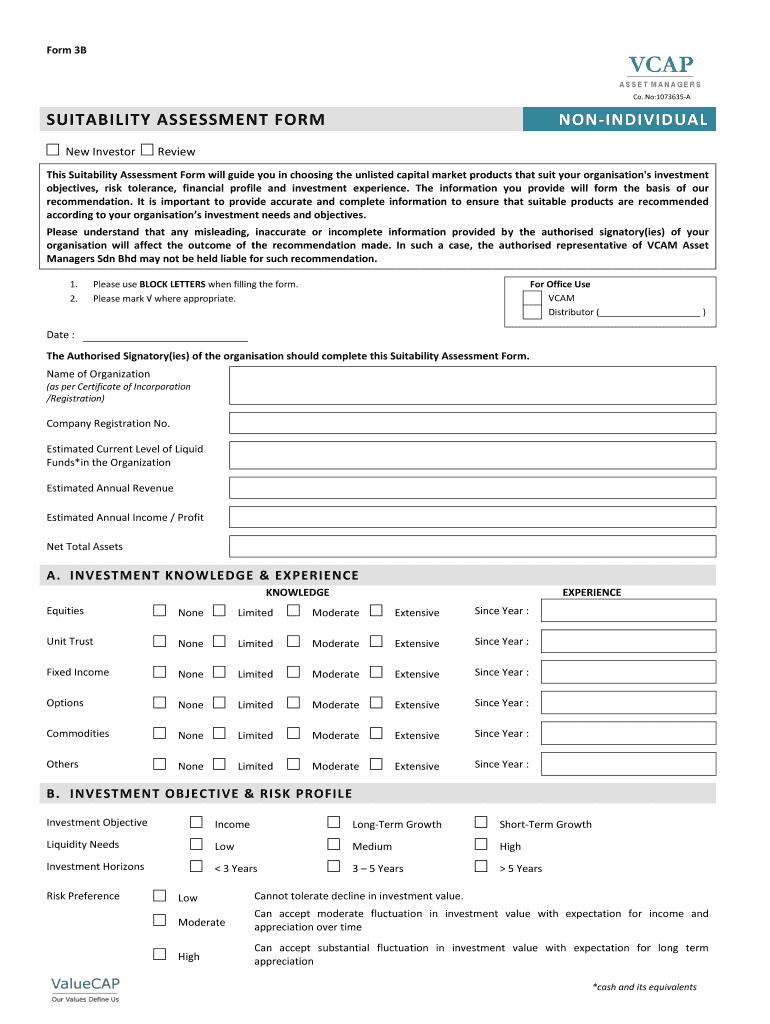

Form 3B Co. No:1073635A SUITABILITY ASSESSMENT FORM New Investor INDIVIDUAL Review This Suitability Assessment Form will guide you in choosing the unlisted capital market products that suit your organization's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assessment - non individual

Edit your assessment - non individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assessment - non individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit assessment - non individual online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit assessment - non individual. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assessment - non individual

How to fill out assessment - non individual:

01

Begin by carefully reading all instructions and guidelines provided with the assessment. Make sure you understand the purpose of the assessment and what information you need to provide.

02

Collect all the necessary information and documentation required for the assessment. This may include financial statements, legal documents, organizational charts, or any other relevant information specific to the non-individual entity being assessed.

03

Start by providing basic information about the non-individual entity in the designated sections of the assessment form. This may include the entity's name, address, contact details, and other relevant identifying information.

04

Follow the instructions and prompts provided in the assessment form to provide details about the entity's structure, ownership, and governance. This could include information about shareholders, board members, or any other individuals or entities that have a controlling interest.

05

Provide financial information as required. This may include disclosing the entity's revenue, expenses, assets, and liabilities. Be sure to fill in all the relevant financial sections accurately and thoroughly.

06

Answer any additional questions or sections related to the specific assessment you are filling out. This may involve providing information about the entity's compliance with regulations, its risk management practices, or any other relevant areas of assessment.

07

Review the completed assessment form to ensure all sections have been filled out correctly and all required information has been provided. Double-check for any errors or omissions that may need to be corrected before submission.

Who needs assessment - non individual?

01

Non-individual entities, such as corporations, partnerships, organizations, or government agencies, may require assessments to evaluate their performance, compliance, or eligibility for certain benefits or certifications.

02

Assessments for non-individual entities can be necessary for regulatory compliance, financial audits, legal purposes, or as part of a due diligence process during a business transaction.

03

Investors, lenders, or grant providers may also require assessments of non-individual entities to assess their financial stability, risk exposure, or operational efficiency before making investment decisions or providing financing.

In summary, individuals or organizations that need to fill out assessments for non-individual entities should carefully follow the instructions provided, gather all necessary information, and accurately fill out each section of the assessment form. Non-individual entities requiring assessments include businesses, organizations, or government agencies, and these assessments may be necessary for various purposes such as compliance, audits, or financial evaluations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send assessment - non individual to be eSigned by others?

Once you are ready to share your assessment - non individual, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in assessment - non individual?

The editing procedure is simple with pdfFiller. Open your assessment - non individual in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out assessment - non individual using my mobile device?

Use the pdfFiller mobile app to fill out and sign assessment - non individual. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is assessment - non individual?

Assessment for non-individuals refers to the evaluation of taxes or obligations for entities such as corporations, partnerships, and other legal entities.

Who is required to file assessment - non individual?

Non-individuals like corporations, partnerships, and other legal entities are required to file assessment for taxation purposes.

How to fill out assessment - non individual?

Assessment for non-individuals can be filled out by providing detailed information about the entity's financial transactions, assets, and liabilities.

What is the purpose of assessment - non individual?

The purpose of assessment for non-individuals is to ensure compliance with tax laws and determine the amount of taxes owed by the entity.

What information must be reported on assessment - non individual?

Non-individuals must report their income, expenses, assets, liabilities, and any other relevant financial information on their assessment forms.

Fill out your assessment - non individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assessment - Non Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.