Get the free British Smaller Companies EIS Fund

Show details

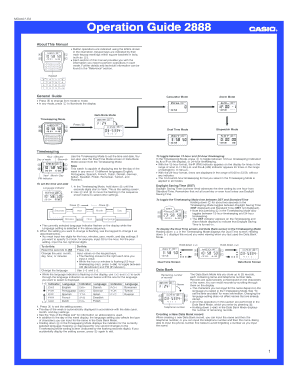

BSC EIS Fund Prospectus Aug 2011 NEW BSC EIS Fund Prospectus Q6.QED 15×11/2011 09:16-Page 1 British Smaller Companies EIS Fund A new Growth Capital EIS fund from the top performing1 VCT investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign british smaller companies eis

Edit your british smaller companies eis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your british smaller companies eis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit british smaller companies eis online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit british smaller companies eis. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out british smaller companies eis

How to fill out British Smaller Companies EIS:

01

Gather all required documentation: Start by gathering all the necessary paperwork such as your personal details, company information, financial statements, and any other relevant documentation required for the application.

02

Familiarize yourself with the eligibility criteria: Ensure that you meet all the eligibility criteria for the British Smaller Companies EIS. This may include having a qualifying trade, being an unquoted company, and meeting various financial thresholds.

03

Complete the application form: Fill out the application form for the British Smaller Companies EIS accurately and provide all the required information. Be thorough but concise in your responses.

04

Seek professional advice if needed: If you are unsure about any part of the application process or have complex circumstances, it is wise to seek guidance from a qualified professional such as an accountant or tax advisor with experience in EIS applications.

05

Double-check your application: Before submitting your application, carefully review all the provided information to ensure accuracy. Any mistakes or missing information can delay or even jeopardize the process.

06

Submit the application: Once you are confident that your application is complete and accurate, submit it to the relevant authority or body responsible for processing British Smaller Companies EIS applications.

Who needs British Smaller Companies EIS:

01

Entrepreneurs and Startups: British Smaller Companies EIS is especially beneficial for entrepreneurs and startups seeking investment capital. It provides a tax-efficient way for these companies to raise funds, attract investors, and fuel growth.

02

Investors: Individuals who are looking to invest in small and growing businesses can benefit from British Smaller Companies EIS. By investing in qualifying companies, they can access tax reliefs such as Income Tax relief, Capital Gains Tax deferral, and Inheritance Tax exemptions.

03

Small and Medium-sized Enterprises (SMEs): SMEs that meet the criteria for British Smaller Companies EIS may find it advantageous to apply. It can help them secure vital funding, promote growth, and potentially attract investors by offering the associated tax benefits.

Please note that it is important to consult with a professional advisor for specific guidance tailored to your circumstances when considering British Smaller Companies EIS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the british smaller companies eis electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your british smaller companies eis in seconds.

Can I edit british smaller companies eis on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign british smaller companies eis on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete british smaller companies eis on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your british smaller companies eis. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is british smaller companies eis?

British Smaller Companies EIS (Enterprise Investment Scheme) is a government scheme that encourages investment in small and growing companies by offering tax relief to investors.

Who is required to file british smaller companies eis?

Companies that meet the criteria set by the government and wish to raise funds through this scheme are required to file British Smaller Companies EIS.

How to fill out british smaller companies eis?

To fill out British Smaller Companies EIS, companies need to provide detailed information about their business, financial projections, and how the investment will be used.

What is the purpose of british smaller companies eis?

The purpose of British Smaller Companies EIS is to incentivize investment in smaller companies, boost economic growth, and create employment opportunities.

What information must be reported on british smaller companies eis?

Companies need to report information such as their business plan, financial performance, use of funds, and how the investment aligns with the criteria set by the government.

Fill out your british smaller companies eis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

British Smaller Companies Eis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.