Get the free Deed of Trust to Secure Assumption

Show details

Este documento es un contrato de fideicomiso que asegura la asunción de la propiedad en un procedimiento de divorcio, incluyendo términos de responsabilidad del otorgante, derechos del beneficiario

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of trust to

Edit your deed of trust to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of trust to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of trust to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deed of trust to. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of trust to

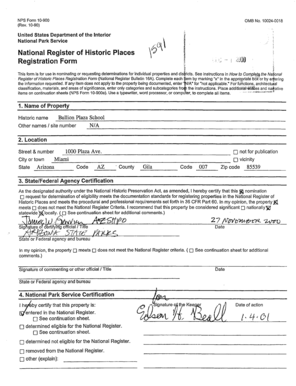

How to fill out Deed of Trust to Secure Assumption

01

Begin by identifying the parties involved, including the trustor (borrower), the trustee (the one who holds the title), and the beneficiary (lender).

02

Obtain the appropriate Deed of Trust form specific to your state or locality.

03

Fill in the legal names and addresses of all parties involved in the deed.

04

Clearly describe the property being secured by the deed, including its legal description.

05

Specify the amount of the loan and the terms of repayment.

06

Include any additional terms or provisions that need to be part of the agreement.

07

Review the document for completeness and accuracy to avoid any legal issues.

08

Have the parties sign the document in the presence of a notary public to ensure its validity.

09

Record the executed Deed of Trust with the appropriate local government office to make it legally binding.

Who needs Deed of Trust to Secure Assumption?

01

Homebuyers who are assuming an existing mortgage.

02

Lenders who want to secure a loan with a legal claim against a property.

03

Real estate investors looking to secure financing through a trust arrangement.

04

Individuals or entities involved in real estate transactions that require a legal framework for assumption.

Fill

form

: Try Risk Free

People Also Ask about

Can you sell a house with a deed of trust?

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

What is a deed of trust in English?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

What is a deed of trust in simple terms?

The deed of trust, sometimes called a “trust deed,” states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

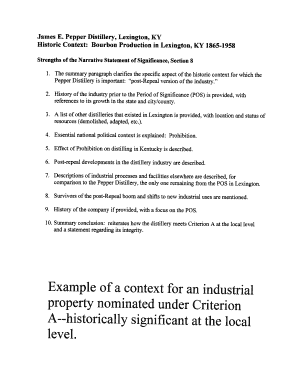

What is the assumption of the deed of trust?

As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

What does deed of assumption mean?

: a deed by which a trustee assumes or appoints a new cotrustee.

What are the disadvantages of a trust deed?

Trust Deed Disadvantages You will be unable to obtain credit. They are not appropriate for secured obligations. They can cause issues for business owners. Your trustee has the authority to claim new assets.

Why do lenders prefer a deed of trust over a mortgage?

Foreclosure details: When your lender forecloses with a deed of trust, the process will usually take less time and money to complete. However, foreclosure with a mortgage can be a lengthy process since you must go through the courts. Therefore, it can eat up a lot of time and money.

What does deed of assumption mean?

: a deed by which a trustee assumes or appoints a new cotrustee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my deed of trust to in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your deed of trust to and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the deed of trust to in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your deed of trust to and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit deed of trust to straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing deed of trust to.

What is Deed of Trust to Secure Assumption?

A Deed of Trust to Secure Assumption is a legal document that secures the assumption of a mortgage by allowing a new borrower to take over the obligations of the original borrower, ensuring the lender's interests are protected.

Who is required to file Deed of Trust to Secure Assumption?

Typically, the original borrower and the new borrower are required to file the Deed of Trust to Secure Assumption. The lender may also need to be involved in the process.

How to fill out Deed of Trust to Secure Assumption?

To fill out a Deed of Trust to Secure Assumption, you need to include the names of the original borrower, the new borrower, the lender, the property description, loan details, and any specific terms of the assumption. It is advisable to consult with a legal professional for accuracy.

What is the purpose of Deed of Trust to Secure Assumption?

The purpose of a Deed of Trust to Secure Assumption is to formally document the transfer of mortgage obligations from the original borrower to the new borrower, ensuring that the lender can enforce the mortgage terms against the new borrower.

What information must be reported on Deed of Trust to Secure Assumption?

The Deed of Trust to Secure Assumption must report information such as the names of the parties involved (original and new borrowers), the lender's name, property address, loan amount, terms of the assumption, and signatures of the relevant parties.

Fill out your deed of trust to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Trust To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.