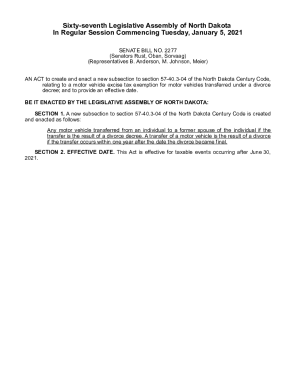

Get the free NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969

Show details

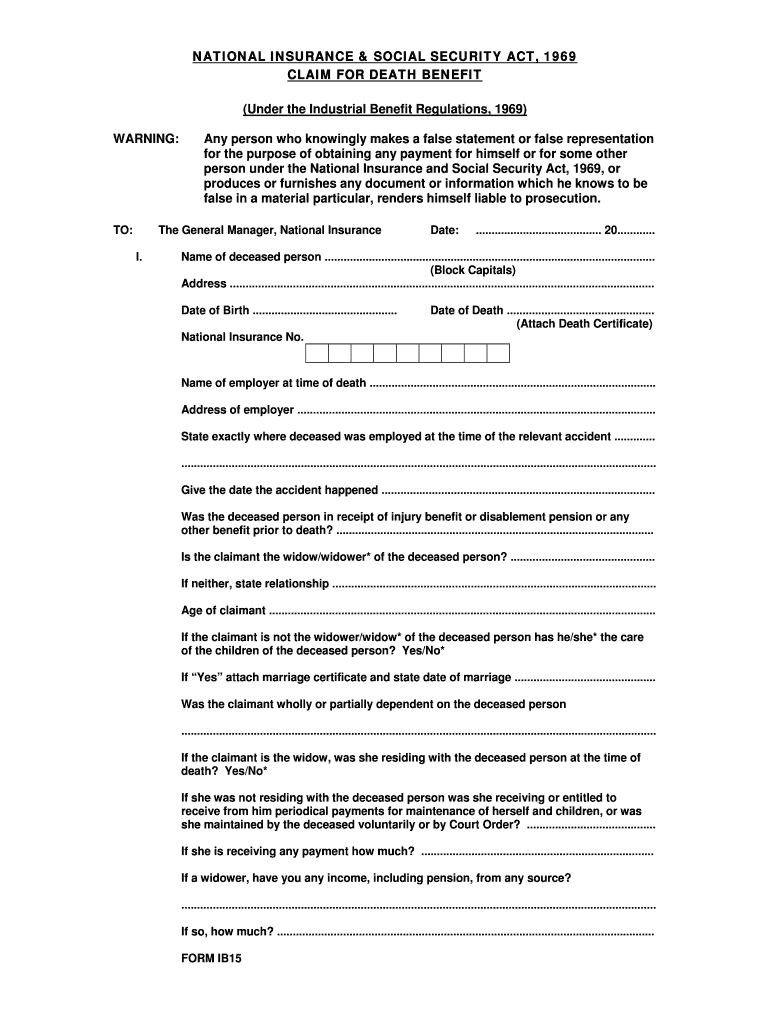

This document is used for claiming death benefits under the National Insurance and Social Security Act, 1969, and outlines the necessary information and declarations required from the claimant regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign national insurance social security

Edit your national insurance social security form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your national insurance social security form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing national insurance social security online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit national insurance social security. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out national insurance social security

How to fill out NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969

01

Obtain the National Insurance & Social Security Act, 1969 document from the relevant authority or website.

02

Read the guidelines provided in the document carefully to understand the purpose of the act.

03

Gather all necessary personal information such as your name, address, and identification details.

04

Complete the application form, ensuring that each section is filled out accurately and completely.

05

Provide any required supporting documents, such as proof of identity or income, as outlined in the guidelines.

06

Review your completed application for any errors or omissions.

07

Submit the application form along with any supporting documents to the designated office or online portal.

08

Keep a copy of your application and any submission receipts for your records.

Who needs NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

01

Individuals seeking social security benefits.

02

Employees who need to contribute to national insurance schemes.

03

Employers who must comply with national insurance regulations.

04

Self-employed individuals who wish to access social security services.

05

Citizens looking for assistance in case of unemployment, sickness, or retirement.

Fill

form

: Try Risk Free

People Also Ask about

What are the pros of the Social Security Act?

Right now, Social Security provides a guaranteed income, paying benefits every month for life, with increases for inflation. After adjusting for risk, Social Security has a rate of return equal to that of any mix of financial assets in private accounts.

What are the three major parts of the Social Security Act?

The Social Security Act gave the board three major assignments. Public Assistance. This was a federal-state program designed to provide assistance on the basis of need for persons over 65 years of age, dependent children and the needy blind. Unemployment Compensation. Old-Age Insurance.

What was the reason for the Social Security Act?

On August 14, 1935, President Franklin D. Roosevelt signed into law the Social Security Act — a monumental legislative achievement that protects our seniors, uplifts our citizens, and sustains the livelihoods of hardworking Americans who devoted their professions to bettering our country.

What did the Social Security Act do and why was it important?

An act to provide for the general welfare by establishing a system of Federal old-age benefits, and by enabling the several States to make more adequate provision for aged persons, blind persons, dependent and crippled children, maternal and child welfare, public health, and the administration of their unemployment

Did the Social Security Act include national health insurance?

The 1965 amendments to the Social Security Act established two separate but coordinated health insurance plans for persons aged 65 or older. The compulsory Hospital Insurance ( HI ) program is Part A of Medicare, and a voluntary program of Supplementary Medical Insurance ( SMI ) is Part B.

Why was the Social Security Act the most important part of the New Deal?

The significance of the new social insurance program was that it sought to address the long-range problem of economic security for the aged through a contributory system in which the workers themselves contributed to their own future retirement benefit by making regular payments into a joint fund.

What is the National Insurance Act in England?

The National Insurance Act 1911 (1 & 2 Geo. 5. c. 55) created National Insurance, originally a system of health insurance for industrial workers in Great Britain based on contributions from employers, the government, and the workers themselves.

What is the purpose of the Social Security Act 1991?

The Social Security Act 1991 and the Social Security (Administration) Act 1999 govern entitlement to and administration of a number of benefits, including the age pension, disability support pension and child disability assistance, carer payment and allowance, parenting payment, youth allowance, Austudy, Newstart

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

The National Insurance & Social Security Act, 1969 is a legislation that aims to provide social insurance and security benefits to workers in the formal sector. It establishes a framework for compulsory insurance for certain risks including sickness, maternity, and unemployment.

Who is required to file NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

Employers and employees in the formal sector are required to file under the National Insurance & Social Security Act, 1969. This includes all businesses that employ workers who are covered by the Act.

How to fill out NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

To fill out the National Insurance & Social Security Act, 1969, employers need to complete the prescribed forms provided by the government. This includes providing information about the employees, their wages, and relevant contributions. It's advisable to consult with a legal expert or the relevant authorities for precise instructions.

What is the purpose of NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

The purpose of the National Insurance & Social Security Act, 1969 is to establish a system of social protection for workers. It aims to provide financial support in cases of illness, maternity, and other social security needs, ensuring a safety net for individuals in the workforce.

What information must be reported on NATIONAL INSURANCE & SOCIAL SECURITY ACT, 1969?

The information that must be reported includes employee details such as names, addresses, national insurance numbers, wages, and contributions made by both the employer and employee. Additionally, any changes in employment status and claim requests for benefits should also be reported.

Fill out your national insurance social security online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

National Insurance Social Security is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.