Get the free BT Lifetime Super – Employer Plan Additional Contributions

Show details

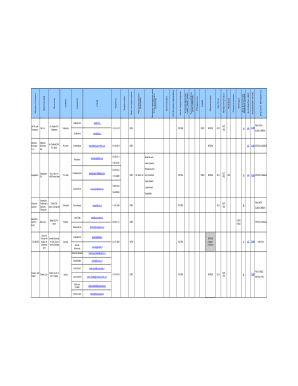

This form is used to make additional contributions into the BT Lifetime Super – Employer Plan, allowing both personal and employer contributions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bt lifetime super employer

Edit your bt lifetime super employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bt lifetime super employer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bt lifetime super employer online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bt lifetime super employer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bt lifetime super employer

How to fill out BT Lifetime Super – Employer Plan Additional Contributions

01

Gather the necessary documents, including your employee details and contribution amounts.

02

Access the BT Lifetime Super online portal or obtain a physical form.

03

Fill out employee details such as name, date of birth, and address.

04

Input the employee's superannuation fund details if not already registered.

05

Specify the contribution amount you wish to make as an additional contribution.

06

Review the information entered for accuracy.

07

Submit the form online or send the physical form to the BT Lifetime Super office.

Who needs BT Lifetime Super – Employer Plan Additional Contributions?

01

Employers looking to enhance their employees' retirement savings.

02

Employees wanting to make additional contributions to boost their superannuation fund.

03

Business owners seeking tax-effective ways to manage payroll and superannuation contributions.

Fill

form

: Try Risk Free

People Also Ask about

What happened to BT Super for Life?

From 3 April 2023, please contact the Mercer Super Helpline on 1800 682 525 for assistance. IMPORTANT INFORMATION BT Super, BT Super for Life and Westpac Group Plan super accounts will merge into Mercer Super Trust on or around 1 April 2023.

What is BT superannuation?

BT Super Invest lets you invest your super how and when you want in one convenient place. Access a range of investments including shares, ETFs, ready-made portfolios, managed funds and more. Download the Investment Options Booklet (PDF) for a full list. Start with a little or a lot.

What is the USI for BT Lifetime Super Employer Plan?

The ABN for BT Super (BT Lifetime Super Employer Plan) is 39827542991. The USI for BT Super BT Lifetime Super Employer Plan is BTA0136AU.

What is BT Super called now?

On or around 1 April 2023 (transfer date) we're closing the BT Super, BT Super for Life and BT Super for Life – Westpac Group Plan products and transferring all accounts to the Mercer Super Trust (Mercer Super).

Is the BT Super for Life retirement wrap no longer active?

On or around 1 April 2023 (transfer date) we're closing BT Super for Life – Retirement and BT Super for Life – Transition to Retirement and transferring all accounts to Mercer SmartRetirement Income which is part of the Mercer Super Trust (Mercer Super).

Is BT Super owned by Westpac?

BT is part of Westpac Group and has a 50 year history in providing wealth management services, including investment solutions, and supporting financial advisers.

Has Panorama super merger?

The Heads of Agreement covers BT's Personal and Corporate superannuation funds including BT Super and BT Super for Life. The merger does not include superannuation held on Westpac's BT Panorama and Asgard platforms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BT Lifetime Super – Employer Plan Additional Contributions?

BT Lifetime Super – Employer Plan Additional Contributions refer to extra contributions made by an employer to their employee's superannuation fund, above the legally required minimum contributions. These additional contributions can enhance the employee's retirement savings.

Who is required to file BT Lifetime Super – Employer Plan Additional Contributions?

Employers who make additional superannuation contributions on behalf of their employees under the BT Lifetime Super – Employer Plan are required to file this information to the relevant superannuation fund and regulatory bodies.

How to fill out BT Lifetime Super – Employer Plan Additional Contributions?

To fill out the form for BT Lifetime Super – Employer Plan Additional Contributions, employers need to provide details such as employee information, the amount of additional contributions being made, and any other required identifying information as specified by the superannuation fund.

What is the purpose of BT Lifetime Super – Employer Plan Additional Contributions?

The purpose of BT Lifetime Super – Employer Plan Additional Contributions is to allow employers to boost their employees' retirement savings, thereby helping them to achieve greater financial security in their retirement years.

What information must be reported on BT Lifetime Super – Employer Plan Additional Contributions?

The information that must be reported on BT Lifetime Super – Employer Plan Additional Contributions includes the employee's details, contribution amounts, payment dates, and any relevant identifiers needed for processing the contributions by the superannuation fund.

Fill out your bt lifetime super employer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bt Lifetime Super Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.