Get the free Perpetual Protected Investments – Series 3

Show details

This document provides a performance summary of the Premium China Fund, detailing investment returns, portfolio allocation, market outlook, and commentary from the fund manager.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign perpetual protected investments series

Edit your perpetual protected investments series form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your perpetual protected investments series form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing perpetual protected investments series online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit perpetual protected investments series. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out perpetual protected investments series

How to fill out Perpetual Protected Investments – Series 3

01

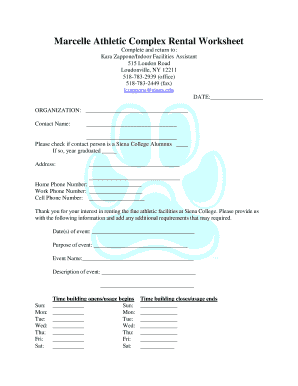

Obtain the Perpetual Protected Investments – Series 3 application form from your financial advisor or the issuing institution.

02

Review the product information and ensure it suits your investment needs and risk tolerance.

03

Complete personal details including your name, contact information, and tax identification number.

04

Provide information about your financial status, including income, assets, and investment experience.

05

Indicate the amount you wish to invest in the Perpetual Protected Investments – Series 3.

06

Review the terms and conditions outlined in the form and ensure you understand the investment requirements.

07

Sign and date the application form to confirm your acceptance of the terms.

08

Submit the completed application form along with any required identification documents to the financial advisor or issuing institution.

Who needs Perpetual Protected Investments – Series 3?

01

Individual investors looking for capital protection combined with potential growth.

02

Conservative investors seeking a low-risk investment option.

03

Individuals planning for retirement who want to secure their principal investment.

04

Investors who prefer structured products with defined terms and returns.

05

Clients of financial advisors who want to diversify their investment portfolio with safer options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Perpetual Protected Investments – Series 3?

Perpetual Protected Investments – Series 3 is a financial product designed to offer investors a combination of capital protection and the potential for market participation. It typically involves a structured investment that guarantees the return of the initial investment at maturity while allowing for potential upside linked to the performance of an underlying asset or index.

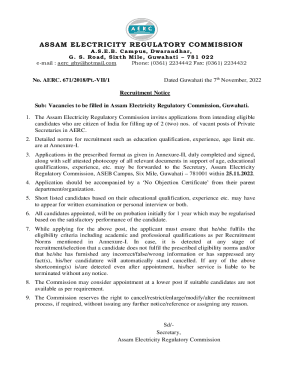

Who is required to file Perpetual Protected Investments – Series 3?

Entities or individuals that offer or manage Perpetual Protected Investments – Series 3 are required to file the necessary documentation. This may include financial institutions, investment firms, or other regulatory bodies overseeing such financial products.

How to fill out Perpetual Protected Investments – Series 3?

To fill out Perpetual Protected Investments – Series 3, investors need to provide personal identification information, investment details such as the amount invested, and acknowledgment of the terms and conditions associated with the investment product. Completing the form accurately ensures compliance and helps streamline the investment process.

What is the purpose of Perpetual Protected Investments – Series 3?

The purpose of Perpetual Protected Investments – Series 3 is to offer investors protection of their principal investment while providing an opportunity to participate in market gains. This product aims to balance risk and return, making it suitable for cautious investors seeking growth without risking their capital.

What information must be reported on Perpetual Protected Investments – Series 3?

The information that must be reported on Perpetual Protected Investments – Series 3 includes the investor's personal information, the amount and date of investment, performance metrics, risk disclosures, and any fees associated with the investment. Compliance with regulatory requirements is crucial when reporting this information.

Fill out your perpetual protected investments series online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Perpetual Protected Investments Series is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.