Get the free Perpetual WealthFocus Pension Plan

Show details

This document serves as a comprehensive Product Disclosure Statement (PDS) detailing the features, benefits, risks, and fees associated with the Perpetual WealthFocus Pension Plan, facilitating informed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign perpetual wealthfocus pension plan

Edit your perpetual wealthfocus pension plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your perpetual wealthfocus pension plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit perpetual wealthfocus pension plan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit perpetual wealthfocus pension plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out perpetual wealthfocus pension plan

How to fill out Perpetual WealthFocus Pension Plan

01

Step 1: Gather personal information, including your age, employment details, and financial status.

02

Step 2: Determine your retirement goals and how much income you will need in retirement.

03

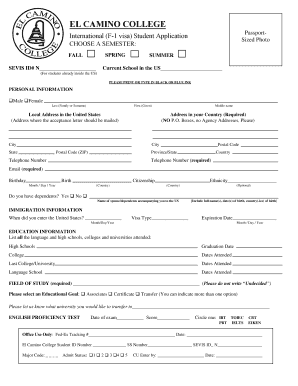

Step 3: Fill out the initial application form, providing all required personal and financial details.

04

Step 4: Select your desired investment options based on risk tolerance and retirement timeline.

05

Step 5: Choose the contribution amount and frequency that suits your budget and goals.

06

Step 6: Review the terms and conditions of the plan carefully.

07

Step 7: Submit the completed application form along with any necessary documentation.

Who needs Perpetual WealthFocus Pension Plan?

01

Individuals planning for retirement who want to secure a steady income.

02

People looking for a structured and disciplined saving method for their pension.

03

Those who wish to benefit from tax advantages related to pension savings.

04

Employees who have limited access to employer-sponsored retirement plans.

Fill

form

: Try Risk Free

People Also Ask about

Are pensions perpetual?

There are various retirement savings vehicles that can provide income in perpetuity. One common option is a pension plan, which offers a guaranteed income for life.

What happened to Perpetual income and Growth Investment Trust?

After 24 years, Perpetual Income & Growth (PLI), the UK equity income investment trust that became synonomous with the rise and fall of its former fund manager Mark Barnett, is no more with its merger with rival Murray Income (MUT) complete.

What is a perpetual investment fund?

Investors may choose a perpetual fund because they can remain invested in the fund until they decide to sell their shares. Given that the majority of CEFs today are perpetual, investors also have more choices when it comes to strategies and asset classes in which to invest.

How do I withdraw from perpetual?

How do I make a withdrawal? You can withdraw all or part of your investment by sending us a written request setting out your client and account number, the name of the fund, the dollar amount or number of units to be withdrawn and your payment instructions.

What is a pension plan in English?

A pension plan is a retirement plan that requires employers to contribute to a pool of funds for a worker's future benefit. A defined-benefit pension plan guarantees a set monthly payment for life or a lump-sum payment at retirement.

Who bought Perpetual?

Perpetual's sale to KKR will significantly reduce its market value. More changes, including in Perpetual's boardroom, are expected to follow the announcement of a transaction with KKR. The company's shares closed at $24.02 on Tuesday, up 1.09 per cent. Spokesmen for Perpetual and KKR declined to comment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Perpetual WealthFocus Pension Plan?

The Perpetual WealthFocus Pension Plan is a retirement savings plan designed to help individuals accumulate wealth for their retirement through systematic contributions and investment growth.

Who is required to file Perpetual WealthFocus Pension Plan?

Typically, individuals participating in the Perpetual WealthFocus Pension Plan are required to file, which may include self-employed individuals or employees contributing to their pension plans.

How to fill out Perpetual WealthFocus Pension Plan?

To fill out the Perpetual WealthFocus Pension Plan, individuals need to complete the designated form provided by the plan administrator, including personal information, contribution details, and investment preference.

What is the purpose of Perpetual WealthFocus Pension Plan?

The purpose of the Perpetual WealthFocus Pension Plan is to provide a structured savings and investment vehicle for individuals to build a retirement fund that can support them financially in their retirement years.

What information must be reported on Perpetual WealthFocus Pension Plan?

Information that must be reported typically includes personal identification details, contribution amounts, investment choices, beneficiary information, and any changes in employment status or income.

Fill out your perpetual wealthfocus pension plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Perpetual Wealthfocus Pension Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.