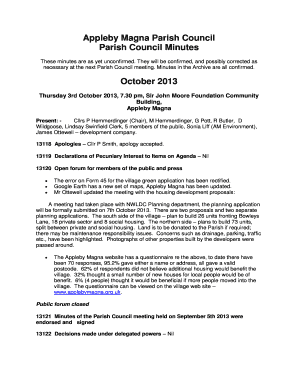

Get the free Perpetual Select Super Plan and Perpetual MySuper Insurance Document

Show details

This document provides important information about the standard insurance cover available to Fund members through Perpetual Select Super Plan and Perpetual MySuper, including automatic cover details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign perpetual select super plan

Edit your perpetual select super plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your perpetual select super plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit perpetual select super plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit perpetual select super plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out perpetual select super plan

How to fill out Perpetual Select Super Plan and Perpetual MySuper Insurance Document

01

Gather all necessary personal information such as your name, address, date of birth, and tax file number.

02

Read the instructions provided in the Perpetual Select Super Plan and Perpetual MySuper Insurance Document carefully.

03

Fill out the personal details section, ensuring that all information is accurate and complete.

04

Select the investment options that align with your financial goals within the Perpetual Select Super Plan.

05

Review the insurance options provided in the Perpetual MySuper Insurance Document and select the type of coverage that suits your needs.

06

Sign and date the document at the designated section, confirming that all information is correct.

07

Submit the completed document according to the instructions provided, ensuring to keep a copy for your records.

Who needs Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

01

Individuals looking to save for retirement through a superannuation fund.

02

Employees who want to take advantage of employer contributions to their superannuation.

03

People seeking life insurance, total and permanent disability insurance, or income protection insurance.

04

Those who want a flexible investment strategy tailored to their personal financial goals.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of perpetual in business?

Perpetual existence means that, by default, a registered company maintains its legal existence regardless of ownership changes. Shareholders and investors can rest assured that their investment won't disappear if an owner dies or sells the company.

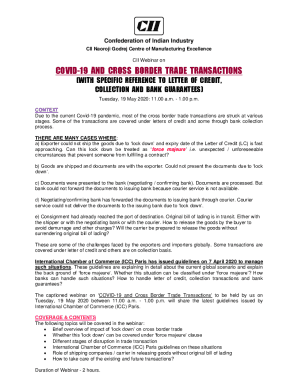

What is the meaning of perpetuity in insurance?

Annuities are investments that make payments for a set duration of time. Perpetuities are investments that make payments indefinitely. A perpetuity is a type of annuity but extremely rare and not commonly offered by insurance companies. The value of a perpetuity tends to decrease over time.

Is perpetual a super fund?

Perpetual's superannuation and retirement solutions aim to help you meet your retirement goals on your journey from employment through to retirement. We offer a range of superannuation solutions that are flexible, convenient and can help you reach retirement with the funds to enjoy the lifestyle you want in retirement.

What is the meaning of perpetual payment?

Perpetuity in the financial system is a situation where a stream of cash flow payments continues indefinitely or is an annuity that has no end. In valuation analysis, perpetuities are used to find the present value of a company's future projected cash flow stream and the company's terminal value.

What is perpetual insurance?

Perpetual insurance is a type of homeowner's insurance policy written to have no term, or date, when the policy expires. From the effective start date, the coverage exists for perpetuity. The insured deposits money, called a deposit premium, with the insurer for insurance for the life of the risk.

What is the meaning of perpetual insurance?

Put simply, a perpetual policy is just what the name implies - it is a policy that never expires. As long as membership conditions are satisfied, the policy remains in effect, subject only to the eligibility requirements of the Society and the policy's cancellation provisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

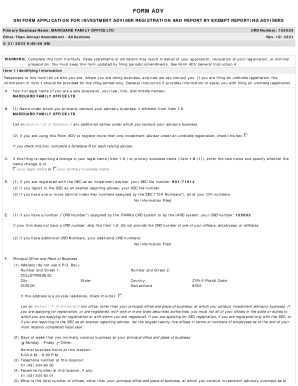

What is Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

The Perpetual Select Super Plan is a superannuation fund designed to help individuals save for retirement, offering various investment options. The Perpetual MySuper Insurance Document outlines the insurance coverage available under the MySuper regulatory framework, typically including default life insurance and total and permanent disability insurance.

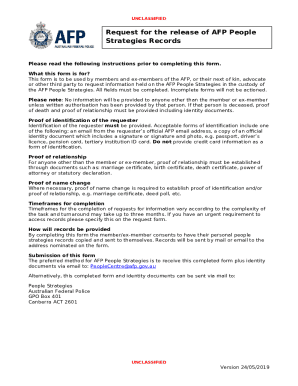

Who is required to file Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

Employers who offer the Perpetual Select Super Plan to their employees, as well as any fund administrators or trustees managing superannuation funds under the MySuper framework, are required to file these documents.

How to fill out Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

To fill out the Perpetual Select Super Plan and MySuper Insurance Document, individuals or employers should provide accurate personal and financial information, including details of contributions, investment choices, and any beneficiaries. It is essential to follow the specific guidelines provided in the documents to ensure compliance.

What is the purpose of Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

The purpose of the Perpetual Select Super Plan is to facilitate retirement savings for individuals, while the Perpetual MySuper Insurance Document serves to inform members about the insurance coverage provided under the MySuper scheme, ensuring they understand their options and benefits.

What information must be reported on Perpetual Select Super Plan and Perpetual MySuper Insurance Document?

Information that must be reported includes member details (such as name, address, and tax file number), contributions made to the fund, investment choices, and any applicable insurance coverage like life and disability insurance. Additionally, compliance-related information for regulatory authorities must also be included.

Fill out your perpetual select super plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Perpetual Select Super Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.