Get the free Consolidated CDP Clearing Rules v3 - Singapore Exchange

Show details

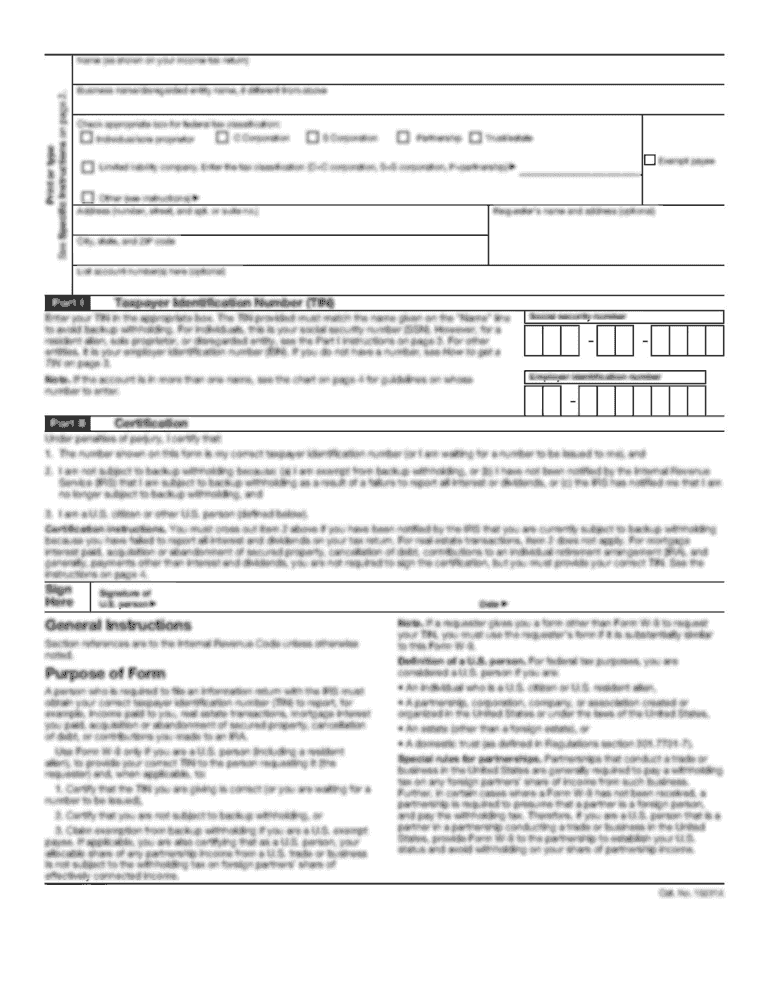

APPENDIX A TO CDP CLEARING RULES PRACTICE NOTE 3.5.4 Business Continuity Management Emergency Contact Person’s) Company Name: Name Department Prepared by: Name: Designation: Designation Office No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated cdp clearing rules

Edit your consolidated cdp clearing rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated cdp clearing rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consolidated cdp clearing rules online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consolidated cdp clearing rules. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated cdp clearing rules

How to fill out consolidated cdp clearing rules:

01

Begin by carefully reviewing the instructions provided for filling out the consolidated cdp clearing rules form.

02

Make sure you have all the necessary information and documents required to complete the form accurately. This may include details about your company, stakeholders, and the specific clearing rules you are implementing.

03

Start by entering your company's name and relevant contact information in the designated fields.

04

Follow the instructions provided to provide a detailed description of the clearing rules you are implementing. This may involve specifying the securities or financial instruments covered, the procedures for trade confirmation and settlement, and any risk management measures in place.

05

Clearly state any exemptions or exceptions to the clearing rules, if applicable.

06

If required, provide any supporting documentation or references to relevant regulatory guidelines or industry standards.

07

Once you have filled out all the necessary information, review the form for any errors or omissions. It is crucial to ensure accuracy and completeness before submission.

08

Sign and date the form, acknowledging that the information provided is accurate to the best of your knowledge.

09

Submit the completed form according to the instructions provided, either by mail, email, or through an online portal.

Who needs consolidated cdp clearing rules:

01

Financial institutions such as banks, broker-dealers, and securities exchanges that engage in clearing activities typically need to adhere to consolidated cdp clearing rules. These rules provide a standardized framework for clearing and settling securities transactions.

02

Regulated entities that report to a central clearing counterparty (ccp) or operate as a ccp themselves should also implement consolidated cdp clearing rules. This is to ensure proper risk management, transparency, and compliance with regulatory requirements.

03

Companies engaged in securities trading or investment activities may also benefit from implementing consolidated cdp clearing rules. These rules help mitigate counterparty risk, enhance operational efficiency, and promote market stability.

04

Market participants involved in derivative transactions, such as futures or options, may be required or incentivized to adopt consolidated cdp clearing rules to reduce systemic risk in the financial system.

05

Regulatory authorities and self-regulatory organizations play a crucial role in establishing and enforcing consolidated cdp clearing rules. They ensure market integrity, protect investors, and promote a fair and transparent trading environment.

Overall, following proper procedures to fill out consolidated cdp clearing rules ensures compliance with regulations, reduces operational risk, and contributes to the overall stability and efficiency of the financial markets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is consolidated cdp clearing rules?

Consolidated CDP clearing rules are regulations that govern the clearing of credit default swaps in a central counterparty clearinghouse.

Who is required to file consolidated cdp clearing rules?

Financial institutions and market participants who engage in trading credit default swaps are required to file consolidated CDP clearing rules.

How to fill out consolidated cdp clearing rules?

Consolidated CDP clearing rules can be filled out by providing accurate and detailed information about the credit default swaps being cleared.

What is the purpose of consolidated cdp clearing rules?

The purpose of consolidated CDP clearing rules is to ensure that credit default swaps are cleared in a transparent and efficient manner, reducing systemic risk in the financial markets.

What information must be reported on consolidated cdp clearing rules?

Information such as the terms of the credit default swaps, the parties involved, and the risk management procedures must be reported on consolidated CDP clearing rules.

How can I edit consolidated cdp clearing rules from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your consolidated cdp clearing rules into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find consolidated cdp clearing rules?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific consolidated cdp clearing rules and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the consolidated cdp clearing rules in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your consolidated cdp clearing rules and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your consolidated cdp clearing rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Cdp Clearing Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.