Get the free OFFICIAL TARIFF

Show details

For OFFICIAL TARIFF Presented by ECO 2016, Düsseldorf Customs & Handling Tariff 1. Customs Formalities Temporary Customs Entry (incl. 5 tariff codes) Temporary Import Bond Fee (import only) 145.00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign official tariff

Edit your official tariff form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your official tariff form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing official tariff online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit official tariff. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

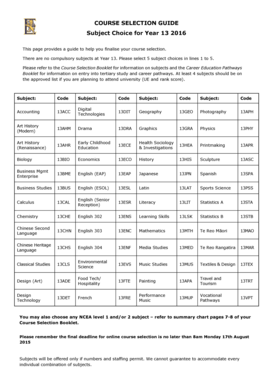

How to fill out official tariff

How to fill out official tariff:

01

Gather necessary information: Begin by collecting all the relevant data and information that needs to be included in the official tariff. This may include details such as product or service descriptions, pricing, taxes, and any other relevant charges.

02

Understand the format: Familiarize yourself with the specific format and structure of the official tariff form. This will ensure that you know where each piece of information should be entered and help you avoid any mistakes or omissions.

03

Fill in the basic details: Start by entering the basic details such as the name of your company, the date, and any other required identification information. This will help to provide context and legitimacy to your official tariff.

04

Provide comprehensive product or service descriptions: Clearly describe each product or service that you are offering in your official tariff. Include specific details such as its features, specifications, and any options or variations available.

05

Specify pricing and charges: Clearly state the pricing for each product or service and outline any additional charges or fees that may apply. This could include taxes, shipping fees, installation charges, or any other relevant costs.

06

Include terms and conditions: Make sure to include any specific terms and conditions that apply to the pricing, delivery, payment, or warranties associated with your products or services. This will help to avoid any misunderstandings or disputes in the future.

07

Double-check for accuracy: Before finalizing your official tariff, thoroughly review all the information you have entered to ensure its accuracy. Mistakes or inconsistencies can lead to confusion or legal issues, so it's important to take the time to double-check everything.

Who needs an official tariff?

01

Importers and exporters: Official tariffs are often needed by companies or individuals involved in international trade. They help to determine the customs duties and taxes associated with the import or export of goods.

02

Manufacturers and suppliers: Manufacturers and suppliers may use official tariffs to establish the pricing and terms for their products or services. This helps to provide transparency and clarity to their customers, as well as to comply with any legal or regulatory requirements.

03

Government agencies and regulators: Official tariffs are important for government agencies and regulators to monitor and control trade activities. They help ensure fair trade practices, protect local industries, and collect revenue through customs duties and taxes.

04

Consumers and buyers: Consumers and buyers can benefit from having access to official tariffs as it allows them to understand the costs and charges associated with the products or services they are interested in purchasing. This helps them make informed decisions and compare pricing options.

05

Legal professionals: Lawyers and legal professionals may need official tariffs as a reference when dealing with trade-related disputes, contract negotiations, or other legal matters. These documents provide valuable information and evidence regarding pricing and terms.

In conclusion, filling out an official tariff involves gathering necessary information, understanding the format, filling in the basic details, providing comprehensive product or service descriptions, specifying pricing and charges, including terms and conditions, and double-checking for accuracy. Official tariffs are needed by importers, exporters, manufacturers, suppliers, government agencies, regulators, consumers, buyers, and legal professionals for various trade-related purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is official tariff?

Official tariff is a list of fees or charges that must be paid for specific goods or services.

Who is required to file official tariff?

Any individual or organization that imports or exports goods is required to file official tariff.

How to fill out official tariff?

Official tariff can be filled out by providing detailed information about the goods or services being charged and the corresponding fees.

What is the purpose of official tariff?

The purpose of official tariff is to regulate trade and ensure that appropriate fees are paid for goods or services entering or leaving a country.

What information must be reported on official tariff?

Information such as the description of goods or services, their value, and the applicable fees must be reported on official tariff.

How can I get official tariff?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific official tariff and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in official tariff without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing official tariff and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the official tariff in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your official tariff directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your official tariff online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Official Tariff is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.