Get the free Banking Ombudsman Scheme Details & Form & Statistics - Societe ... - societe...

Show details

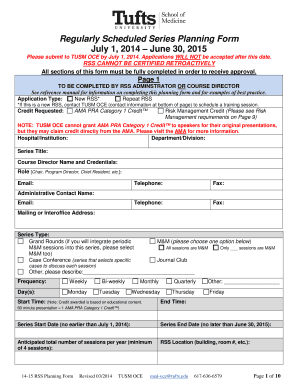

SO CIT GRALE, INDIA BRANCHES DISCLOSURE OF COMPLAINTS (Information as at March 31, 2015) Customer Complaints a) No. of complaints pending at the beginning of the year 1 b) No. of complaints received

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign banking ombudsman scheme details

Edit your banking ombudsman scheme details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your banking ombudsman scheme details form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing banking ombudsman scheme details online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit banking ombudsman scheme details. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out banking ombudsman scheme details

How to fill out banking ombudsman scheme details:

01

Gather all relevant information: Before filling out the banking ombudsman scheme details, make sure you have all the necessary information at hand. This includes your personal details, account details, and any documentation related to the complaint or dispute with the bank.

02

Download the complaint form: Visit the official website of the banking ombudsman scheme or contact them to obtain the complaint form. This form will include fields for you to provide your personal information, details of the bank involved, and a description of the issue or complaint.

03

Fill in personal details: Start by filling in your personal details accurately. This typically includes your name, address, contact information, and any other details required by the form.

04

Provide account information: If the complaint is related to a specific account, provide the necessary account details such as account number, type of account, and branch details.

05

Explain the complaint or dispute: In a clear and concise manner, describe the complaint or dispute you have with the bank. Include all relevant details, such as dates, specific incidents, and any communication you've had with the bank regarding the issue.

06

Attach supporting documents: If you have any supporting documents that can strengthen your complaint, make sure to attach copies of them. These may include bank statements, transaction records, email correspondence, or any other relevant evidence.

07

Sign and submit the form: Once you have filled out all the required information, carefully read through the form to ensure accuracy. Sign the form and submit it to the designated address or email provided by the banking ombudsman scheme.

Who needs banking ombudsman scheme details?

01

Individuals with complaints or disputes: Any individual who has encountered an issue or dispute with their bank and wishes to seek redress can benefit from having banking ombudsman scheme details. This could include cases of unauthorized transactions, wrongful charges, or unsatisfactory customer service.

02

Account holders: If you have a bank account, it is essential to be aware of the banking ombudsman scheme details. In case of any problems or grievances with the bank, knowing how to access the scheme can help ensure that your concerns are addressed in a fair and impartial manner.

03

Customers of participating banks: The banking ombudsman scheme typically covers a range of banks and financial institutions. Therefore, customers of these participating banks should familiarize themselves with the scheme details. This knowledge can prove helpful if they encounter any issues and wish to seek resolution through the ombudsman scheme's intervention.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is banking ombudsman scheme details?

The banking ombudsman scheme details refer to the guidelines and regulations set by the central bank for handling and resolving customer complaints related to banking services.

Who is required to file banking ombudsman scheme details?

All banks and financial institutions that are regulated by the central bank are required to file banking ombudsman scheme details.

How to fill out banking ombudsman scheme details?

Banks and financial institutions can fill out banking ombudsman scheme details by following the reporting guidelines provided by the central bank.

What is the purpose of banking ombudsman scheme details?

The purpose of banking ombudsman scheme details is to ensure transparency in the resolution of customer complaints and to uphold the rights of banking customers.

What information must be reported on banking ombudsman scheme details?

The information that must be reported on banking ombudsman scheme details includes details of customer complaints received, actions taken to resolve complaints, and any penalties issued.

How can I send banking ombudsman scheme details to be eSigned by others?

banking ombudsman scheme details is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the banking ombudsman scheme details electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your banking ombudsman scheme details in minutes.

How do I edit banking ombudsman scheme details on an Android device?

With the pdfFiller Android app, you can edit, sign, and share banking ombudsman scheme details on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your banking ombudsman scheme details online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banking Ombudsman Scheme Details is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.