UK Royal London P8B0077 2015 free printable template

Show details

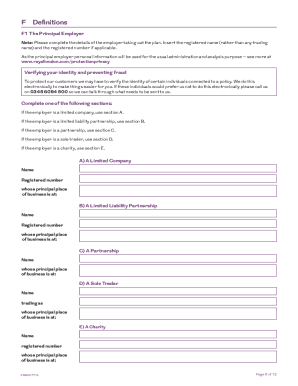

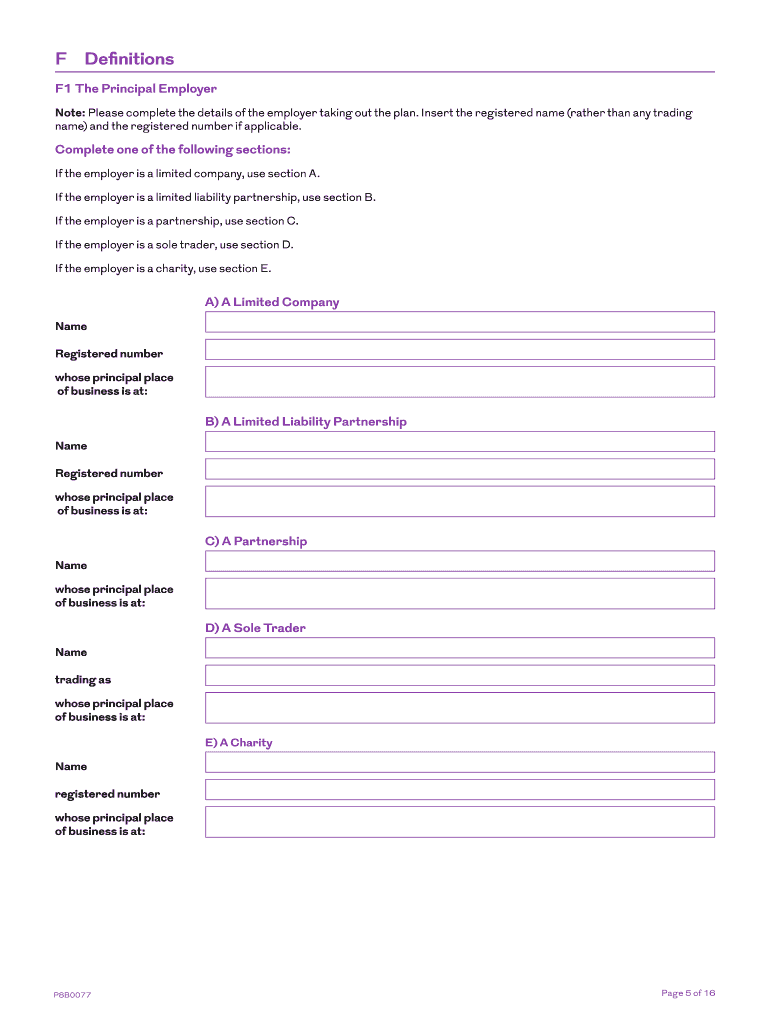

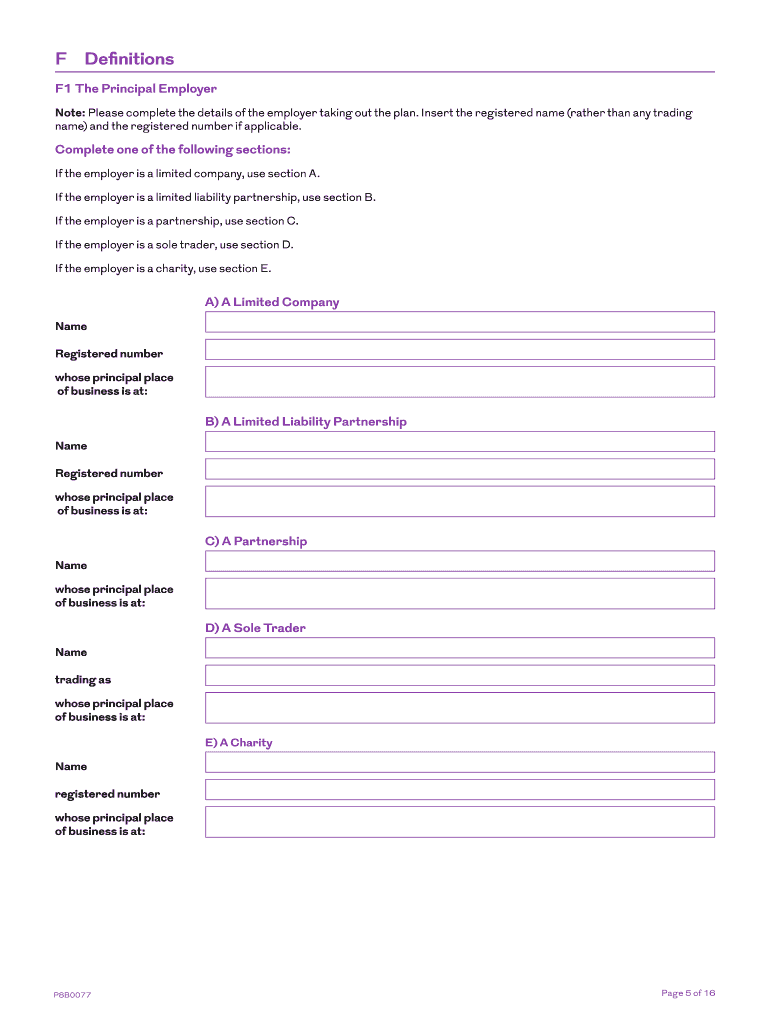

RELEVANT LIFE POLICY TRUST AND NOMINATION FORMS Important notes The forms are designed for use only with Royal London Relevant Life plans. Both forms can be used in England, Wales, Scotland or Northern

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Royal London P8B0077

Edit your UK Royal London P8B0077 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Royal London P8B0077 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Royal London P8B0077 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK Royal London P8B0077. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Royal London P8B0077 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Royal London P8B0077

How to fill out UK Royal London P8B0077

01

Gather the necessary personal information, including your name, address, and National Insurance number.

02

Obtain your current pension details from Royal London if applicable.

03

Complete Section A by providing your personal details accurately.

04

Fill out Section B regarding your employment information, including job title and employer's name.

05

If applicable, provide details in Section C about any existing pension plans.

06

Review and double-check all information provided for accuracy.

07

Sign and date the completed form in Section D.

08

Submit the form to the designated address provided by Royal London.

Who needs UK Royal London P8B0077?

01

Individuals who are looking to transfer their pension savings to Royal London.

02

Employees seeking to consolidate their pensions with Royal London.

03

Anyone who has received a notification from Royal London prompting them to complete the form.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a trust and a life insurance policy?

Your earnings on a pre-need trust can be used to cover the gap between today's costs and tomorrow's costs. An insurance policy, on the other hand, has extremely limited growth potential. By law, a percentage of the contract must be held in reserve, and there is a cap on your earnings.

What are the disadvantages of life insurance trust?

Disadvantages. The most glaring disadvantage is the loss of control. While a trustee is named to carry out the instructions of the trust, the grantor is effectively relinquishing ownership of the life insurance policy.

What is a life insurance trust form?

It allows the owner of property (or in this case a life insurance policy) to transfer legal ownership of that policy to another person. The original owner of the life insurance policy is known as the settlor.

What is the purpose of a life insurance trust?

An insurance trust can be an easy way to shelter the insurance proceeds from eventual estate taxes and prevent those proceeds from pushing your spouse's estate value over the estate tax exemption threshold.

Why put a life insurance policy in a trust?

An insurance trust can be an easy way to shelter the insurance proceeds from eventual estate taxes and prevent those proceeds from pushing your spouse's estate value over the estate tax exemption threshold.

How do I put my life insurance policy into a trust?

Follow these four steps to set up a life insurance trust ing to your wishes. Work with an estate attorney. Choose a trustee. Select a life insurance trust beneficiary. Provide your financial professionals with copies of the trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get UK Royal London P8B0077?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the UK Royal London P8B0077 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the UK Royal London P8B0077 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your UK Royal London P8B0077.

How do I edit UK Royal London P8B0077 on an Android device?

You can make any changes to PDF files, like UK Royal London P8B0077, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is UK Royal London P8B0077?

UK Royal London P8B0077 is a specific form used by the Royal London Group for reporting financial information related to pensions and investments. It is important for regulatory compliance and ensuring accurate data submission.

Who is required to file UK Royal London P8B0077?

Entities or individuals involved in pension schemes or investments that fall under the Royal London Group are required to file UK Royal London P8B0077, particularly those managing or reporting on pension funds.

How to fill out UK Royal London P8B0077?

To fill out UK Royal London P8B0077, gather the necessary financial documents, provide accurate information regarding pension investments, and ensure all fields are completed as per the guidelines provided by Royal London.

What is the purpose of UK Royal London P8B0077?

The purpose of UK Royal London P8B0077 is to collect and report financial data pertaining to pension schemes and investments, ensuring transparency and compliance with financial regulations.

What information must be reported on UK Royal London P8B0077?

The information that must be reported on UK Royal London P8B0077 includes details about the pension fund's assets, liabilities, contributions, and other relevant financial data that reflects the status of the pension scheme.

Fill out your UK Royal London P8B0077 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Royal London P8B0077 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.