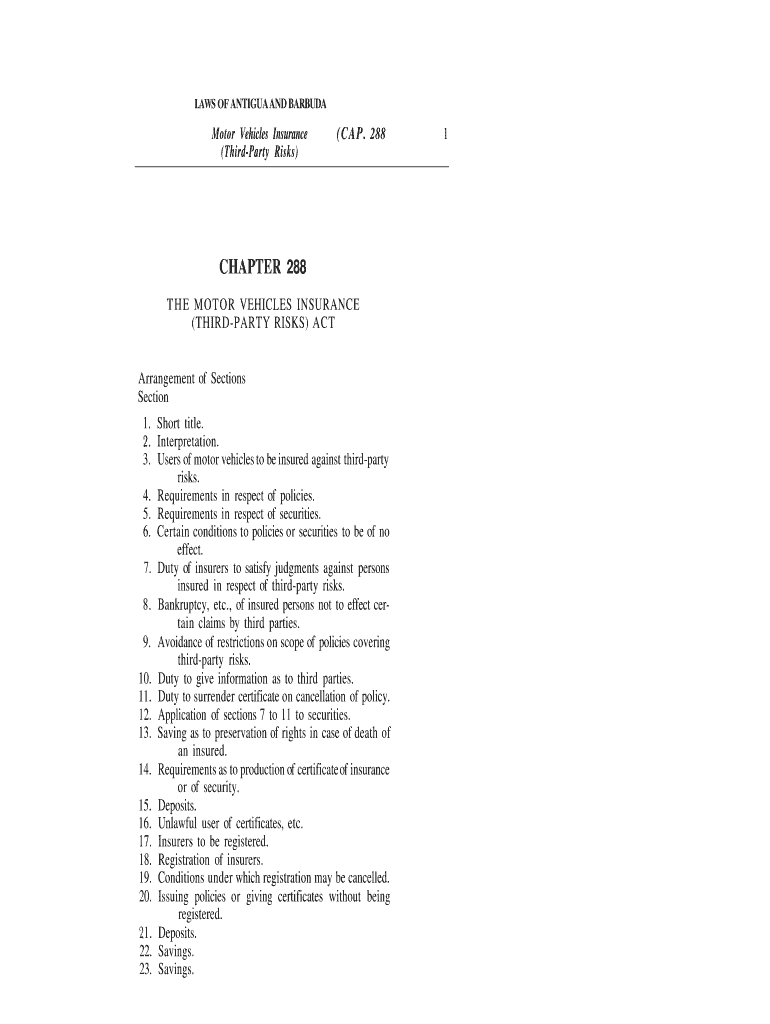

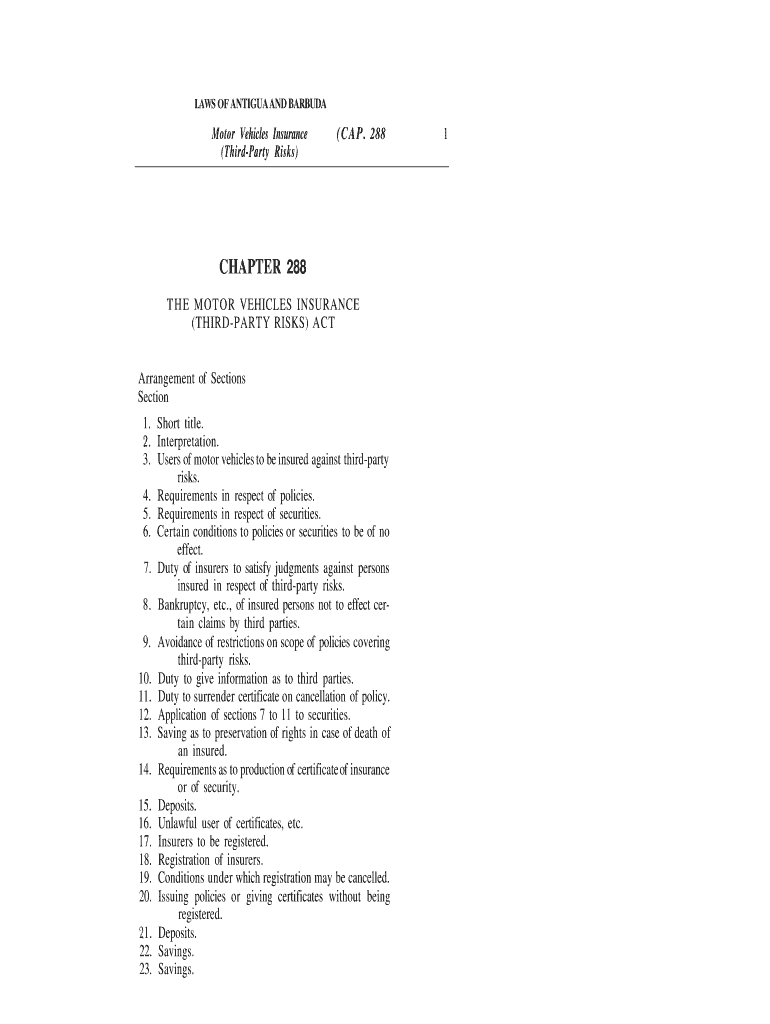

Get the free Motor Vehicles Insurance (Third-Party Risks) Act

Show details

This Act outlines the requirements for motor vehicle insurance related to third-party risks in Antigua and Barbuda, detailing obligations for users, insurers, and provisions concerning insurance policies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicles insurance third-party

Edit your motor vehicles insurance third-party form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicles insurance third-party form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor vehicles insurance third-party online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit motor vehicles insurance third-party. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicles insurance third-party

How to fill out Motor Vehicles Insurance (Third-Party Risks) Act

01

Obtain the Motor Vehicles Insurance (Third-Party Risks) Act form from the relevant authority or online portal.

02

Read the instructions and requirements carefully before filling out the form.

03

Provide your personal information, including your full name, address, and contact details.

04

Enter the vehicle details, such as make, model, registration number, and engine number.

05

Specify the type of insurance coverage you wish to obtain under the Act.

06

Include information about any previous insurance policies, claims, or accidents related to the vehicle.

07

Review the filled-out form for accuracy and completeness.

08

Submit the form, along with any required documents, to the relevant insurance provider or authority.

09

Pay any associated fees or premiums as instructed.

Who needs Motor Vehicles Insurance (Third-Party Risks) Act?

01

All vehicle owners and drivers who operate motor vehicles on public roads.

02

Individuals seeking to comply with legal requirements for third-party liability insurance.

03

Businesses that own or operate vehicles for commercial purposes.

04

Any person who wants to protect themselves against potential financial liability arising from accidents involving their vehicles.

Fill

form

: Try Risk Free

People Also Ask about

What does third party insurance do?

Third party This is the minimum legal requirement and covers you for damage to someone else's vehicle or property or injury to someone else in an accident. This includes accidents caused by your passenger. It doesn't cover repairs to your own vehicle.

Is insurance liable for third party risks?

Third-party liability insurance covers you financially when someone makes a claim against you for damages arising from your actions. A common example of this is auto insurance, which will pay the medical bills of a driver who is injured in an accident that you have caused.

Does insurance cover third party?

Third party This is the minimum legal requirement and covers you for damage to someone else's vehicle or property or injury to someone else in an accident. This includes accidents caused by your passenger. It doesn't cover repairs to your own vehicle.

What is the third party limit for motor insurance?

There is no limit on the liability covered for injury or death, but the limit for third party property is capped at ₹7.5 lakh by Insurance Regulatory and Development Authority of India (IRDAI). For damages exceeding this limit, the policyholders will have to pay the balance themselves.

Does your insurance have to have third-party liability?

Third-party liability insurance is mandatory and included in all car insurance policies. Coverage protects you if you injure or cause damage to a third party while driving. We recommend having more than the minimum amount of third-party liability coverage.

What is a third-party liability insurance policy?

Third-party liability insurance covers you financially when someone makes a claim against you for damages arising from your actions. A common example of this is auto insurance, which will pay the medical bills of a driver who is injured in an accident that you have caused.

What is insurance liability for third party risk?

In India, third-party liability insurance is mandatory for all drivers. Third party insurance covers the legal liability of the insured driver for bodily injury or property damage caused to third parties in an accident.

What is third party risk under Motor vehicle Act?

Third-party insurance is compulsory for all vehicle-owners as per the Motor Vehicles Act. It covers only your legal liability for the damage you may cause to a third party – bodily injury, death, and damage to third party property – while using your vehicle. TP cover does not pay for repair of damage to your vehicle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Vehicles Insurance (Third-Party Risks) Act?

The Motor Vehicles Insurance (Third-Party Risks) Act is legislation that mandates insurance coverage for third-party liabilities arising from the use of motor vehicles. It ensures that victims of accidents caused by motor vehicles can receive compensation for damages, injuries, or loss.

Who is required to file Motor Vehicles Insurance (Third-Party Risks) Act?

All owners of motor vehicles that are intended for use on public roads are required to file under the Motor Vehicles Insurance (Third-Party Risks) Act. This includes individuals and businesses that operate vehicles.

How to fill out Motor Vehicles Insurance (Third-Party Risks) Act?

To fill out the Motor Vehicles Insurance (Third-Party Risks) Act, individuals must provide details such as the vehicle's registration number, owner's information, insurance provider details, and coverage specifics. It's important to ensure all information is accurate and up to date.

What is the purpose of Motor Vehicles Insurance (Third-Party Risks) Act?

The purpose of the Motor Vehicles Insurance (Third-Party Risks) Act is to protect individuals involved in motor vehicle accidents by ensuring that compensation is available for any injuries or damages caused by a motor vehicle. It aims to promote road safety and accountability among vehicle owners.

What information must be reported on Motor Vehicles Insurance (Third-Party Risks) Act?

The information that must be reported on the Motor Vehicles Insurance (Third-Party Risks) Act includes the vehicle owner's name and address, vehicle registration details, policy number, insurance company information, and details regarding the extent of coverage provided.

Fill out your motor vehicles insurance third-party online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicles Insurance Third-Party is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.