Get the free BOE-261-G - recorder co kern ca

Show details

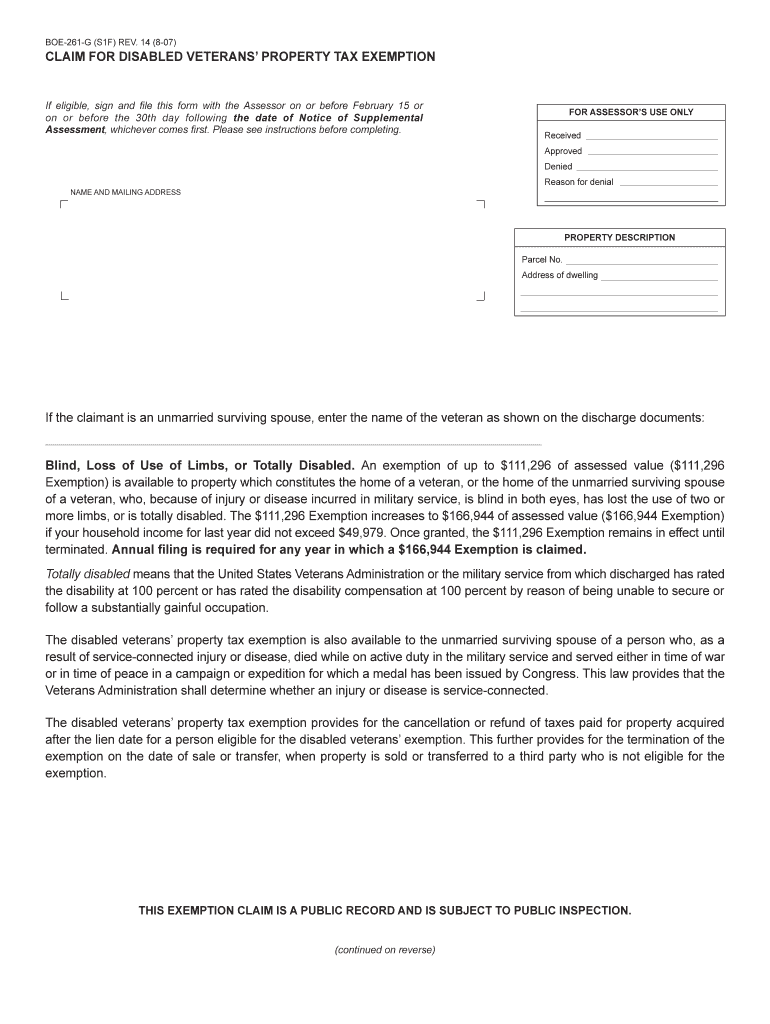

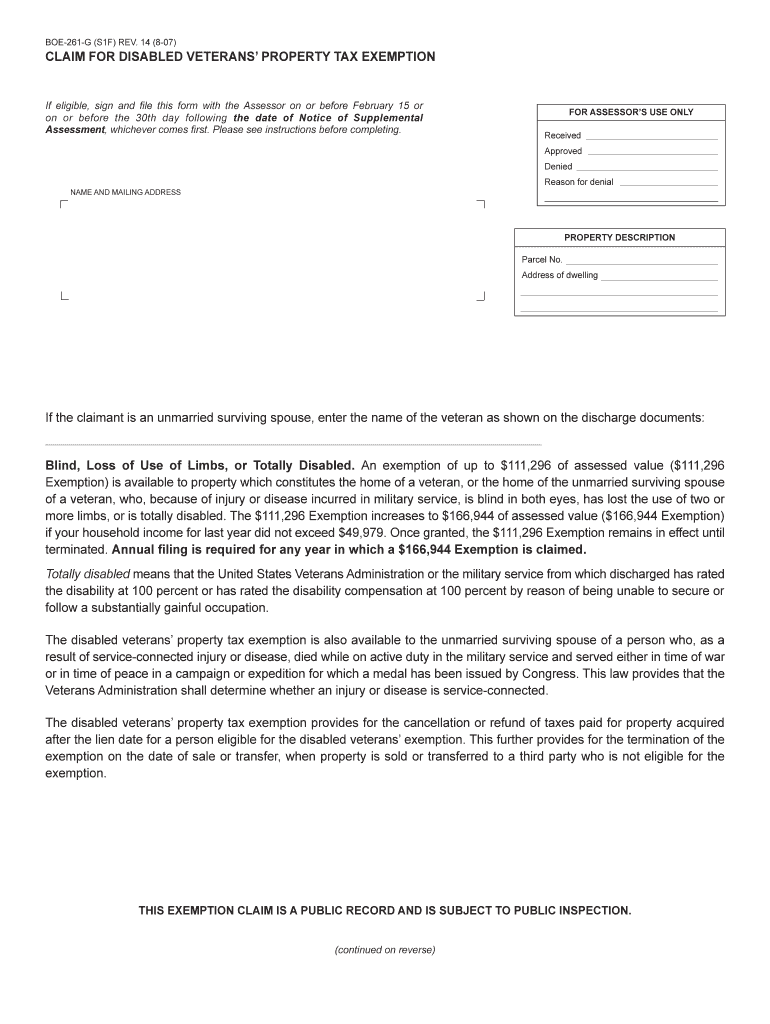

Este formulario se utiliza para solicitar la exención de impuestos sobre la propiedad para veteranos discapacitados en California, permitiendo una reducción en el valor tasado de la propiedad que

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-261-g - recorder co

Edit your boe-261-g - recorder co form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-261-g - recorder co form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe-261-g - recorder co online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit boe-261-g - recorder co. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-261-g - recorder co

How to fill out BOE-261-G

01

Begin by heading to the official website of the California Department of Tax and Fee Administration (CDTFA).

02

Download the BOE-261-G form from the website.

03

Fill in your name and address at the top of the form.

04

Indicate the tax period for which you are filing.

05

Provide the necessary information regarding your revenue and any tax deductions.

06

Review the completed form for accuracy.

07

Sign and date the form before submission.

08

Submit the form either online or by mailing it to the appropriate CDTFA office.

Who needs BOE-261-G?

01

Businesses in California that are required to report taxes related to sales and use tax.

02

Taxpayers who need to amend their previous sales and use tax returns.

03

Any individual or entity involved in the sale of tangible personal property.

Fill

form

: Try Risk Free

People Also Ask about

Do 100% disabled veterans pay sales tax on vehicles?

Motor Vehicle: Permanently disabled Veterans or those with vision/limb loss pay no property tax on vehicles. A VA grant for vehicle purchase/adaptation waives state sales tax.

Do 100% disabled veterans pay property tax in California?

Disabled Veterans' Exemption The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who, due to a service-connected injury or disease, have been rated 100% disabled or are being compensated at the 100% rate due to unemployability.

Are 100% disabled veterans exempt from federal taxes?

VA disability benefits are automatically exempt because they aren't included in your taxable income, so no application process is required.

Are disabled veterans eligible to claim a federal tax refund?

Combat-disabled Veterans who are granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability may be eligible to claim a federal tax refund.

Can 100% disabled veterans fly for free?

Veterans who are rated by the VA as permanently and totally disabled can travel Space-A (space available) on military aircraft for free. If you qualify you can travel in the continental United States (CONUS) or directly between CONUS and Alaska, Hawaii, Puerto Rico, the U.S. Islands, Guam and American Samoa.

Do 100% disabled veterans pay capital gains tax?

Some states provide property tax exemptions or reductions these benefits may indirectly affectMoreSome states provide property tax exemptions or reductions these benefits may indirectly affect capital gains tax obligations. It is essential to consult state specific regulations for accurate.

Do 100% disabled veterans pay federal taxes?

Veterans with a 100% VA disability rating do not pay federal taxes on their VA disability compensation, as these benefits are tax-exempt by law. This applies regardless of the percentage rating, meaning that a 100% rating guarantees that VA disability payments will remain non-taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-261-G?

BOE-261-G is a form used by the California State Board of Equalization that reports sales of fuel or fuel products to the state.

Who is required to file BOE-261-G?

Any person or business engaged in making sales of fuel or fuel products in California is generally required to file BOE-261-G.

How to fill out BOE-261-G?

To fill out BOE-261-G, you need to provide specific details including your business information, the period covered, and the quantities and values of fuel sold.

What is the purpose of BOE-261-G?

The purpose of BOE-261-G is to ensure compliance with state tax laws by reporting fuel sales and remitting the appropriate taxes to the state.

What information must be reported on BOE-261-G?

Information that must be reported on BOE-261-G includes seller information, purchaser information, fuel type, quantity sold, and the total sales amount.

Fill out your boe-261-g - recorder co online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-261-G - Recorder Co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.