Get the free TRADE CREDIT INSURANCE Application - bBTAb

Show details

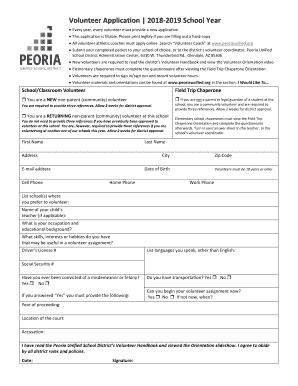

TRADE CREDIT INSURANCE Application Is filled in by BTA representative! Reference number of indemnity claim: Received on: Place where received: Name, surname of the receiver: Signature: Applicant:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trade credit insurance application

Edit your trade credit insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trade credit insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trade credit insurance application online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trade credit insurance application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trade credit insurance application

How to fill out a trade credit insurance application:

01

Gather all necessary information and documents: Before filling out the application, gather relevant information such as company name, address, contact details, financial statements, sales figures, and credit limits.

02

Research different trade credit insurance providers: Look for reputable and reliable insurance providers specialized in trade credit insurance. Compare their offerings, coverage limits, and terms to find the best fit for your business.

03

Complete the application form: Fill out the application form accurately and comprehensively. Provide all required information, including company details, financial information, credit terms, and payment history. Make sure to double-check your inputs for any errors or omissions before submitting.

04

Include supporting documents: Attach any requested supporting documents, such as financial statements, accounts receivable aging reports, and trade references. These documents help the insurer assess the creditworthiness of your business and determine appropriate coverage and premiums.

05

Provide additional information if necessary: Depending on the insurance provider, you may need to provide additional information or answer specific questions regarding your business operations, customers, or credit management practices. Cooperate and provide the requested information promptly to expedite the application process.

06

Review and sign the application: Before submitting, carefully review all the provided information, ensuring its accuracy and completeness. Sign the application form where required, indicating your agreement to the terms and conditions of the trade credit insurance policy.

07

Submit the application: Once you have filled out the application form, attached all supporting documents, and reviewed everything, submit the completed application to the trade credit insurance provider through the designated channel, such as online submission or mailing.

Who needs trade credit insurance application?

01

Businesses engaging in domestic or international trade: Trade credit insurance application is essential for businesses involved in selling goods or services on credit terms, particularly those dealing with foreign customers or exporting to high-risk markets.

02

Suppliers and manufacturers: Suppliers and manufacturers who rely heavily on receivables as a significant portion of their working capital should consider trade credit insurance to protect against potential non-payment or insolvency of buyers.

03

Small and medium-sized enterprises (SMEs): SMEs often have limited resources and face higher risks when extending credit to customers. Trade credit insurance provides protection against non-payment, giving them the confidence to expand their customer base and strengthen their cash flow.

04

Businesses operating in volatile industries: Industries prone to economic volatility or experiencing frequent uncertainties, such as construction, manufacturing, or retail, can benefit from trade credit insurance to mitigate the risks associated with fluctuating market conditions.

05

Businesses seeking growth opportunities: Trade credit insurance enables businesses to offer competitive credit terms, expand into new markets, and take advantage of growth opportunities while mitigating the potential impact of bad debt.

Remember, it is advisable to consult with an insurance professional or broker who specializes in trade credit insurance to better understand your specific needs and find the most suitable coverage for your business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is trade credit insurance application?

Trade credit insurance application is a form that businesses use to apply for insurance coverage for potential losses due to non-payment by customers.

Who is required to file trade credit insurance application?

Businesses that want to protect themselves from the risk of non-payment by customers are required to file a trade credit insurance application.

How to fill out trade credit insurance application?

Trade credit insurance application can be filled out by providing information about the business, its customers, and the amount of coverage needed.

What is the purpose of trade credit insurance application?

The purpose of trade credit insurance application is to protect businesses from financial losses that may result from unpaid invoices.

What information must be reported on trade credit insurance application?

Trade credit insurance application typically requires information about the business's financials, sales history, customer base, and credit policies.

How do I edit trade credit insurance application on an iOS device?

Use the pdfFiller mobile app to create, edit, and share trade credit insurance application from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit trade credit insurance application on an Android device?

The pdfFiller app for Android allows you to edit PDF files like trade credit insurance application. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete trade credit insurance application on an Android device?

On an Android device, use the pdfFiller mobile app to finish your trade credit insurance application. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your trade credit insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trade Credit Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.