Get the free Bankruptcy / Insolvency guidelines - qls com

Show details

This document sets out guidelines for the Society’s Council regarding the procedures and policies to be observed in relation to insolvent practitioners as per the Legal Profession Act 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy insolvency guidelines

Edit your bankruptcy insolvency guidelines form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy insolvency guidelines form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bankruptcy insolvency guidelines online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bankruptcy insolvency guidelines. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

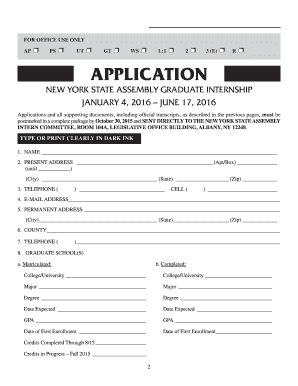

How to fill out bankruptcy insolvency guidelines

How to fill out Bankruptcy / Insolvency guidelines

01

Identify the type of bankruptcy or insolvency to file (e.g., Chapter 7, Chapter 11, or Chapter 13).

02

Gather all financial documents, including income statements, expenses, debts, and assets.

03

Complete the required bankruptcy forms accurately, ensuring all information is up-to-date.

04

Calculate your total debts and total income to determine eligibility for bankruptcy.

05

File the bankruptcy forms and pay the required filing fee to the bankruptcy court.

06

Attend the creditors' meeting to discuss your financial situation and answer any questions.

07

Complete a credit counseling course as required by law before finalizing the bankruptcy process.

08

Wait for the court to issue a discharge of debts, which will formally conclude the bankruptcy process.

Who needs Bankruptcy / Insolvency guidelines?

01

Individuals facing overwhelming debt and unable to meet financial obligations.

02

Small business owners seeking relief from business liabilities.

03

Those experiencing significant medical expenses or job loss that affect their financial stability.

04

Individuals wanting to reorganize debts while keeping certain assets like a home or car.

05

Anyone who wants to eliminate certain debts and start fresh financially.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for insolvency?

Application by debtor. — (1) A debtor shall apply under Section 94(1) in Form 1. (2) In case the default is in respect of a separate debt, the person liable for such separate debt shall apply for an insolvency resolution process for himself, personally or through a resolution professional.

What type of debt cannot be discharged?

Key Takeaways Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

Are debts dischargeable?

A discharge is a court order that forgives a debtor of certain specific debts. The discharge order prohibits a creditor from attempting to collect from a debtor a debt that has been discharged. However, not all debts are dischargeable.

What is the main difference between insolvency and bankruptcy?

Insolvency is a financial state in which an individual or a business is unable to pay their debts because their assets are insufficient to meet their liabilities. On the other hand, bankruptcy is a legal procedure that is initiated when an insolvent party is unable to settle their debts through other means.

What debts cannot be discharged in chapter 13?

Debts not discharged in chapter 13 include certain long term obligations (such as a home mortgage), debts for alimony or child support, certain taxes, debts for most government funded or guaranteed educational loans or benefit overpayments, debts arising from death or personal injury caused by driving while intoxicated

What debts are not dischargeable?

Conventional wisdom suggests there is no requirement that a debtor be “insolvent” to file a case under Chapter 11 or any other chapter of the Bankruptcy Code. No Code provision explicitly imposes such a requirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bankruptcy / Insolvency guidelines?

Bankruptcy/insolvency guidelines are legal standards that outline the process by which individuals or businesses can declare their inability to repay debts. These guidelines help to facilitate the orderly resolution of debts and provide a fresh financial start under judicial protection.

Who is required to file Bankruptcy / Insolvency guidelines?

Individuals or businesses that are unable to meet their financial obligations and debts are required to file for bankruptcy or insolvency. This may include those with overwhelming debt, insufficient income, or a significant financial crisis.

How to fill out Bankruptcy / Insolvency guidelines?

To fill out bankruptcy/insolvency guidelines, individuals or businesses must complete specific forms that detail their financial status, including assets, liabilities, income, and expenses. It's advisable to consult with a legal professional to ensure accurate completion and adherence to local laws.

What is the purpose of Bankruptcy / Insolvency guidelines?

The purpose of bankruptcy/insolvency guidelines is to provide a legal framework for debt relief, protect debtors from creditors, and facilitate the fair distribution of a debtor's assets to creditors. This process aims to allow individuals and businesses to re-organize their debts or obtain a discharge from certain debts.

What information must be reported on Bankruptcy / Insolvency guidelines?

The information that must be reported typically includes personal details, a list of assets and liabilities, income sources, expenses, and a detailed account of financial transactions. Accurate disclosure is crucial for the bankruptcy process.

Fill out your bankruptcy insolvency guidelines online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Insolvency Guidelines is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.