Get the free Retirement Planning Package

Show details

This package provides guidance for individuals planning to retire from the Public Service Pension Plan, including important considerations, age requirements for retirement, financial planning advice,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement planning package

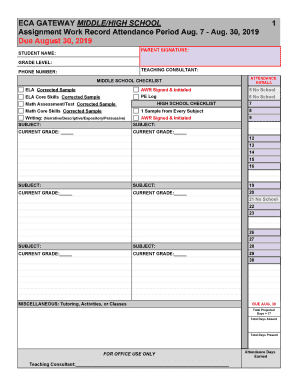

Edit your retirement planning package form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement planning package form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement planning package online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retirement planning package. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement planning package

How to fill out Retirement Planning Package

01

Gather your financial documents, including income, expenses, assets, and liabilities.

02

Determine your retirement goals, such as desired age of retirement and lifestyle expectations.

03

Assess your current savings and investments to understand your financial standing.

04

Consult with a financial advisor if needed to tailor the Retirement Planning Package to your needs.

05

Fill out the Retirement Planning Package by providing the required personal and financial information.

06

Review your completed package for accuracy and completeness before submission.

07

Schedule a follow-up meeting with a financial advisor to discuss your plan and make any necessary adjustments.

Who needs Retirement Planning Package?

01

Individuals approaching retirement age who want to ensure financial stability.

02

Young professionals planning for their financial future.

03

Anyone seeking to understand their retirement savings needs.

04

Individuals wanting to optimize their retirement benefits and investments.

05

Couples looking to align their retirement goals and plans.

Fill

form

: Try Risk Free

People Also Ask about

Can I retire with $600k and social security at 62?

ing to data from Edward Jones, by age 62 you should have $435,000 to $530,000 in savings. Since your net worth is more than just your savings, you can add to that base amount (and subtract liabilities) based on your lifestyle and what you think it'll look like in retirement.

Is $600,000 enough to retire at 62?

The “7% rule” suggests that a retiree could withdraw 7% of their retirement portfolio each year and not run out of money — but this is not a formal, tested rule like the 4% rule. It's more of an optimistic estimate based on higher-risk assumptions like strong stock market growth without major downturns.

How much money do you need to retire comfortably at age 62?

Retiring at 62 may be your goal, but can you do it with $600,000 in savings? If you plan to downsize your home, live a minimalist lifestyle and supplement your retirement savings with a pension plan, annuity or Social Security benefits then the answer may be yes.

What is a typical retirement package?

Retiring at 62 with $600,000 may not be realistic if you plan to spend more or lack other income sources. While Social Security benefits can provide income, taking those benefits at 62 will reduce the amount you receive. You'll need to wait until full retirement age, typically 66 or 67, to get your full benefit amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Retirement Planning Package?

The Retirement Planning Package is a collection of documents and resources designed to assist individuals in planning for their retirement. It typically includes information on savings strategies, investment options, and tax implications related to retirement funds.

Who is required to file Retirement Planning Package?

Individuals who are approaching retirement age or those looking to plan their retirement savings and investments are required to file the Retirement Planning Package. This may include employees, self-employed individuals, and retirees.

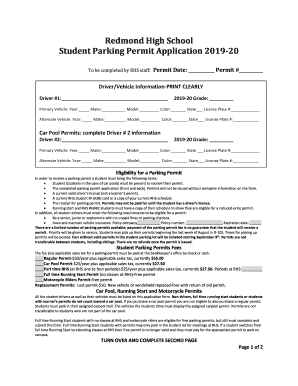

How to fill out Retirement Planning Package?

To fill out the Retirement Planning Package, individuals should gather their financial information, including income, expenses, savings, and investment portfolio. They should then follow the provided instructions in the package to complete the necessary forms and provide the required details.

What is the purpose of Retirement Planning Package?

The purpose of the Retirement Planning Package is to help individuals prepare for their financial future by providing structured guidelines and tools for retirement planning, ensuring that they have a comprehensive strategy to achieve their retirement goals.

What information must be reported on Retirement Planning Package?

The Retirement Planning Package typically requires reporting of personal financial information, including income sources, current savings, expected retirement age, desired lifestyle during retirement, and any other relevant financial commitments or obligations.

Fill out your retirement planning package online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Planning Package is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.