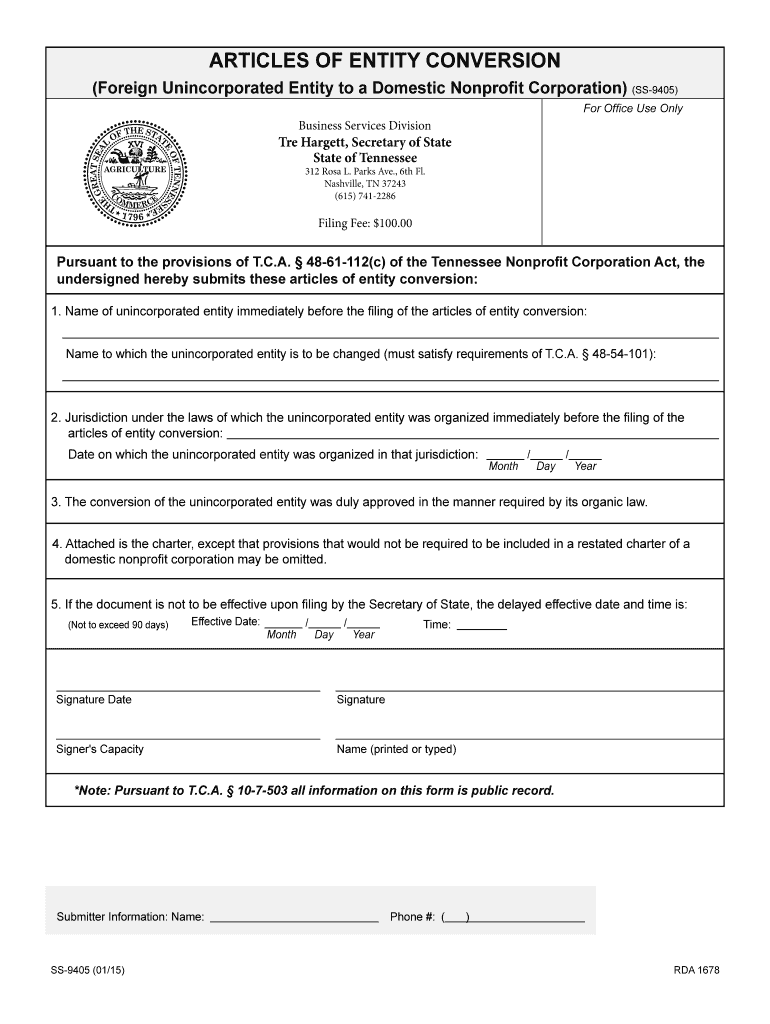

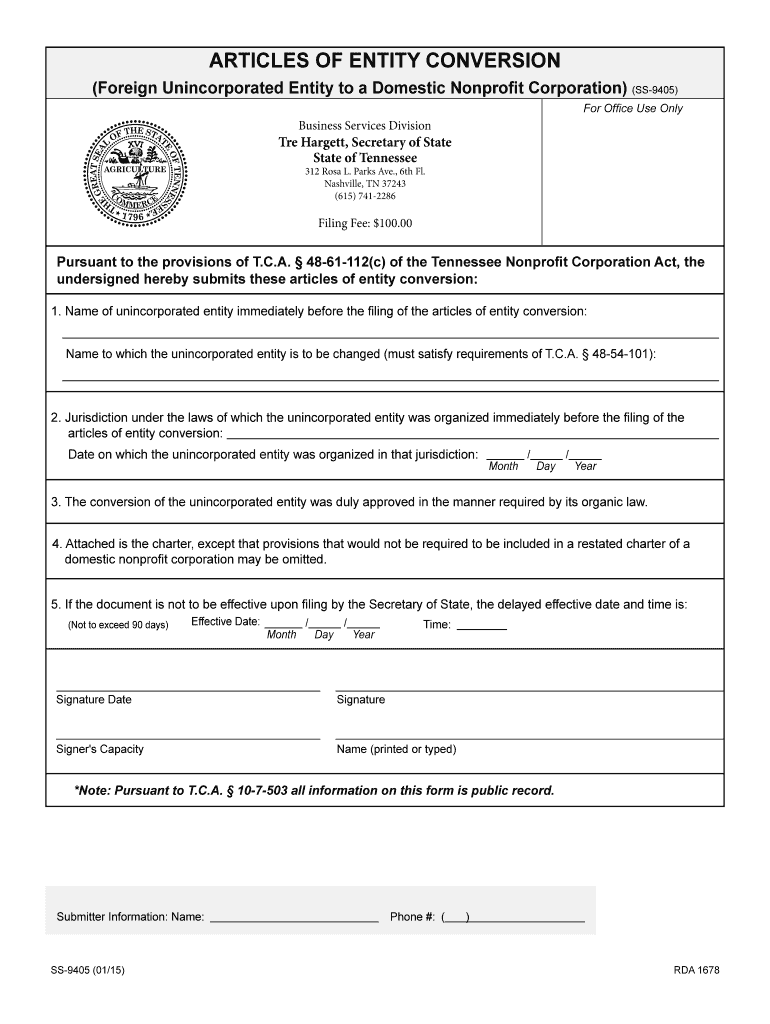

Get the free (Foreign Unincorporated Entity to a Domestic Nonprofit Corporation)

Show details

SS9405 (01×15) Business Services Division TRE Largest, Secretary of State of Tennessee INSTRUCTIONS Filing Fee: $100.00 ARTICLES OF ENTITY CONVERSION (Foreign Unincorporated Entity to a Domestic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign unincorporated entity to

Edit your foreign unincorporated entity to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign unincorporated entity to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign unincorporated entity to online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit foreign unincorporated entity to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign unincorporated entity to

How to fill out foreign unincorporated entity to:

01

Obtain the necessary forms: Visit the website of the relevant government agency or department to download or request the appropriate form for foreign unincorporated entity registration. Ensure that you are using the most up-to-date version of the form.

02

Provide basic information: Start by entering the basic information about the foreign unincorporated entity, such as its name, address, contact details, and any other identifying information required by the form.

03

Specify the type of entity: Indicate the specific type of entity you are registering, such as a partnership, limited liability company (LLC), trust, or association. Provide any additional details or documentation required for your chosen entity type.

04

Identify the representatives: Include the names, addresses, and contact details of the individuals who will act as the entity's representatives, such as the managing partners, members, or trustees. Include any additional information or documentation requested by the form.

05

Outline the entity's activities: Describe the nature of the entity's business or activities, including a brief summary of its purpose, the countries it operates in, its products or services, and any other relevant details. This information helps the authorities understand the entity's operations.

06

Disclose financial information: Provide any necessary financial information, such as the entity's annual revenue, assets, and liabilities. Attach any required financial statements, audit reports, or supporting documentation as specified by the form.

07

Submit supporting documentation: Along with the completed form, attach any required supporting documentation, such as a certificate of good standing or registration from the entity's home country, a power of attorney, or other relevant documents. Ensure that the attached documents are properly notarized or certified, if required.

08

Pay the registration fee: Check the form for any applicable registration fees and submit the payment along with the completed form. Follow the specified payment methods, such as online payment, bank transfer, or mailing a check or money order.

09

Review and submit: Before submitting the form, carefully review all the information provided to ensure accuracy and completeness. Make sure all required fields are filled out correctly and that all supporting documentation is included. Sign and date the form as required and submit it by the specified deadline.

10

Follow up: After submitting the form, keep track of the registration process. Follow up with the relevant government agency or department to inquire about the status of your application, any additional requirements, or any further steps that may be needed.

Who needs foreign unincorporated entity to:

01

Companies expanding internationally: Companies that are expanding their operations to foreign countries may need to establish a foreign unincorporated entity to comply with local laws and regulations. This helps them engage in various business activities, establish a legal presence, and ensure compliance with tax and reporting requirements.

02

Partnerships and joint ventures: Partnerships and joint ventures involving companies or individuals from different countries may require the formation of a foreign unincorporated entity to facilitate the collaboration and protect the rights and obligations of the involved parties.

03

Trusts and associations: Trusts, associations, or other legal entities that operate internationally, either for philanthropic or commercial purposes, may need to register as a foreign unincorporated entity in the countries where they conduct their activities to establish legal recognition and fulfill regulatory obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in foreign unincorporated entity to?

With pdfFiller, the editing process is straightforward. Open your foreign unincorporated entity to in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit foreign unincorporated entity to straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing foreign unincorporated entity to.

How do I complete foreign unincorporated entity to on an Android device?

Complete your foreign unincorporated entity to and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is foreign unincorporated entity to?

Foreign unincorporated entity refers to an entity that is formed outside of the jurisdiction where it is conducting business.

Who is required to file foreign unincorporated entity to?

Any foreign unincorporated entity that is conducting business in a specific jurisdiction may be required to file.

How to fill out foreign unincorporated entity to?

Foreign unincorporated entity forms can usually be filled out online or submitted through mail with the required information.

What is the purpose of foreign unincorporated entity to?

The purpose is to provide transparency and ensure that foreign entities conducting business in a jurisdiction are properly registered.

What information must be reported on foreign unincorporated entity to?

Information such as the entity's name, address, registered agent, business activities, and financial details may need to be reported.

Fill out your foreign unincorporated entity to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Unincorporated Entity To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.