Get the free Contents Insurance Policy Booklet

Show details

This document is a policy booklet for Contents Insurance provided by Crystal Insurance, detailing coverage, conditions, exclusions, and claims procedures for tenants and leaseholders.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contents insurance policy booklet

Edit your contents insurance policy booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contents insurance policy booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contents insurance policy booklet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit contents insurance policy booklet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

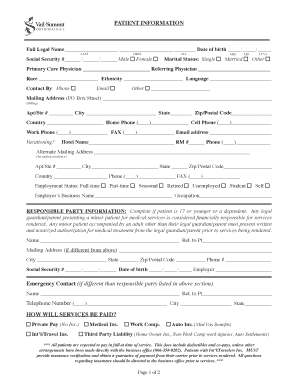

How to fill out contents insurance policy booklet

How to fill out Contents Insurance Policy Booklet

01

Gather all necessary documentation related to your belongings, including receipts or appraisals.

02

Read the introductory section of the booklet to understand the coverage offered.

03

Fill out your personal information in the designated section, including your name, address, and contact details.

04

List all items you wish to insure, providing as much detail as possible, including their value.

05

Review the coverage options available and select the ones that best suit your needs.

06

Provide any previous insurance information, if applicable.

07

Review the terms and conditions carefully before signing.

08

Submit the completed booklet to your insurance provider.

Who needs Contents Insurance Policy Booklet?

01

Anyone who owns personal belongings or valuable items that they want to protect against theft, damage, or loss.

02

Renters who want to insure their contents against potential risks.

03

Homeowners looking to safeguard their possessions, especially those with high-value items.

Fill

form

: Try Risk Free

People Also Ask about

Who is best for home contents insurance?

Best contents insurance policies PolicyContents score (average = 67%)Damage to contents in the open LV Home Plus Insurance 81% ★★★★★ M&S Premier Home Insurance 80% ★★★★★ NatWest Elite Home Insurance 79% ★★★☆☆ best buy Royal Bank of Scotland Elite Home Insurance 79% ★★★☆☆3 more rows • Apr 15, 2025

What are the contents of insurance policy?

The five parts of an insurance policy are: declarations, insuring agreements, definitions, conditions, and exclusions.

What should contents insurance include?

Home contents insurance covers you against loss, theft or damage to your personal and home possessions. It can also cover you if you take items out of the home, on holiday, for example. The insurance covers your own possessions and those of close family members living with you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Contents Insurance Policy Booklet?

A Contents Insurance Policy Booklet is a document that outlines the details, terms, and conditions of an insurance policy that covers the personal belongings within a property against risks such as theft, fire, or damage.

Who is required to file Contents Insurance Policy Booklet?

Typically, individuals or households who purchase contents insurance are required to file the Contents Insurance Policy Booklet to ensure their possessions are covered.

How to fill out Contents Insurance Policy Booklet?

To fill out a Contents Insurance Policy Booklet, you need to provide accurate information about your personal belongings, including their value, type, and condition, as well as details about the property where they are located.

What is the purpose of Contents Insurance Policy Booklet?

The purpose of the Contents Insurance Policy Booklet is to serve as an official record of the insurance policy, detailing what is covered, any exclusions, and the obligations of the policyholder and insurer.

What information must be reported on Contents Insurance Policy Booklet?

The information that must be reported on a Contents Insurance Policy Booklet typically includes a list of covered items, their estimated values, property address, policyholder's details, and any specific coverage limits or exclusions.

Fill out your contents insurance policy booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contents Insurance Policy Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.