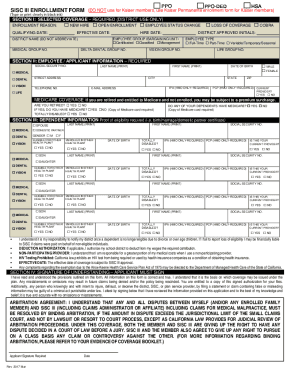

Get the free Housing & Council Tax Benefit - Claim form

Show details

This document is a claim form for individuals seeking Housing Benefit or Council Tax Benefit, detailing the necessary evidence, eligibility criteria, and the process for submitting claims.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign housing council tax benefit

Edit your housing council tax benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your housing council tax benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit housing council tax benefit online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit housing council tax benefit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out housing council tax benefit

How to fill out Housing & Council Tax Benefit - Claim form

01

Obtain the Housing & Council Tax Benefit Claim form from your local council's website or office.

02

Fill out your personal details, including your name, address, and contact information.

03

Provide details of your household, including information about anyone living with you, their relationship to you, and their income.

04

Fill in your income details, including wages, benefits, and any other sources of income.

05

Include information about your savings and investments.

06

Provide details about your rent and any other housing costs.

07

Check if you qualify for Council Tax Benefit based on your circumstances.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form.

10

Submit the form to your local council either online, by mail, or in person as instructed.

Who needs Housing & Council Tax Benefit - Claim form?

01

Individuals or families who are on a low income.

02

People who receive certain benefits.

03

Renters who need assistance with housing costs.

04

Those responsible for paying Council Tax and facing financial difficulties.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income to spend on housing?

The 30% rule is a way to determine how much of your income should go toward housing expenses. According to this rule, you should aim to spend no more than 30% of your gross income on housing-related expenses. If you're a renter, this includes your rent plus any utility costs, such as heat, water, and electricity.

What's the most Housing Benefit will pay?

Maximum LHA rates payable The maximum housing benefit that you can receive cannot be more than the rent that you pay or the LHA evaluation, whichever is the lowest. The LHA rates for the area that you live in are published on the VOA website.

What is the maximum amount of Housing Benefit you can receive?

Every privately rented property has a Local Housing Allowance (LHA) rate. The maximum amount of Housing Benefit you can get is 100% of the LHA rate. If your rent is more than the LHA rate, you cannot get Housing Benefit on the difference. You can search Directgov for LHA rates by postcode.

What is council tax benefit?

You may be able to get Council Tax Reduction (this used to be called Council Tax Benefit) if you're on a low income or get benefits. You can challenge your Council Tax band if you think your home is in the wrong valuation band.

What is the maximum amount of benefits I may receive?

Benefit cap outside Greater London Per weekPer month If you're in a couple £423.46 £1,835 If you're a single parent and your children live with you £423.46 £1,835 If you're a single adult £283.71 £1,229.42

What is the maximum amount you can get on universal credit?

Standard allowance How much you'll getMonthly standard allowance If you're single and under 25 £316.98 If you're single and 25 or over £400.14 If you live with your partner and you're both under 25 £497.55 (for you both) If you live with your partner and either of you are 25 or over £628.10 (for you both)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

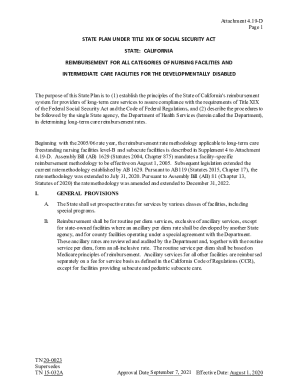

What is Housing & Council Tax Benefit - Claim form?

The Housing & Council Tax Benefit - Claim form is an application used by individuals or families to claim financial assistance for housing costs and council tax liabilities from their local council.

Who is required to file Housing & Council Tax Benefit - Claim form?

Individuals or families who are on a low income, those receiving certain benefits, or those who need help with rent and council tax payments are required to file the Housing & Council Tax Benefit - Claim form.

How to fill out Housing & Council Tax Benefit - Claim form?

To fill out the Housing & Council Tax Benefit - Claim form, you should provide personal information, details about your household income, rent, and council tax, along with any supporting documents required by your local council.

What is the purpose of Housing & Council Tax Benefit - Claim form?

The purpose of the Housing & Council Tax Benefit - Claim form is to assess eligibility for financial assistance to help cover housing costs and council tax, ensuring that those in need receive necessary support.

What information must be reported on Housing & Council Tax Benefit - Claim form?

The Housing & Council Tax Benefit - Claim form requires information such as personal details, household composition, income sources, rent amounts, council tax details, and any other relevant financial circumstances.

Fill out your housing council tax benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Housing Council Tax Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.