Get the free Claim for Australian Age Pension under the Agreement between Australia and the Czech...

Show details

Tento formulář slouží k žádosti o australský starobní důchod a zahrnuje proces registrace, požadavky na pobyt a další praktické informace.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for australian age

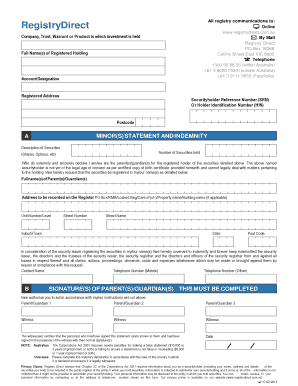

Edit your claim for australian age form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for australian age form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for australian age online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for australian age. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for australian age

How to fill out Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security

01

Gather necessary documents, including proof of identity, residency, and age.

02

Obtain the claim form for the Australian Age Pension, available from the Services Australia website or local office.

03

Fill out personal details on the claim form including your name, address, and contact information.

04

Provide details of your Czech Republic pension entitlements, if applicable.

05

List any other income or assets, including savings, property, and other pensions.

06

Sign the declaration at the end of the form, confirming the information is accurate.

07

Submit the completed claim form along with all required supporting documents to Services Australia.

08

Wait for confirmation and further instructions from Services Australia regarding your claim.

Who needs Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

01

Australian citizens and permanent residents who have worked in the Czech Republic and wish to claim Age Pension benefits.

02

Individuals who are approaching retirement age and are seeking pension support under the bilateral agreement.

03

Those who are currently residing in Australia but have historical work credits in the Czech Republic.

Fill

form

: Try Risk Free

People Also Ask about

What is the 5 year certain pension benefit?

Five-Year Certain This form of payment provides a monthly pension to you for your lifetime with the guarantee that if you die before receiving 60 monthly pension payments, the remainder of the 60 monthly payments will be paid to your designated beneficiary.

How many years do you need to work in Australia to get a pension?

Generally, to be eligible for the Age Pension, you must: be age 67 or over. be an Australian resident and have lived in Australia for at least 10 years, and at least 5 of these years without a break in residence. meet the income and asset tests.

Can you live overseas and claim Australian pension?

You may get Age Pension for the whole time you're outside Australia. Even if you're leaving to live in another country.

How does a foreign pension affect my Australian pension?

This means that a foreign pension, converted to Australian dollars, reduces your income support pension by 50 cents for every $1 of comparable foreign pension received that is over the income free area. For more information about how income is assessed refer to the Income test.

Can you receive an Australian disability pension overseas?

You may get DSP overseas if all of these apply: you go to a country we have a social security agreement with. the agreement covers DSP. you're severely disabled.

Is it worth paying into a pension for 5 years?

Is it worth paying into a pension for five years? The answer to this question is a definitive yes, as in simple terms, the more you can save in the run up to retirement, the more you'll have to live on when you eventually stop work.

What is the 5 year rule for pension in Australia?

To get Age Pension you generally need to have been an Australian resident for at least 10 years in total. For at least 5 of these years, there must be no break in your residence.

How long do you lose your Australian pension if you live overseas?

Australian pensioners can stay up to 6 weeks overseas and receive their Australian pension normally before their return to Australia. If you're moving overseas or your travel plans exceed 6 weeks, you'll need to let Services Australia know, and your pension payments may be affected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

The Claim for Australian Age Pension under the Agreement is a formal request made by individuals who have lived or worked in both Australia and the Czech Republic to receive age pension benefits based on their combined social security contributions.

Who is required to file Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

Individuals who have qualifying periods of residence or work in both Australia and the Czech Republic and who meet the age and residency requirements set by Australian law are required to file the claim.

How to fill out Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

To fill out the claim, applicants must complete the official claim form, provide personal identification, details of their work history, residency, and any relevant documentation from both countries regarding their social security contributions.

What is the purpose of Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

The purpose of the claim is to allow individuals who have worked or resided in both countries to access their entitlements to age pension benefits, ensuring that they receive a fair pension based on their total contributions.

What information must be reported on Claim for Australian Age Pension under the Agreement between Australia and the Czech Republic on Social Security?

Applicants must report personal details such as name, date of birth, current address, work history, periods of residence in both countries, social security account details, and any other relevant information that supports their claim.

Fill out your claim for australian age online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Australian Age is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.