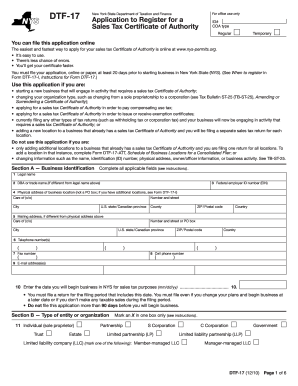

Who needs a DTF-17 form?

Every business entity that provides taxable services or sells tangible property, collects taxes from customers. In New York State, companies have to apply for a Certificate of Authority; otherwise, they are not allowed to withhold taxes from their customers.

What is a DTF-17 form for?

A DTF-17 form is an application for the Certificate of Authority. It is required for the NYS Department of Taxation and Finance.

Is it accompanied by other forms?

No, this application does not require companion forms.

When is form DTF-17 due?

All new business entities should file a quarterly return. The due dates for every quarter are June, 20th, September, 20th, December, 20th, March, 20th. If the due date falls on Saturday, Sunday, or a legal holiday, your DTF-17 form should arrive by the first business day after the due date. You must file your first sales tax return for the sales tax quarter that includes the date you plan on starting business.

How do I fill out a form DTF-17?

There are only 2 pages of questions in this form, so it should not take long to complete. First, you should write about your business activity, then you need to answer the questions in order to articulate more about your business activity. You should send the completed form at least 20 days prior to the first working day of your organization.

Where do I send it?

NYS Department of Taxation and Finance encourages taxpayers to file their returns online. This will guarantee that you will receive your Certificate of Authority sooner than a person who mailed his application. Visit Online Permit Assistance and Licensing website and submit your application. If you still prefer to send a DTF-17 form via mail, the address is:

NYS Tax Department

Sales Tax Registration Unit

W A Harriman Campus

Albany, NY 12227