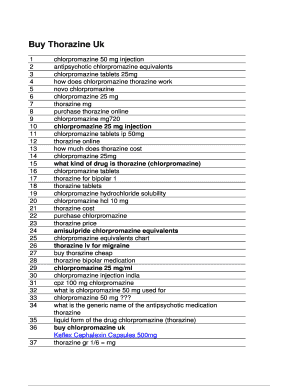

Get the free UUT 1 Long

Show details

Este documento es un formulario para la declaración del impuesto universal de uso en Ohio, donde los contribuyentes reportan el número de cuenta, el período de reporte, las compras imponibles y

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uut 1 long

Edit your uut 1 long form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uut 1 long form via URL. You can also download, print, or export forms to your preferred cloud storage service.

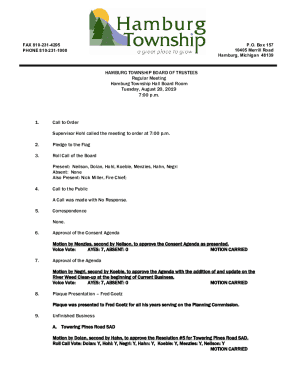

How to edit uut 1 long online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit uut 1 long. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

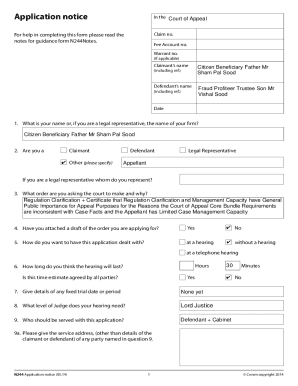

How to fill out uut 1 long

How to fill out UUT 1 Long

01

Begin by gathering all necessary personal and financial information.

02

Carefully read the instructions provided with UUT 1 Long to understand the requirements.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Enter any required financial information accurately, such as income details and expenses.

05

Provide any relevant additional information or documentation as specified in the form.

06

Review all entries for accuracy and completeness before submitting the form.

07

Submit the UUT 1 Long according to the submission guidelines outlined in the instructions.

Who needs UUT 1 Long?

01

Individuals applying for specific financial assistance or benefits.

02

Businesses seeking grants or funding.

03

Residents needing to report personal or property information for official purposes.

Fill

form

: Try Risk Free

People Also Ask about

What type of taxes does Ohio have?

Ohio Tax Rates, Collections, and Burdens Ohio does not have a corporate income tax but does levy a state gross receipts tax. Ohio has a 5.75 percent state sales tax rate and an average combined state and local sales tax rate of 7.24 percent.

How to file a UST 1 in Ohio?

After signing into the Gateway, select OHTAX eServices on your dashboard. From the Sales Tax account panel, select File Now for the UST-1 you choose to file. You will be asked if you have a file to upload for the return, select Yes. Then, click the File Upload button.

How do I register for Ohio use tax?

You can register for an Ohio sales tax permit in one of two ways: Register online at the Ohio Business Gateway. In state based sellers: Choose “County Vendor's license.” Out of state based sellers: Choose “ Ohio Taxation – New Account Registration and Fuel Permit” and then Choose “Sellers Registration.”

What is an Ohio universal use tax?

All states that have a sales tax have a companion use tax. Basically, the use tax applies to all tax- able purchases when insufficient sales or use tax has been paid. Ohio use tax is applied at the same rate and to the same tangible personal property and services as the Ohio sales tax. State Use Taxes.

What is the accelerated payment in Ohio?

Along with that, Ohio does require accelerated payments for taxpayers whose sales tax liability exceeds $75,000 annually. The accelerated payment is 75% of the average of the previous fourth month's tax liability. The previous month's accelerated payment is subtracted from the current month's total liabilities.

How to file a UST-1 in Ohio?

After signing into the Gateway, select OHTAX eServices on your dashboard. From the Sales Tax account panel, select File Now for the UST-1 you choose to file. You will be asked if you have a file to upload for the return, select Yes. Then, click the File Upload button.

Do I have to pay Ohio use tax?

The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer.

Is Ohio sales tax paid monthly or semi annually?

Monthly sales tax returns are due by the 23rd of the following month from the period filed. Example: January 1 through January 31 return is due on February 23rd. Semi annual sales tax returns are due by the 23rd of the following month from the end of the six month period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is UUT 1 Long?

UUT 1 Long is a form used by entities in California to report Utility User Tax (UUT) obligations related to utility services received.

Who is required to file UUT 1 Long?

Individuals or businesses that receive taxable utility services and have a tax liability under the local Utility User Tax ordinance are required to file UUT 1 Long.

How to fill out UUT 1 Long?

To fill out UUT 1 Long, report the total utility usage and tax calculations in the provided sections, ensuring all required fields are completed accurately.

What is the purpose of UUT 1 Long?

The purpose of UUT 1 Long is to collect information on utility usage and associated taxes to ensure compliance with local tax laws.

What information must be reported on UUT 1 Long?

The UUT 1 Long requires information such as the type of utility services, total usage amounts, applicable tax rates, and the calculated tax owed.

Fill out your uut 1 long online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uut 1 Long is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.