Get the free Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption...

Show details

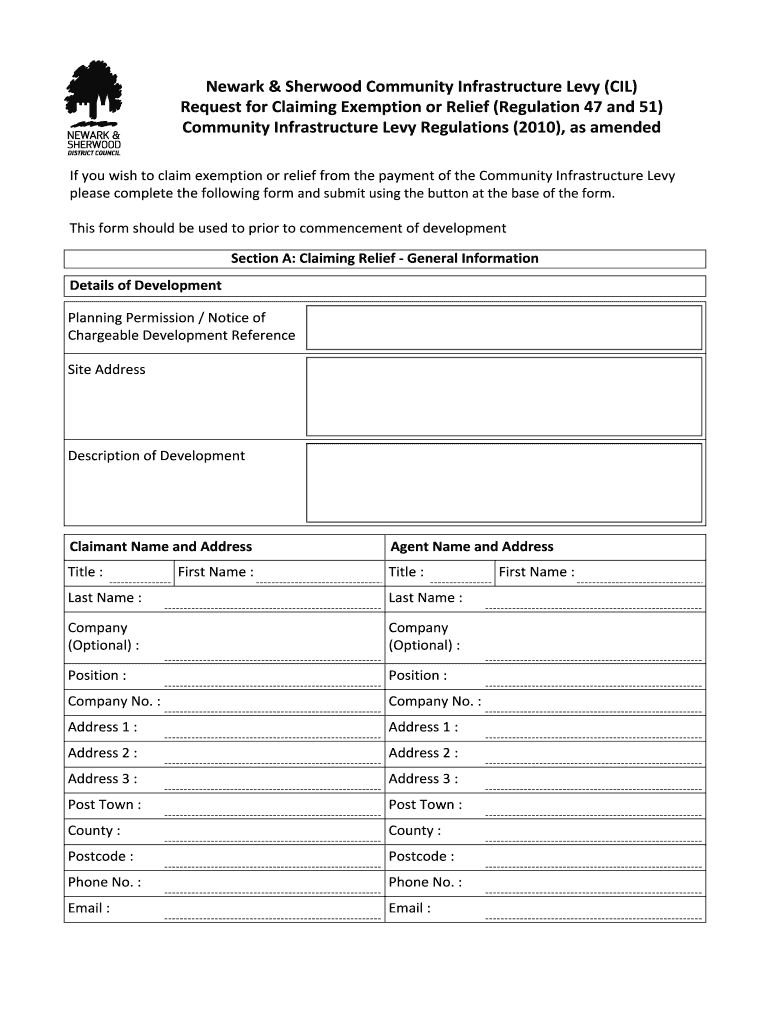

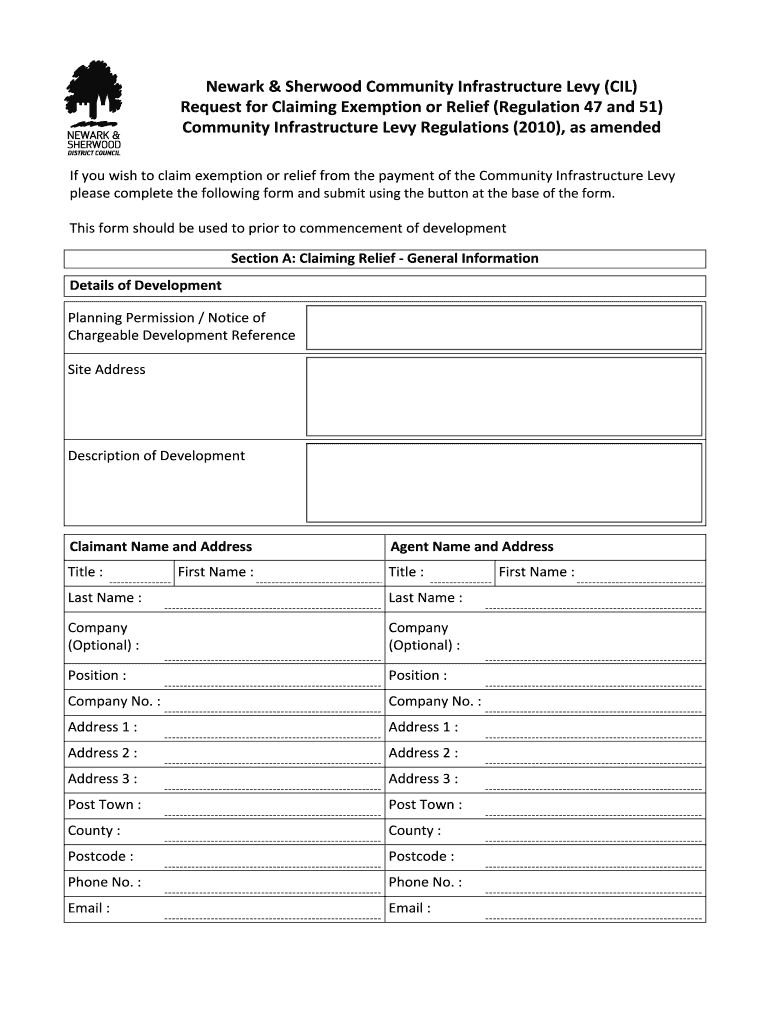

This document is a form used to claim exemption or relief from the payment of the Community Infrastructure Levy (CIL) prior to the commencement of development, in accordance with the Community Infrastructure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign newark sherwood community infrastructure

Edit your newark sherwood community infrastructure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your newark sherwood community infrastructure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit newark sherwood community infrastructure online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit newark sherwood community infrastructure. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out newark sherwood community infrastructure

How to fill out Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief

01

Visit the Newark & Sherwood District Council website to access the CIL exemption form.

02

Read the guidance notes to understand the eligibility criteria for exemption or relief.

03

Gather necessary documentation, such as proof of ownership, planning permission, and any relevant certificates.

04

Complete the CIL Request for Claiming Exemption or Relief form accurately, filling in all required fields.

05

Provide detailed information regarding the specific exemption or relief being claimed.

06

Sign and date the form to confirm its accuracy.

07

Submit the completed form along with any supporting documents to the Newark & Sherwood District Council via the specified submission method.

Who needs Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

01

Developers who are planning to undertake construction on eligible projects.

02

Individuals or organizations seeking to claim exemption or relief from the CIL due to specific circumstances.

03

Property owners who have received planning permission but are unsure if they qualify for relief from the levy.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of the cil?

CIL is one method to help fund the delivery of infrastructure to support the planned growth identified within the adopted Local Plan 2026.

How do I know if I have to pay cil?

On making a planning application, an additional information requirement form needs to be submitted to enable the local authority to determine whether a development may be CIL liable. The local authority gives notice of its calculation as to CIL liability (the liability notice).

How much is cil levy?

How much is the CIL charge? UseZoneIndexed 2025 CIL Rate: (per sq. m) Residential dwellings – schemes of more than 10 units Zone A £485.68 Zone B £457.40 Residential dwellings – schemes of 10 or less Zone A £555.76 Zone B £534.8610 more rows

Why do I have to pay cil?

The money generated through the levy will contribute to the funding of infrastructure to support development growth in Cotswold District. You will need to pay CIL if you are: creating a new dwelling or residential annex (of any size) increasing the gross floor area by 100 square metres or more.

How to avoid cil charge?

Know the CIL exemptions This means that development would not be chargeable under CIL if you are just adding an extension that was under 100 sqm, and that additional 100 sqm was not creating a new dwelling. If you're claiming an exemption, it's integral that you do it before you commence development or it won't count.

What is a cil liability notice?

What is a liability notice? The liability notice: sets out the CIL amount you must pay for the development. will include all relevant floorspace contained in the development. includes floorspace that may be eligible for relief or exemption.

What is the cil community infrastructure levy?

The Community Infrastructure Levy (CIL) is a planning charge, introduced by the Planning Act 2008, as a tool for local authorities in England and Wales to help deliver infrastructure to support the development of their area. It came into force on 6 April 2010 through the Community Infrastructure Levy Regulations 2010.

What is a cil in real estate?

Community Infrastructure Levy (CIL) is a charge on additional floor space that Local Planning Authorities charge and which is designed to help fund local and sub-regional infrastructure identified in the Local Authority's development plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

The Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief is a formal procedure that allows developers to apply for exemptions or reductions from the CIL charges based on certain criteria, such as the type of development or its impact on local infrastructure.

Who is required to file Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

Developers or landowners who are planning to undertake development that is subject to the Community Infrastructure Levy in Newark & Sherwood are required to file this request if they believe they qualify for an exemption or relief.

How to fill out Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

To fill out the application, you need to complete the official CIL exemption or relief form provided by Newark & Sherwood District Council, ensuring to provide all necessary information such as details about the development, grounds for exemption, and any supporting evidence required.

What is the purpose of Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

The purpose of the CIL Request for Claiming Exemption or Relief is to provide a mechanism for developers to reduce their financial burden under the CIL if their projects meet specific criteria established by the council.

What information must be reported on Newark & Sherwood Community Infrastructure Levy (CIL) Request for Claiming Exemption or Relief?

The request must include information such as the nature and scale of the proposed development, the grounds for claiming exemption or relief, the expected impact on community infrastructure, and any relevant documents that support the claim.

Fill out your newark sherwood community infrastructure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Newark Sherwood Community Infrastructure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.