Get the free Specific Purpose Tax Project Application - tetonwyo

Show details

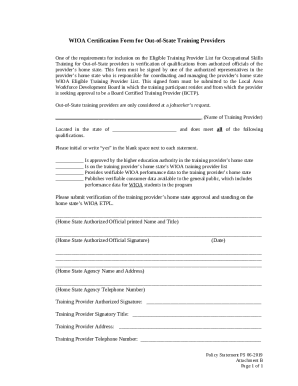

This document outlines the application process for local government entities in Teton County and the Town of Jackson to submit proposals for projects funded by specific purpose tax initiatives to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign specific purpose tax project

Edit your specific purpose tax project form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your specific purpose tax project form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit specific purpose tax project online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit specific purpose tax project. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out specific purpose tax project

How to fill out Specific Purpose Tax Project Application

01

Obtain the Specific Purpose Tax Project Application form from the relevant tax authority website or office.

02

Fill in your personal details, including name, address, and contact information.

03

Clearly state the specific purpose for which the tax project is intended.

04

Provide a detailed description of the project, including objectives, expected outcomes, and timeline.

05

Itemize the budget for the project, specifying costs and funding sources.

06

Attach any required supporting documents, such as project proposals, quotes, or letters of endorsement.

07

Review the application for completeness and accuracy.

08

Submit the application by the specified deadline, either online or by mail.

Who needs Specific Purpose Tax Project Application?

01

Municipalities or local government entities planning a specific tax-funded project.

02

Nonprofit organizations aiming to implement community projects funded by a specific tax.

03

Businesses seeking tax incentives for specific development projects that benefit the community.

Fill

form

: Try Risk Free

People Also Ask about

Is Form 1023 difficult to complete?

Government-issued forms in general have a reputation for being difficult. Form 1023 is especially notorious for its length and complexity, regardless of your organizational structure. Even though it may be complicated, there are a ton of resources that you can turn to for assistance.

How do I apply for a 501c3 application?

To apply for recognition by the IRS of exempt status under IRC Section 501(c)(3), you must use either Form 1023 or Form 1023-EZ. All organizations seeking exemption under IRC Section 501(c)(3) can use Form 1023, but certain small organizations can apply using the shorter Form 1023-EZ.

How long does it take the IRS to approve a 501(c)(3) application?

If you file Form 1023, the average IRS processing time is 6 months. Processing times of 9 or 12 months are not unheard of. The IRS closely scrutinizes these applications, as the applicants are typically large or complex organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Specific Purpose Tax Project Application?

The Specific Purpose Tax Project Application is a formal request submitted by organizations or government entities to seek approval for funding a designated project through a specific purpose tax.

Who is required to file Specific Purpose Tax Project Application?

Entities such as local governments, municipalities, or organizations seeking to implement a project funded by a specific purpose tax are required to file this application.

How to fill out Specific Purpose Tax Project Application?

To fill out the application, one must provide detailed information about the project, including budget estimates, timelines, and objectives, along with necessary documentation as required by the governing authority.

What is the purpose of Specific Purpose Tax Project Application?

The purpose of the application is to ensure accountability and transparency in the use of funds generated by specific purpose taxes and to evaluate the viability and necessity of proposed projects.

What information must be reported on Specific Purpose Tax Project Application?

The application must report project description, objectives, estimated costs, funding sources, timelines, and expected outcomes, along with any supporting documents that demonstrate the need and feasibility of the project.

Fill out your specific purpose tax project online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Specific Purpose Tax Project is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.