Get the free Authorization for Payroll Deductions for Employee Organization Dues

Show details

This document authorizes the State of Wisconsin to deduct employee organization dues from earnings for the Wisconsin Professional Employees Council.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization for payroll deductions

Edit your authorization for payroll deductions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization for payroll deductions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization for payroll deductions online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit authorization for payroll deductions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out authorization for payroll deductions

How to fill out Authorization for Payroll Deductions for Employee Organization Dues

01

Obtain the Authorization for Payroll Deductions form from your employer or organization.

02

Fill in your personal information, including your name, employee ID, and department.

03

Indicate the amount you wish to deduct for employee organization dues.

04

Select the type of organization you are authorizing deductions for.

05

Sign and date the authorization form to confirm your consent.

06

Submit the completed form to your HR or payroll department for processing.

Who needs Authorization for Payroll Deductions for Employee Organization Dues?

01

Employees who are members of a recognized employee organization.

02

Employees who wish to have their organization dues deducted directly from their paycheck.

Fill

form

: Try Risk Free

People Also Ask about

What is a form 1188?

Employees use PS Form 1188, Cancellation of Organization Dues from Payroll Withholdings, to cancel dues withholding.

How do I stop payroll in QBO?

Follow the steps below: Log into your QuickBooks Online account. Click the gear icon in the top right corner and select Account and settings. On the Payroll product, select Cancel subscription. Fill out the online cancellation form to complete this process.

What is an 1187 form?

The 1187 form is used by federal agencies and federal payroll processors to assign membership to the correct employee and initiate withdrawal of bi-weekly membership dues.

How do I stop a payroll deduction?

Employees desiring to cancel voluntary miscellaneous payroll deduction(s) should contact the respective company/companies or their personnel/payroll offices.

How to stop payroll deductions?

Employees desiring to cancel voluntary miscellaneous payroll deduction(s) should contact the respective company/companies or their personnel/payroll offices.

What is a mandatory payroll deduction?

Mandatory Deductions: Employers are legally required to make these from every paycheck, regardless of employee consent. Examples include federal and state taxes, Social Security contributions, and in some cases, wage garnishments and union dues.

What is a payroll correction deduction?

A payroll correction is a payroll run that happens off your regular cycle to fix an error made in a previous payroll. For most payroll mistakes, time is of the essence when it comes to fixing them, which is why employers often opt for correction, or off-cycle, payroll runs in those situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

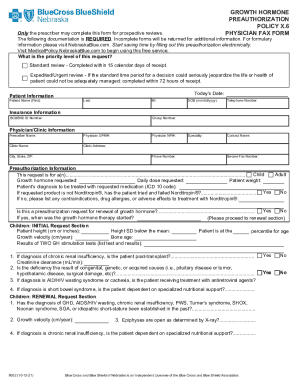

What is Authorization for Payroll Deductions for Employee Organization Dues?

Authorization for Payroll Deductions for Employee Organization Dues is a form used by employees to permit their employer to deduct dues or fees from their paychecks for membership in a specific employee organization or union.

Who is required to file Authorization for Payroll Deductions for Employee Organization Dues?

Employees who wish to have their dues or fees deducted from their paychecks for membership in an employee organization or union are required to file this authorization.

How to fill out Authorization for Payroll Deductions for Employee Organization Dues?

To fill out the Authorization for Payroll Deductions for Employee Organization Dues, an employee must provide their personal information, including name, employee identification number, the organization they are joining, and the amount to be deducted. The employee must then sign and date the authorization form.

What is the purpose of Authorization for Payroll Deductions for Employee Organization Dues?

The purpose of the Authorization for Payroll Deductions for Employee Organization Dues is to facilitate the automatic deduction of union dues or fees from employee paychecks, ensuring that employees remain in good standing with their respective organizations.

What information must be reported on Authorization for Payroll Deductions for Employee Organization Dues?

The information that must be reported on the Authorization for Payroll Deductions for Employee Organization Dues includes the employee’s name, employee ID number, the name and identification of the employee organization, the amount to be deducted, and the employee's signature and date.

Fill out your authorization for payroll deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization For Payroll Deductions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.