Get the free Loan Counseling Information - lacitycollege

Show details

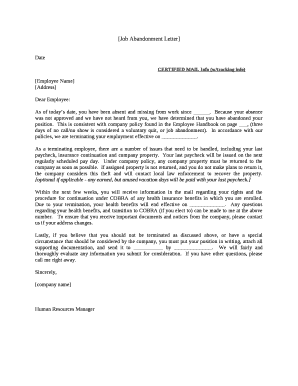

This document is intended for students at LACC who are requesting loan amounts over $12,500, those borrowing for the third year, or enrolling in non-regular college classes to complete their loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan counseling information

Edit your loan counseling information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan counseling information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan counseling information online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan counseling information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan counseling information

How to fill out Loan Counseling Information

01

Gather necessary personal information such as your name, contact details, and Social Security number.

02

Collect financial documents including income statements, bank statements, and tax returns.

03

List all debts and obligations, including monthly payments and current balances.

04

Complete the loan counseling form by providing accurate and honest answers.

05

Review your completed form for any errors or omissions.

06

Submit the loan counseling information to the relevant agency or lender.

Who needs Loan Counseling Information?

01

Individuals seeking financial assistance or loans.

02

Borrowers who want to understand the terms and conditions of their loans.

03

People looking to improve their financial literacy.

04

Those facing financial difficulties and needing guidance on loan repayment.

Fill

form

: Try Risk Free

People Also Ask about

What is loan advice?

Loan Advice means the confirmation issued by the Bank to the Borrower in relation to the Loan; and. View Source.

What is loan counseling?

Entrance counseling ensures you understand the terms and conditions of your loan and your rights and responsibilities. You'll learn what a loan is, how interest works, your options for repayment, and how to avoid delinquency and default.

How long does loan exit counseling take?

How Long Will It Take? Exit counseling takes about 30 minutes to complete. You must complete it in one session; you cannot save and return to an incomplete session.

How to exit loan counseling?

You can complete the Exit Loan Counseling on the Federal Student Aid Website by logging in with your FSA ID Username and Password. How long will it take? The entire counseling process must be completed in a single session. Most people complete counseling in 20-30 minutes.

What is the meaning of loan advisor?

Loan advisors possess extensive knowledge of various loan products, including personal loans, home loans, business loans, MSME loans, and more. They assess your financial status, credit score, and repayment capability to recommend the best loan options that align with your financial goals.

What information is available in NSLDS?

The National Student Loan Data System (NSLDS) is the U.S. Department of Education's centralized database of all federal student aid. This system provides you with an overview of your federal student loans; your loan amounts, enrollment status, outstanding balances, loan status and disbursements.

What are the disadvantages of having a student loan?

Delaying or Forgoing Grad School. Difficulty Purchasing a Home. Difficulty Renting a Home. Decreased Net Worth. Career Goals Impeded. Adverse Impacts to Your Score. Job Disqualification. Fund Seizure.

What is loan entrance counseling?

Entrance Counseling is required to help borrowers understand their responsibilities in taking out a loan. It offers information about the loan process, managing education expenses, suggests other resources, and shares rights and responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan Counseling Information?

Loan Counseling Information refers to the details and guidance provided to borrowers regarding their loans, including the terms, repayment options, and resources available for financial education.

Who is required to file Loan Counseling Information?

Entities that participate in federal student loan programs or offer loans that require counseling typically must file Loan Counseling Information. This includes schools, lenders, and certain financial institutions.

How to fill out Loan Counseling Information?

To fill out Loan Counseling Information, borrowers must complete a counseling session, which may be done online or in-person, and provide the required documentation and details about their loan and financial situation as instructed by the lending or counseling institution.

What is the purpose of Loan Counseling Information?

The purpose of Loan Counseling Information is to ensure that borrowers understand their loan obligations, rights, and options before taking on debt, ultimately aiming to foster responsible borrowing and repayment practices.

What information must be reported on Loan Counseling Information?

Loan Counseling Information must typically include the borrower's financial circumstances, loan amounts, terms of the loan, interest rates, repayment plans, and resources for managing student loans or financial education.

Fill out your loan counseling information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Counseling Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.