Get the free MOTOR VEHICLE EXCISE ABATEMENT APPLICATION

Show details

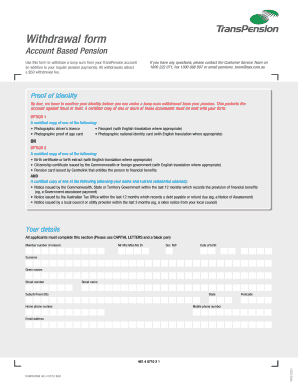

This document serves as an application for abatement of motor vehicle excise tax for the Town of Easton and outlines the requirements and instructions for filing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle excise abatement

Edit your motor vehicle excise abatement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle excise abatement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor vehicle excise abatement online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor vehicle excise abatement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle excise abatement

How to fill out MOTOR VEHICLE EXCISE ABATEMENT APPLICATION

01

Obtain the MOTOR VEHICLE EXCISE ABATEMENT APPLICATION form from your local tax office or online.

02

Fill in your personal information such as name, address, and contact information.

03

Provide details about the vehicle, including the make, model, year, and vehicle identification number (VIN).

04

Indicate the reason for the abatement request, such as selling the vehicle, total loss, or exemption eligibility.

05

Attach any required documentation, such as proof of sale, insurance claims, or other relevant papers.

06

Review the application for completeness and accuracy.

07

Submit the application to the appropriate local tax office within the required timeframe.

Who needs MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

01

Individuals who have sold, traded, or no longer own a vehicle for which they are being charged motor vehicle excise tax.

02

Owners of vehicles that were declared a total loss or were damaged beyond repair.

03

Anyone eligible for an exemption, such as veterans or certain charitable organizations.

Fill

form

: Try Risk Free

People Also Ask about

How do I file an abatement for sales tax in Massachusetts?

Taxpayers seeking to obtain an abatement of a tax or penalty that has been assessed by DOR should use MassTaxConnect (MTC) and follow the instructions provided for disputing a tax or penalty. Alternatively, taxpayers may file a paper Form ABT, Application for Abatement.

Can my license be suspended for unpaid excise tax in Massachusetts?

State tax non-payment As stated in Massachusetts General Laws Chapter 62C Section 47B, the RMV may suspend or revoke your learner's permit, driver's license, or right to operate, and/or registration indefinitely if you fail to pay state taxes to the Department of Revenue Collections Bureau.

Is excise tax mandatory?

Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720.

What happens if you don't pay excise tax in MA?

If you still fail to pay the excise, the deputy collector or collector will notify the Registrar of Motor Vehicles (RMV) within a 2 year period after the original excise bill was mailed. The RMV will then mark your license and registration as unable to be renewed.

What is the purpose of excise tax in Massachusetts?

The excise is levied annually in lieu of a tangible personal property tax. Non-registered vehicles, however, remain subject to the taxation as personal property. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury.

How do I request abatement of tax penalties?

A One-Time Abatement can be requested verbally or in writing. You may file FTB 2918 or call 800-689-4776 to request that we cancel a penalty based on one-time abatement.

How do I cancel my excise tax in MA?

If you sold your vehicle and still received an excise bill, you must return the plate(s) to the RMV, get a return plate receipt, and file an application for abatement together with the return plate receipt and the bill of sale with the Board of Assessors.

Where can I pay overdue excise tax in Massachusetts?

In Person: We accept payment for excise tax warrants at City Hall OR or you may pay at Kelley and Ryan's offices located in Leominster (RMV), Lowell, Beverly, Lawrence, Brockton, Taunton, Hopedale, Springfield or Worcester. Please call the Deputy's office at (508) 473-9660 for directions to their payment offices.

Is motor vehicle excise tax deductible?

1. State and local sales and excise taxes paid on up to $49,500 of the purchase price of each qualifying vehicle are deductible. In other words, you can deduct the sales tax on multiple vehicles but only the taxes paid on up to the $49,500 limit for each vehicle is allowed. 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

The MOTOR VEHICLE EXCISE ABATEMENT APPLICATION is a form used by vehicle owners to request a reduction or exemption from motor vehicle excise tax due to various qualifying reasons, such as a change in ownership or the vehicle being lost or stolen.

Who is required to file MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

Individuals who believe they are eligible for a reduction or exemption from the motor vehicle excise tax, including those who have sold or transferred ownership of their vehicle, or experienced a significant loss, are required to file this application.

How to fill out MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

To fill out the MOTOR VEHICLE EXCISE ABATEMENT APPLICATION, you need to provide your personal information, details about the vehicle, the reason for the abatement request, and any supporting documents required by your local tax authority.

What is the purpose of MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

The purpose of the MOTOR VEHICLE EXCISE ABATEMENT APPLICATION is to allow vehicle owners to formally request a reduction or exemption from motor vehicle excise taxes based on specific qualifying conditions, ensuring fair taxation.

What information must be reported on MOTOR VEHICLE EXCISE ABATEMENT APPLICATION?

Information that must be reported includes the applicant's name and address, vehicle details (make, model, year, VIN), the reason for the abatement request, and any relevant dates such as sale or transfer dates.

Fill out your motor vehicle excise abatement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Excise Abatement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.