Get the free Mortgage Relief Application Form - dhs vic gov

Show details

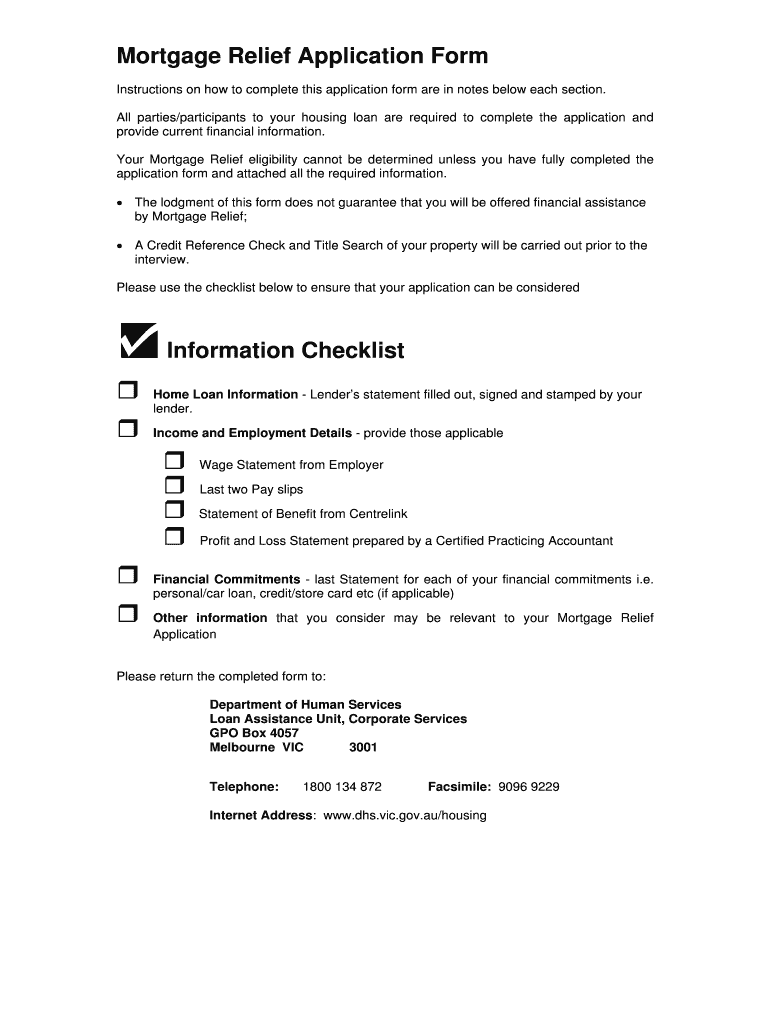

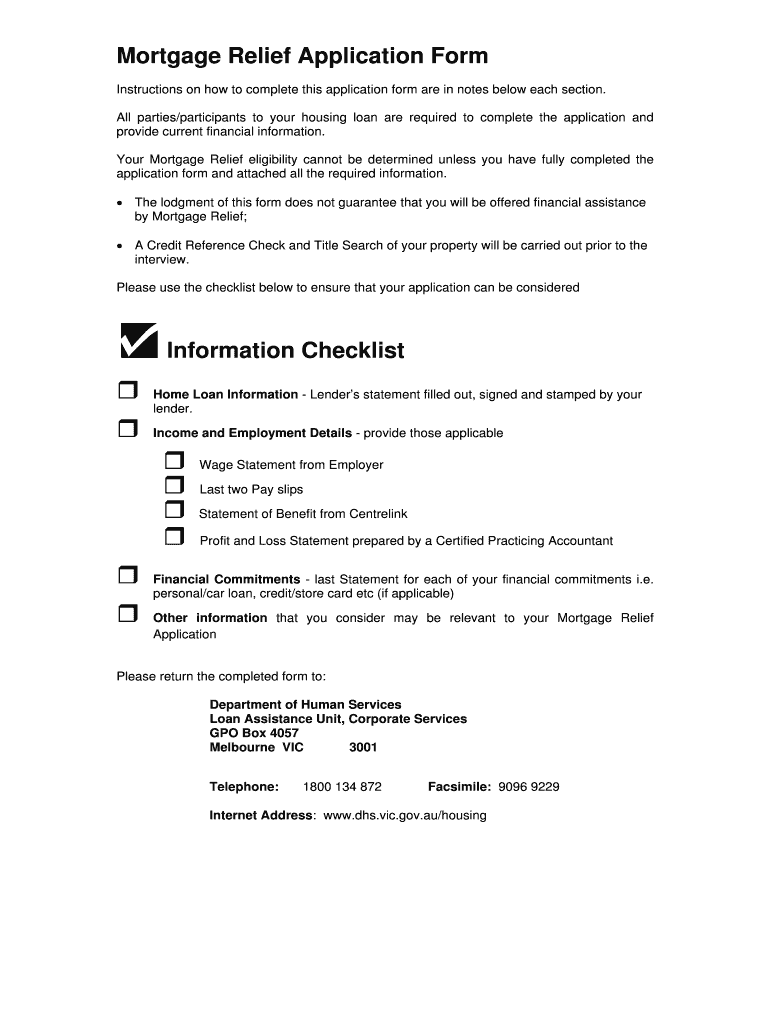

This document is a form for applying for mortgage relief assistance from the Department of Human Services, requiring financial information and documentation from all parties involved in the housing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage relief application form

Edit your mortgage relief application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage relief application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage relief application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage relief application form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage relief application form

How to fill out Mortgage Relief Application Form

01

Obtain the Mortgage Relief Application Form from your lender or relevant government website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including name, address, and contact details.

04

Provide information about your mortgage, such as lender's name, account number, and loan amount.

05

Include details regarding your financial situation, including income, expenses, and hardship reason.

06

Attach necessary documentation, such as proof of income and any hardship letters.

07

Review the completed application for accuracy and completeness.

08

Sign and date the application form.

09

Submit the application either by mail or electronically, as per your lender’s instructions.

10

Follow up with your lender to ensure they have received your application and inquire about the processing timeline.

Who needs Mortgage Relief Application Form?

01

Homeowners experiencing financial hardship and struggling to make their mortgage payments.

02

Individuals facing temporary job loss or significant medical expenses.

03

Borrowers at risk of foreclosure and in need of assistance to avoid losing their home.

04

Homeowners seeking to lower their monthly mortgage payments through government assistance.

Fill

form

: Try Risk Free

People Also Ask about

What is the mortgage application form?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The form is required by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) for mortgages that they purchase from lenders.

How long does it take to get approved for mortgage assistance?

How long will it take for my mortgage assistance application to be reviewed and approved? An initial decision usually happens less than 30 days after we receive all required application documents.

What can I do if I can't pay my mortgage?

If there is a hardship, your servicer will explore mortgage assistance options with you. Options might include a repayment plan, loan modification, short sale or Deed-In-Lieu of foreclosure. If a mortgage assistance solution cannot be reached, and the account remains delinquent, your home may be foreclosed on.

How can I get mortgage forgiveness?

How to Get Mortgage Forgiveness in 4 Steps Begin by contacting your lender to ask about mortgage forgiveness options. Gather your financial documents. Write a letter detailing your financial hardship. Request a letter from your lender that precisely states the terms of your mortgage forgiveness arrangement.

Can a reverse mortgage be forgiven?

There are no restrictions on sales to family members or otherwise, just in the case of a balance of the reverse mortgage being higher than the value of the property and heirs wanting the lender to forgive the over-value portion of the loan and keep the property within the family.

How to get out of debt when you have a mortgage?

While you could borrow on your mortgage to consolidate your debts, you may wish to consider the other options available to you such as: speaking to your existing lender to change your existing borrowing agreement. taking a personal loan to consolidate your debts.

What is considered a hardship for a mortgage?

For short-term hardships, a forbearance plan can temporarily reduce or suspend your monthly mortgage payments. Sudden financial hardships can occur for many reasons, such as job loss, illness, disability, natural disasters, or divorce.

How often can you skip a mortgage payment?

Skip-A-Payment Mortgage Option You can skip up to four consecutive weekly payments, up to two consecutive bi-weekly or semi-monthly payments, or one monthly payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Relief Application Form?

The Mortgage Relief Application Form is a document that individuals must submit to request assistance or relief options for their mortgage payments, typically in situations of financial hardship.

Who is required to file Mortgage Relief Application Form?

Homeowners experiencing financial difficulties that affect their ability to make mortgage payments are required to file the Mortgage Relief Application Form.

How to fill out Mortgage Relief Application Form?

To fill out the Mortgage Relief Application Form, individuals need to provide their personal information, mortgage details, financial status, and any supporting documentation that demonstrates their need for relief.

What is the purpose of Mortgage Relief Application Form?

The purpose of the Mortgage Relief Application Form is to assess an applicant's eligibility for mortgage relief programs offered by lenders or government agencies to help mitigate the impact of financial hardships.

What information must be reported on Mortgage Relief Application Form?

The information that must be reported includes contact details, mortgage account number, income, monthly expenses, details of financial hardship, and any assets that may be relevant to the application.

Fill out your mortgage relief application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Relief Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.