Get the free Application For Rates Rebate: Farming - joburg-archive co

Show details

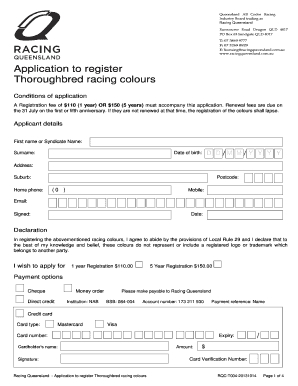

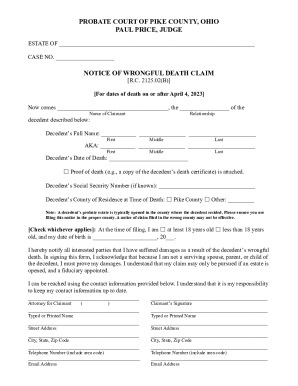

A document for farmers to apply for a rates rebate for agricultural properties in Johannesburg for the financial year 2008/2009, requiring personal and property details along with supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for rates rebate

Edit your application for rates rebate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for rates rebate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for rates rebate online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for rates rebate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for rates rebate

How to fill out Application For Rates Rebate: Farming

01

Obtain the Application For Rates Rebate: Farming form from the relevant government website or office.

02

Fill out your personal details in the designated sections, including name, address, and contact information.

03

Provide details about your farming operation, including the type of farming, size of the land, and any relevant agricultural practices.

04

Include information about income generated from farming, as well as any subsidies or grants received.

05

Attach any required documentation, such as proof of farming activity, tax records, or land ownership documents.

06

Review the application thoroughly to ensure all information is accurate and complete.

07

Submit the application by mailing it to the relevant authority or delivering it in person, according to the guidelines provided.

Who needs Application For Rates Rebate: Farming?

01

Farmers who own or operate agricultural land and are seeking financial relief in the form of rates rebates.

02

Individuals or entities engaged in farming activities that incur rates or taxes on their property.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for rates rebate in Durban?

He said properties owned by pensioners, child-headed households, disability grantees and the medically boarded were exempt from paying rates where their annual rates do not exceed the maximum rebate of R5 290.

What is the rates rebate in Wellington?

Residential ratepayers on low incomes may be eligible for a rates rebate. Residential ratepayers on low incomes may be eligible for a rates rebate of up to $805 for the current rating year. You can apply for a rebate for the current rating year only.

How much is the rate rebate in NZ?

Rates rebate thresholds The maximum rates rebate is $805.

What is the rates rebate for Waipa?

How do you qualify? The rates reduction (rebate) for the 2025-26 financial year is set at a maximum of $805. Eligible households can have an income of up to $32,210 and $45,000 for SuperGold cardholders to get the maximum rebate amount.

What is the rates rebate in Hastings?

The rates rebate scheme provides a discount on rates to low-income homeowners. Depending on your circumstances you may be eligible for a rebate. We may also be able to offer a direct debit payment arrangement to assist with keeping up with rates payments. Please contact us on 06 871 5000 to discuss your options.

What is a rebate rate?

The securities lending rebate rate is the interest the lender pays to the borrower when cash is used as collateral and this cash is reinvested. When a lender reinvests the cash used as collateral, an agreed upon proportion of the reinvestment return (or interest) is paid to the borrower, this is called the rebate rate.

How do you calculate the rebate rate?

Percent Rebate = (Rebate Amount / Original Amount) × 100 The calculation basis value influences the rebate amount.

What is the current rebate?

The maximum rebate is Rs. 12,500 under the old tax regime and Rs. 60,000 under the new tax regime for FY 2025-26 (AY 2026-27). If your calculated tax liability is less than the maximum rebate amount, your tax liability will be reduced to zero. Senior citizens (aged 60-79) are eligible for this rebate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Rates Rebate: Farming?

Application For Rates Rebate: Farming is a process where farmers can apply for a reduction in rates (taxes) on their agricultural properties, aimed at providing financial relief and supporting the farming community.

Who is required to file Application For Rates Rebate: Farming?

Farmers or landowners who operate agricultural properties that meet specific criteria set by local authorities are required to file the Application For Rates Rebate: Farming.

How to fill out Application For Rates Rebate: Farming?

To fill out the Application For Rates Rebate: Farming, applicants should gather necessary documentation, complete the application form with accurate details regarding their farming operations, and submit it to the relevant local government authority before the deadline.

What is the purpose of Application For Rates Rebate: Farming?

The purpose of the Application For Rates Rebate: Farming is to provide financial assistance to farmers by reducing their property rates, thereby helping them maintain their agricultural operations and promoting the sustainability of farming.

What information must be reported on Application For Rates Rebate: Farming?

Applicants must report information such as property details, ownership information, type of farming operations, income generated from farming activities, and any other relevant data as required by the application form.

Fill out your application for rates rebate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Rates Rebate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.