Get the free CREDIT CONTROL AND DEBT COLLECTION POLICY - joburg-archive co

Show details

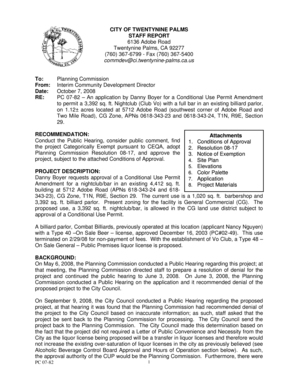

This document outlines the credit control and debt collection policy of the City of Johannesburg (COJ) as mandated by the Local Government: Municipal Systems Act, focusing on the procedures for collecting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit control and debt

Edit your credit control and debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit control and debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit control and debt online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit control and debt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit control and debt

How to fill out CREDIT CONTROL AND DEBT COLLECTION POLICY

01

Begin with a clear statement of the purpose of the policy.

02

Define the key terms related to credit control and debt collection.

03

Outline the criteria for granting credit to customers.

04

Establish the procedures for monitoring payments and aging accounts.

05

Detail the steps for following up on overdue accounts, including communication methods.

06

Specify the actions that will be taken for accounts that remain unpaid, including escalation processes.

07

Include guidelines for negotiating payment plans with customers.

08

Include legal considerations and compliance with relevant laws regarding debt collection.

09

Provide instructions on how to document all communications and actions taken.

10

Review and update the policy periodically to reflect changes in laws and business practices.

Who needs CREDIT CONTROL AND DEBT COLLECTION POLICY?

01

Businesses that extend credit to customers.

02

Companies that deal with accounts receivable.

03

Financial departments responsible for managing cash flow.

04

Sales teams that need to understand credit risks.

05

Management needing a framework for debt recovery.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT CONTROL AND DEBT COLLECTION POLICY?

CREDIT CONTROL AND DEBT COLLECTION POLICY is a set of guidelines and procedures that businesses implement to manage credit extended to customers and the collection of outstanding debts. It outlines the process for assessing credit risk, setting payment terms, and handling overdue accounts.

Who is required to file CREDIT CONTROL AND DEBT COLLECTION POLICY?

Businesses that extend credit to customers, particularly those in industries like retail, finance, and services, are required to implement and file a CREDIT CONTROL AND DEBT COLLECTION POLICY to ensure compliance with regulatory standards and effective debt management.

How to fill out CREDIT CONTROL AND DEBT COLLECTION POLICY?

To fill out a CREDIT CONTROL AND DEBT COLLECTION POLICY, a business should outline its credit risk assessment procedures, payment terms, collection processes, steps for dealing with late payments, and any legal actions that may be pursued for debt recovery. It should be tailored to the specific needs of the business.

What is the purpose of CREDIT CONTROL AND DEBT COLLECTION POLICY?

The purpose of a CREDIT CONTROL AND DEBT COLLECTION POLICY is to establish a clear framework for managing credit risk, minimizing bad debts, ensuring timely collection of payments, and maintaining healthy cash flow for the business.

What information must be reported on CREDIT CONTROL AND DEBT COLLECTION POLICY?

The information that must be reported on a CREDIT CONTROL AND DEBT COLLECTION POLICY includes the credit evaluation criteria, terms of credit, procedures for invoicing and collections, actions for overdue accounts, and details about legal recourse if debts remain unpaid.

Fill out your credit control and debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Control And Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.