Get the free Member Due Diligence Procedures - Universal Federal Credit Union

Show details

BSA / Member Identification Program MIP

INTRODUCTION:

As part of the effort to fight organized crime and drug dealing, federal law requires

businesses to report large cash transactions to the government.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign member due diligence procedures

Edit your member due diligence procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your member due diligence procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing member due diligence procedures online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit member due diligence procedures. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out member due diligence procedures

How to fill out member due diligence procedures?

01

Begin by identifying the purpose of the member due diligence procedures. Is it for compliance with regulatory requirements or internal risk management purposes?

02

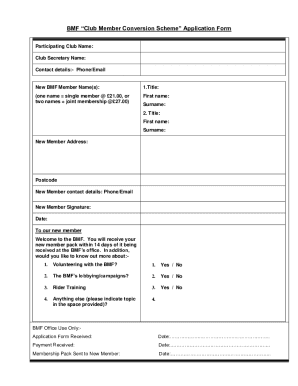

Gather all necessary information from the member, such as their name, contact details, identification documents, and any relevant business information.

03

Conduct a risk assessment to determine the level of due diligence required for the member. This can be based on factors such as the nature of their business, their jurisdiction, and their level of perceived risk.

04

Verify the member's identity through reliable and independent documentation. This can include checking their identification documents, verifying their address through utility bills or bank statements, and conducting other checks as required.

05

Evaluate the member's risk profile by assessing factors such as their industry, geographic location, business relationships, and any adverse media or negative information.

06

Determine the appropriate level of ongoing monitoring required for the member. This may include periodic reviews of their information, monitoring of their transactions and activities, and conducting enhanced due diligence as necessary.

07

Document all steps taken in the member due diligence process, including any exceptions or deviations from standard procedures.

08

Regularly review and update the member due diligence procedures to ensure they remain relevant and effective.

Who needs member due diligence procedures?

01

Financial institutions, such as banks, credit unions, and insurance companies, are typically required to have member due diligence procedures in place. This is to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

02

Other types of regulated entities, such as money service businesses, casinos, and investment firms, may also need to establish member due diligence procedures to meet their regulatory obligations.

03

Non-regulated organizations that want to mitigate risks and ensure the integrity of their business relationships may voluntarily adopt member due diligence procedures. This can help protect against fraud, money laundering, and reputational damage.

Note: The specific requirements for member due diligence procedures may vary depending on the jurisdiction and industry. It is important to consult relevant legal and regulatory sources to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is member due diligence procedures?

Member due diligence procedures are processes implemented by organizations to verify and collect information about their members to assess risks associated with money laundering, terrorist financing, and other illegal activities.

Who is required to file member due diligence procedures?

Financial institutions, including banks, credit unions, and other regulated entities, are required to file member due diligence procedures.

How to fill out member due diligence procedures?

Member due diligence procedures are typically filled out by obtaining identification documents, verifying the information provided, and assessing the risk associated with each member.

What is the purpose of member due diligence procedures?

The purpose of member due diligence procedures is to prevent money laundering, terrorist financing, and other illegal activities by identifying and assessing the risks associated with each member.

What information must be reported on member due diligence procedures?

Member due diligence procedures typically require information such as name, address, identification documents, source of funds, and risk assessment.

How can I modify member due diligence procedures without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your member due diligence procedures into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find member due diligence procedures?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific member due diligence procedures and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out member due diligence procedures using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign member due diligence procedures and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your member due diligence procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Member Due Diligence Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.