Get the free Dance of the Corporate Veils

Show details

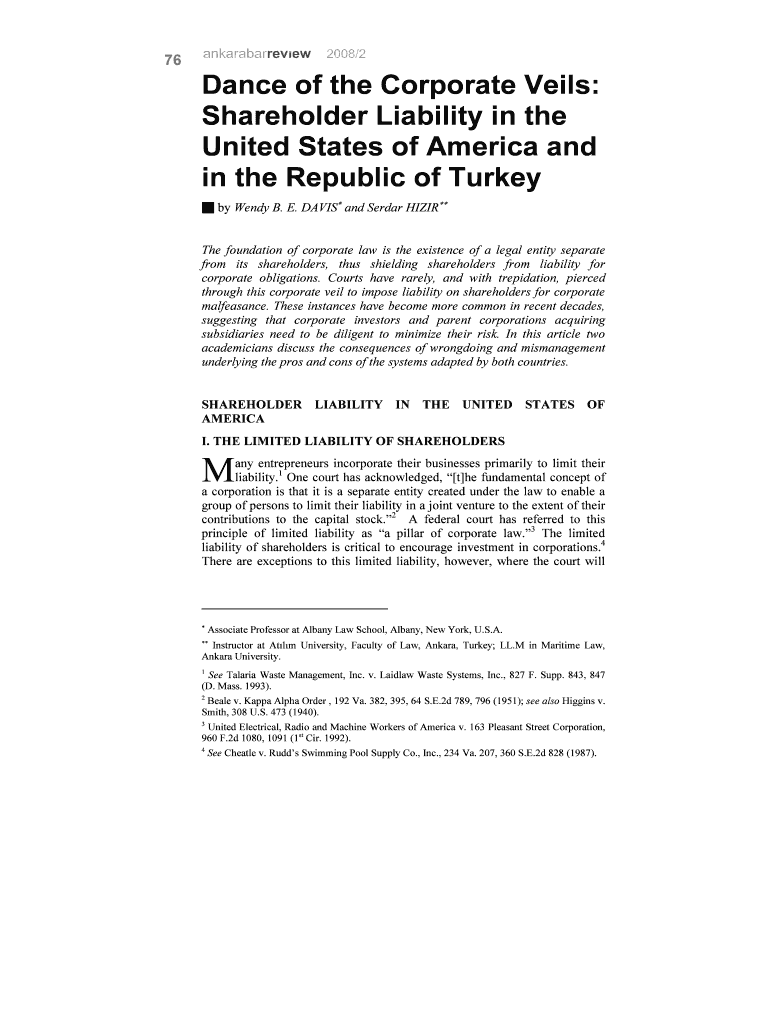

This document discusses the principle of shareholder liability in corporate law, highlighting differences and similarities between the United States and Turkish legal systems. It addresses limited

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dance of form corporate

Edit your dance of form corporate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dance of form corporate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dance of form corporate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dance of form corporate. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dance of form corporate

How to fill out Dance of the Corporate Veils

01

Gather all necessary information about your corporate structure, including the names of subsidiaries and parent companies.

02

Begin filling out the form by entering the name of the primary corporation at the top.

03

List each subsidiary company under the main corporation, providing their legal names and any identifying numbers.

04

For each subsidiary, include details such as the nature of the business, location, and ownership percentage.

05

Review the instructions on the form for any additional information required, such as financial data or governance structure.

06

Double-check the accuracy of all entries before submitting the completed form.

Who needs Dance of the Corporate Veils?

01

Businesses that operate with multiple subsidiary companies.

02

Corporations looking to clarify their corporate structure for compliance purposes.

03

Legal and accounting professionals who assist businesses in maintaining proper documentation.

04

Companies aiming to enhance transparency in their corporate governance.

Fill

form

: Try Risk Free

People Also Ask about

Why is it called piercing the corporate veil?

Piercing the corporate veil means that the court ignores the separation between the corporation and its shareholders. This happens when shareholders abuse the corporate form, such as by commingling personal and corporate assets, using the corporation to commit fraud, or undercapitalizing the company.

What is the corporate veil in the UK?

This concept has traditionally been likened to a "veil" of separation between the legal entity of a corporation and the real people who invest their money and labor into a company's operations.

When can the veil be lifted?

This principle exists in very limited circumstances “when a person is under an existing legal obligation or liability or subject to an existing legal restriction which he deliberately evades or whose enforcement he deliberately frustrates by interposing a company under his control.” The court is then able to lift the

What does piercing the veil of corporate fiction mean?

When the veil is pierced, the acts and liabilities of a corporation are treated as those of its incorporators, officers, or directors, who are then personally liable for the corporation's obligations. The purpose of piercing the corporate veil is to prevent fraud or injustice.

What is the rule of piercing the corporate veil?

Piercing the corporate veil The piercing of the corporate veil occurs when a creditor of a shareholder attempts to hold the corporation liable for the shareholder's debts. This principle applies particularly where a company was established primarily to evade a shareholder's pre-existing personal obligations.

What is the corporate veil in simple terms?

The corporate veil is a legal concept which separates the actions of an organization to the actions of the shareholder. Moreover, it protects the shareholders from being liable for the company's actions. In this case a court can also determine whether they hold shareholders responsible for a company's actions or not.

What is piercing the corporate veil in English law?

Piercing the corporate veil refers to the judicial act of disregarding an entity's corporate form, which normally provides limited liability to stockholders, to impose personal liability on the stockholders for the obligations of the corporation.

What is the corporate veil in English?

The corporate veil is a term used to describe a legal shield of separation between a business and its owners (shareholders) and officers (directors). Under the veil the owners' and officers' personal assets are protected and cannot be taken by creditors to settle the debts of the company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Dance of the Corporate Veils?

Dance of the Corporate Veils is a legal and financial concept that refers to the examination of corporate structures to determine the validity and separateness of corporate entities from their owners or officers. This is often explored in cases of liability and financial accountability.

Who is required to file Dance of the Corporate Veils?

Generally, businesses and corporations that are structured as separate legal entities, including LLCs and corporations, may be required to file documents or reports related to the Dance of the Corporate Veils in order to maintain their legal protections.

How to fill out Dance of the Corporate Veils?

Filling out the Dance of the Corporate Veils typically involves providing detailed information about the corporation's structure, ownership, operations, and any transactions that may affect the separation between the entity and its owners. It may require legal assistance or specialized knowledge to ensure compliance with applicable laws.

What is the purpose of Dance of the Corporate Veils?

The purpose of the Dance of the Corporate Veils is to ensure transparency within corporate structures and to assess whether entities are maintaining their legal separateness, which is essential to protect owners from liability and uphold corporate governance.

What information must be reported on Dance of the Corporate Veils?

Information that must be reported may include the names of owners and shareholders, financial statements, details of corporate operations, inter-company transactions, and any relevant agreements that establish relationships between the corporate entities and their owners.

Fill out your dance of form corporate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dance Of Form Corporate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.