Get the free (fsa) enrollment - Southern Research Institute - southernresearch

Show details

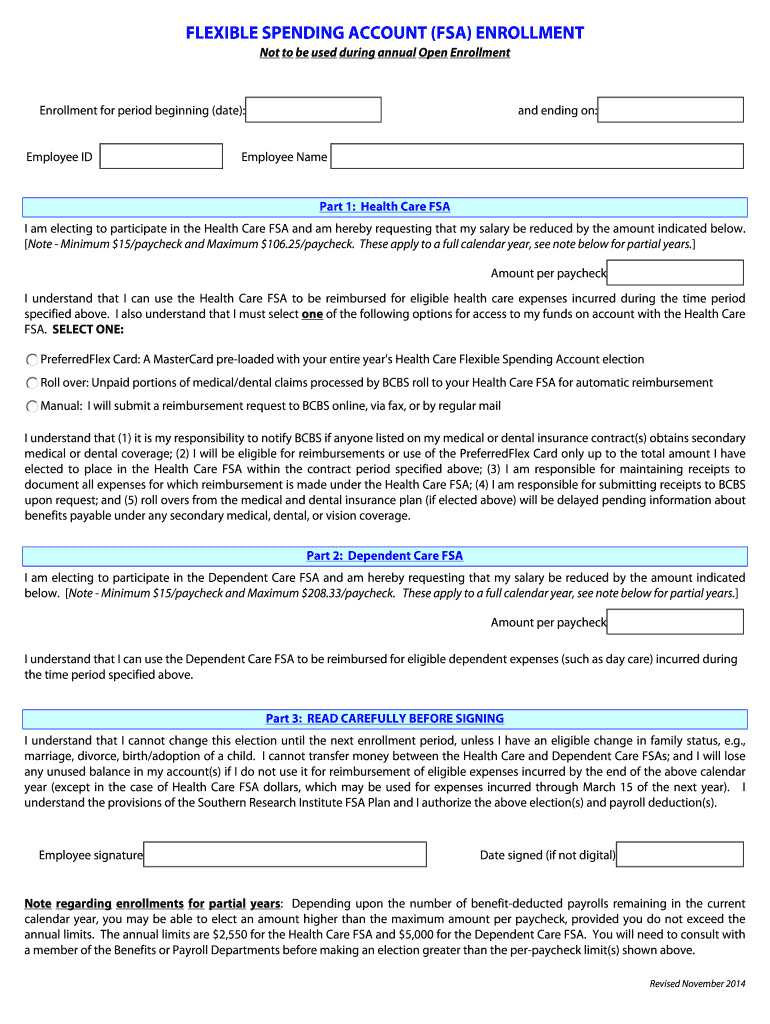

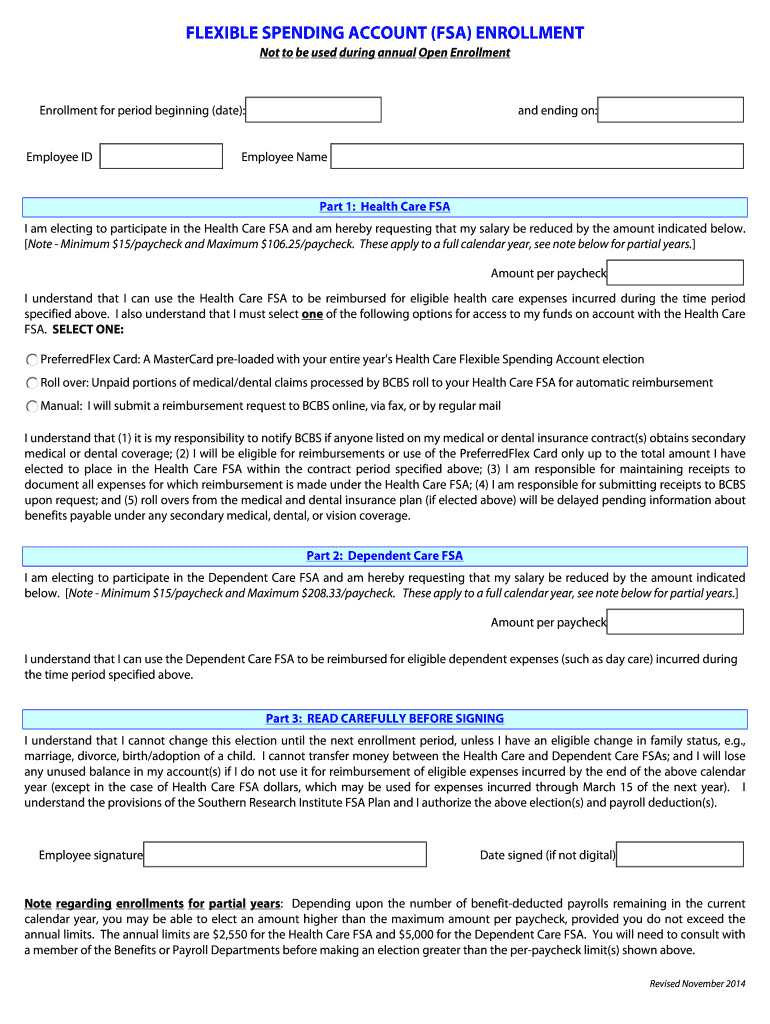

FLEXIBLE SPENDING ACCOUNT (FSA) ENROLLMENT Not to be used during annual Open Enrollment for period beginning (date): Employee ID and ending on: Employee Name Part 1: Health Care FSA I am electing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fsa enrollment - souformrn

Edit your fsa enrollment - souformrn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fsa enrollment - souformrn form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fsa enrollment - souformrn online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fsa enrollment - souformrn. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fsa enrollment - souformrn

How to fill out fsa enrollment - souformrn:

01

Start by obtaining the necessary forms. You can usually find these forms on the website of your employer or the company providing the flexible spending account (FSA). If you cannot find the forms online, reach out to the appropriate HR or benefits department for assistance.

02

Carefully read through the instructions provided along with the fsa enrollment forms. Make sure you understand all the terms and conditions, eligibility requirements, and any deadlines that may apply.

03

Fill out the required personal information accurately. This typically includes your full name, social security number, address, and contact information. Pay close attention to detail and ensure all information is correct.

04

Determine the amount of money you wish to contribute to the FSA for the upcoming year. Keep in mind any factors that may affect your calculation, such as expected medical expenses or dependent care costs. Be realistic and choose a contribution amount that suits your needs.

05

If applicable, indicate the specific types of expenses for which you will use the FSA funds. This may include medical expenses, child care services, or other eligible expenses. Ensure that you understand the specific rules and guidelines for each category.

06

Review the completed fsa enrollment forms to make sure all fields are filled out accurately and completely. Verify that you have signed and dated the forms where necessary.

07

Submit the completed fsa enrollment forms to the appropriate entity. This may be your employer's HR department, the FSA provider, or another designated party. Follow any submission instructions provided to ensure your enrollment is processed correctly.

Who needs fsa enrollment - souformrn:

01

Employees who want to take advantage of a tax-advantaged way to pay for eligible medical expenses or dependent care costs may need fsa enrollment - souformrn. FSA enrollment allows individuals to set aside pre-tax dollars to cover anticipated expenses, which can result in potential tax savings.

02

Individuals who anticipate upcoming medical expenses or costs related to dependent care may find fsa enrollment beneficial. By participating in an FSA, individuals can allocate a portion of their salary to the FSA account, which can help offset these expenses.

03

Those who have access to an fsa enrollment - souformrn through their employer's benefits package should consider taking advantage of this opportunity. Participating in an FSA can help individuals manage out-of-pocket costs more effectively and potentially save money on taxes.

Remember to consult with a tax advisor or benefits specialist for specific guidance and to ensure fsa enrollment aligns with your financial situation and needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fsa enrollment - souformrn online?

Filling out and eSigning fsa enrollment - souformrn is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the fsa enrollment - souformrn in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fsa enrollment - souformrn in minutes.

How do I edit fsa enrollment - souformrn on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fsa enrollment - souformrn on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is fsa enrollment - souformrn?

FSA enrollment - souformrn is a process where employees can sign up for flexible spending accounts.

Who is required to file fsa enrollment - souformrn?

All eligible employees are required to file FSA enrollment - souformrn.

How to fill out fsa enrollment - souformrn?

FSA enrollment - souformrn can be filled out online or through paper forms provided by the employer.

What is the purpose of fsa enrollment - souformrn?

The purpose of FSA enrollment - souformrn is to allow employees to set aside pre-tax money for eligible expenses such as healthcare or dependent care.

What information must be reported on fsa enrollment - souformrn?

On FSA enrollment - souformrn, employees must report their desired contribution amount and select the type of flexible spending account.

Fill out your fsa enrollment - souformrn online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fsa Enrollment - Souformrn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.