Get the free NATURAL GAS USE TAX RETURN - dor wa

Show details

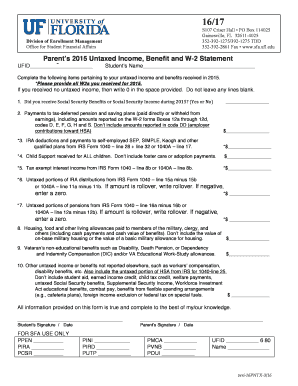

This document serves as a tax return form for reporting the state and local natural gas use tax due for the second quarter of 2006 in Washington State. It includes sections for state and local taxes,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign natural gas use tax

Edit your natural gas use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your natural gas use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit natural gas use tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit natural gas use tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out natural gas use tax

How to fill out NATURAL GAS USE TAX RETURN

01

Gather necessary documents, including purchase receipts and previous tax returns.

02

Obtain the NATURAL GAS USE TAX RETURN form from the relevant tax agency.

03

Fill in your business name, address, and tax identification number at the top of the form.

04

Report the volume of natural gas used during the reporting period.

05

Calculate the tax owed based on the local tax rate applicable to natural gas.

06

Include any exemptions or deductions that you qualify for.

07

Sum the total tax liability and ensure all calculations are correct.

08

Sign and date the form before submission.

09

Submit the completed return to the appropriate tax authority by the deadline.

Who needs NATURAL GAS USE TAX RETURN?

01

Individuals or businesses that purchase natural gas for use in their operations.

02

Users of natural gas that are not directly supplied by a utility company.

03

Companies that operate in regions where natural gas use tax is applicable.

Fill

form

: Try Risk Free

People Also Ask about

Which state has the highest gas tax?

California levies the highest tax on gasoline at 70.9 cents per gallon (cpg), followed by Illinois at 66.4 cpg and Washington at 59.0 cpg. The lowest gas tax rates are levied in Alaska at 8.95 cpg, followed by Hawaii at 18.5 cpg and New Mexico at 18.9 cpg.

What state has the highest taxes in the US?

Highest taxed states California (12.3%, with 1% tax on income in excess of $1 million) Hawaii (11%) New York (10.9%) New Jersey (10.75%) District of Columbia (10.75%) Oregon (9.9%) Minnesota (9.85%) Massachusetts (5%, with 4% surtax on taxable income in excess of $1,053,750)

Is gas taxed in Washington?

Washington's state tax is on top of federal fuel taxes, which are 18.4 cents for gasoline and 24.4 cents for diesel. Hiking the gas tax is expected to raise $1.4 billion over the next six years. The diesel tax is counted on to bring in $166 million over that time.

What state charges the most for gas?

California levies the highest tax on gasoline at 70.9 cents per gallon (cpg), followed by Illinois at 66.4 cpg and Washington at 59.0 cpg. The lowest gas tax rates are levied in Alaska at 8.95 cpg, followed by Hawaii at 18.5 cpg and New Mexico at 18.9 cpg.

What is the highest gas tax in the world?

The Netherlands has the highest gas tax in the EU at €0.789 per liter ($3.53 per gallon), followed by Italy at €0.713 per liter ($3.19 per gallon) and Denmark at €0.711 per liter ($3.18 per gallon).

Which state pays the least for gas?

With that being said, let's dive into the states with the lowest taxes on gasoline. Louisiana. Texas. Oklahoma. Arizona. New Mexico. Gas tax total: 18.8 cents per gallon. Hawaii. Gas tax total: 18.5 cents per gallon. Mississippi. Gas tax total: 18.4 cents per gallon. Alaska. Gas tax total: 8.95 cents per gallon.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NATURAL GAS USE TAX RETURN?

The Natural Gas Use Tax Return is a tax document that individuals or businesses must file to report the use of natural gas that was not acquired through a regulated utility provider and to remit any owed taxes to the relevant state authority.

Who is required to file NATURAL GAS USE TAX RETURN?

Individuals or businesses that purchase and use natural gas outside of the jurisdiction of a utilities provider, or that consume natural gas for which sales tax has not been paid, are required to file this return.

How to fill out NATURAL GAS USE TAX RETURN?

To fill out the Natural Gas Use Tax Return, collect all relevant documentation regarding your natural gas purchases, complete the necessary fields on the form by reporting the amount of natural gas used, the purchase price, and calculate the applicable use tax based on your state’s tax rate.

What is the purpose of NATURAL GAS USE TAX RETURN?

The purpose of the Natural Gas Use Tax Return is to ensure that taxes are collected on natural gas consumption that has not been subjected to sales tax at the point of purchase, thus contributing to state revenue.

What information must be reported on NATURAL GAS USE TAX RETURN?

The information that must be reported includes the total amount of natural gas consumed, the purchase date, the cost of the gas, and the computed use tax amount owed, as well as any other required personal or business identification details.

Fill out your natural gas use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Natural Gas Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.