Get the free Waiver of Premium Disability Claim for Association Plans

Show details

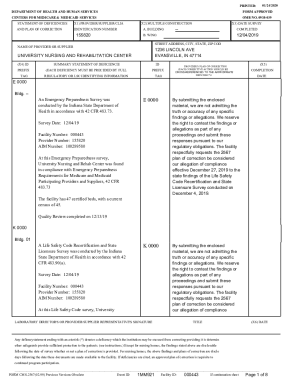

This document is a waiver of premium disability claim form for the ReliaStar Life Insurance Company, detailing the required statements and certifications from both the administrator and the insured,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign waiver of premium disability

Edit your waiver of premium disability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your waiver of premium disability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing waiver of premium disability online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit waiver of premium disability. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out waiver of premium disability

How to fill out Waiver of Premium Disability Claim for Association Plans

01

Obtain the Waiver of Premium Disability Claim form from the Association's website or member services.

02

Read all instructions carefully before filling out the form.

03

Complete personal information sections, including full name, address, and member ID.

04

Provide details about your disability, including diagnosis and treatment information.

05

Attach any required medical documentation that supports your claim.

06

Include information regarding your employment status and how the disability affects your ability to work.

07

Sign and date the form, confirming all information is accurate to the best of your knowledge.

08

Submit the completed form and documentation through the specified submission method (by mail, online, etc.).

09

Keep a copy of the submitted form and documents for your records.

Who needs Waiver of Premium Disability Claim for Association Plans?

01

Individuals who are members of the Association and have a qualifying disability that prevents them from working.

02

Members who wish to continue their insurance coverage without premium payments while they are disabled.

03

Those who have a Waiver of Premium benefit as part of their existing insurance policy.

Fill

form

: Try Risk Free

People Also Ask about

What is a waiver of premium for total disability?

Your Waiver of Premium Benefit Total disability or totally disabled means that, due directly to injury or sickness, you are unable to perform the essential duties of your regular occupation, are not engaged in any other gainful occupation, and are receiving appropriate physician's care.

What is a waiver of premium disability?

A waiver of premium rider is an optional life insurance add-on that allows you to stop paying your life insurance premium while you're experiencing a qualifying disability.

What is a waiver of premium for disability?

A waiver of premium rider is an optional life insurance add-on that allows you to stop paying your life insurance premium while you're experiencing a qualifying disability.

What does it mean when a premium is waived?

A waiver of premium is a type of add-on cover that can be added to your life insurance policy so that if you're ever unable to work due to a serious illness or injury, your policy stays active. Your waiver of premium will cover your monthly payments so you can focus on your health.

What is the purpose of the waiver of premium?

What Is a Waiver of Premium Rider? A Waiver of Premium Rider is an optional add-on to a life insurance policy that will waive or pay your life insurance premiums for you if you become disabled and unable to work. This ensures your policy stays in force even if you can no longer afford the premiums yourself.

What is the meaning of premium waiver?

'Waiver of Premium' is usually a rider (paid addition to your insurance plan) or a plan benefit that ensures that your family is still protected by your life cover without having to pay any more premiums.

What is an example of a waiver of premium benefit?

An insurance company may offer an enhanced waiver of premium for payer rider options. For example, a company might provide a potential policyholder an opportunity to expand the waiver to cover unemployment or possibly skip payments in the event a policyholder is laid off and out of work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Waiver of Premium Disability Claim for Association Plans?

The Waiver of Premium Disability Claim for Association Plans is a provision that allows policyholders to stop paying premiums on their insurance while they are disabled, ensuring that their coverage remains in force during their disability period.

Who is required to file Waiver of Premium Disability Claim for Association Plans?

The policyholder who becomes disabled and is seeking to have their premiums waived is required to file the Waiver of Premium Disability Claim for Association Plans.

How to fill out Waiver of Premium Disability Claim for Association Plans?

To fill out the Waiver of Premium Disability Claim for Association Plans, the policyholder must complete the claim form provided by the insurance company, providing personal information, details of the disability, and any necessary medical documentation.

What is the purpose of Waiver of Premium Disability Claim for Association Plans?

The purpose of the Waiver of Premium Disability Claim for Association Plans is to provide financial relief to policyholders during periods of disability by allowing them to maintain their insurance coverage without the burden of paying premiums.

What information must be reported on Waiver of Premium Disability Claim for Association Plans?

The information that must be reported includes the policyholder's personal details, the nature of the disability, date of onset, attending physician's details, and any relevant medical treatment information.

Fill out your waiver of premium disability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Waiver Of Premium Disability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.