Get the free Hancock County Residential Data Form - auditor co hancock oh

Show details

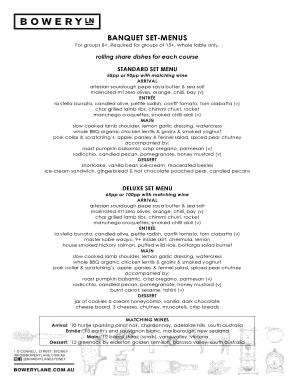

This form is used to collect residential property data in Hancock County, including details about property ownership, building conditions, modifications, and other relevant information for tax assessment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hancock county residential data

Edit your hancock county residential data form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hancock county residential data form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hancock county residential data online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hancock county residential data. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hancock county residential data

How to fill out Hancock County Residential Data Form

01

Obtain the Hancock County Residential Data Form from the local government office or website.

02

Read the instructions carefully to understand what information is required.

03

Fill in the property address in the designated field.

04

Provide details about the property owner, including their name and contact information.

05

Indicate the type of residence (single-family, multi-family, etc.) in the appropriate section.

06

Input the square footage of the residence and the number of bedrooms and bathrooms.

07

Complete any additional sections related to property features, such as garage size, yard type, and amenities.

08

Review all filled-out information for accuracy and completeness.

09

Sign and date the form in the provided area.

10

Submit the completed form to the relevant local authorities, either in person or via email as directed.

Who needs Hancock County Residential Data Form?

01

Property owners seeking to establish or update information on their residential property.

02

Real estate agents involved in property transactions in Hancock County.

03

Local government offices for assessment and planning purposes.

04

Mortgage lenders requiring property details for loan approval.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from property tax in Mississippi?

Regular Homestead Exemption (homeowners under 65) Homeowners who are younger than 65 on January 1 of the year for which the exemption is claimed (and who are not totally disabled) are exempt from ad valorem taxes in the amount prescribed in MS Code § 27-33-7.

What tax breaks are available for seniors in Mississippi?

Homestead Exemption - Additional Benefit Residents 65 and older, and persons who are totally disabled, who are otherwise eligible for a homestead exemption, are exempt from taxes on their first $75,000 of true value on their home. Must be 65 or older on or before January 1 of that tax year to qualify.

At what age do seniors stop paying property taxes in Mississippi?

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value. The application for exemption must be filed with the individual county on or before April 1.

Is there an age when you no longer have to pay property taxes?

The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65. While many states like New York, Texas and Massachusetts require seniors be 65 or older, there are other states such as Washington where the age is only 61.

Who is the auditor of Hancock County Ohio?

View the Hancock County Annual Appropriation Resolutions. Hancock County Auditor, Charity Rauschenberg, receives the Ohio State Auditor Award with Distinction for 2023 Financials.

Do seniors have to pay property taxes in Mississippi?

Are elderly persons or disabled persons exempt from property taxes? Persons 65 years or older and persons who are totally disabled, who are otherwise eligible for homestead exemption, are exempt from taxes on the first $75,000 of true value on their home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Hancock County Residential Data Form?

The Hancock County Residential Data Form is a document used to collect information about residential properties in Hancock County for assessment and valuation purposes.

Who is required to file Hancock County Residential Data Form?

Property owners or their representatives are required to file the Hancock County Residential Data Form when there is a transfer of ownership, construction of new structures, or significant changes to existing properties.

How to fill out Hancock County Residential Data Form?

To fill out the form, one must provide accurate details about the property including owner information, property address, physical characteristics, improvements, and any recent changes to the property.

What is the purpose of Hancock County Residential Data Form?

The purpose of the form is to ensure accurate property assessment for tax purposes, maintain up-to-date property records, and assist in fair valuation of residential properties.

What information must be reported on Hancock County Residential Data Form?

The form must report information such as property owner details, property location, size and type of dwelling, number of rooms, age of the property, and any renovations or improvements made.

Fill out your hancock county residential data online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hancock County Residential Data is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.