Get the free Debt Collection (B2B) Instruction Form

Show details

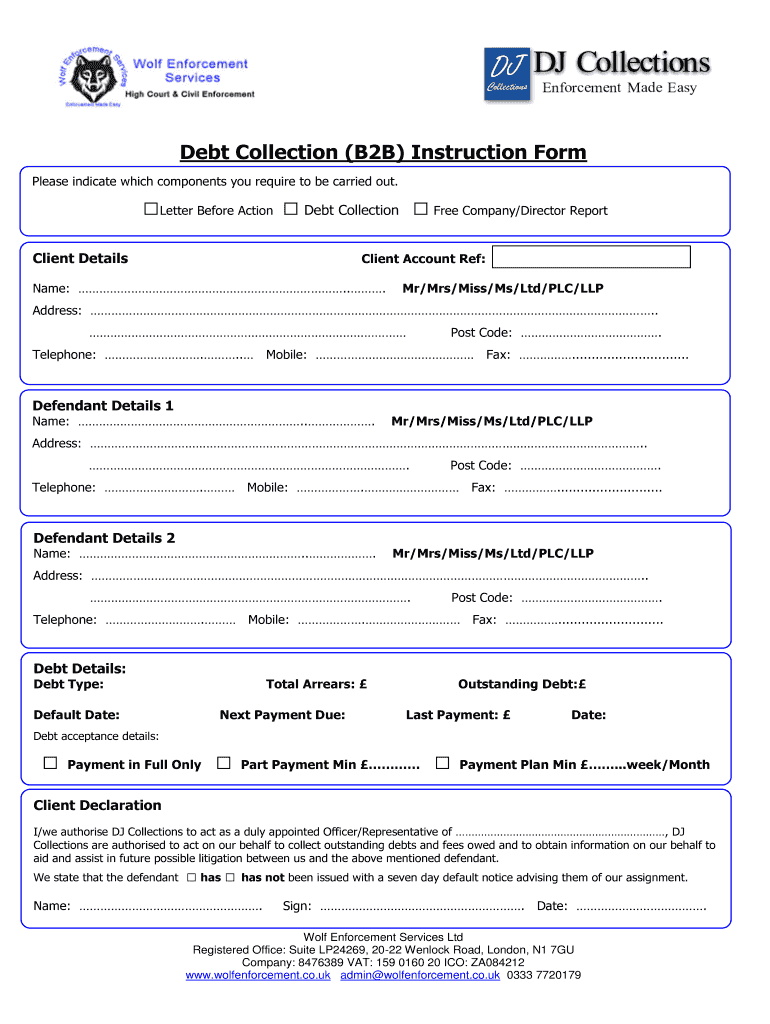

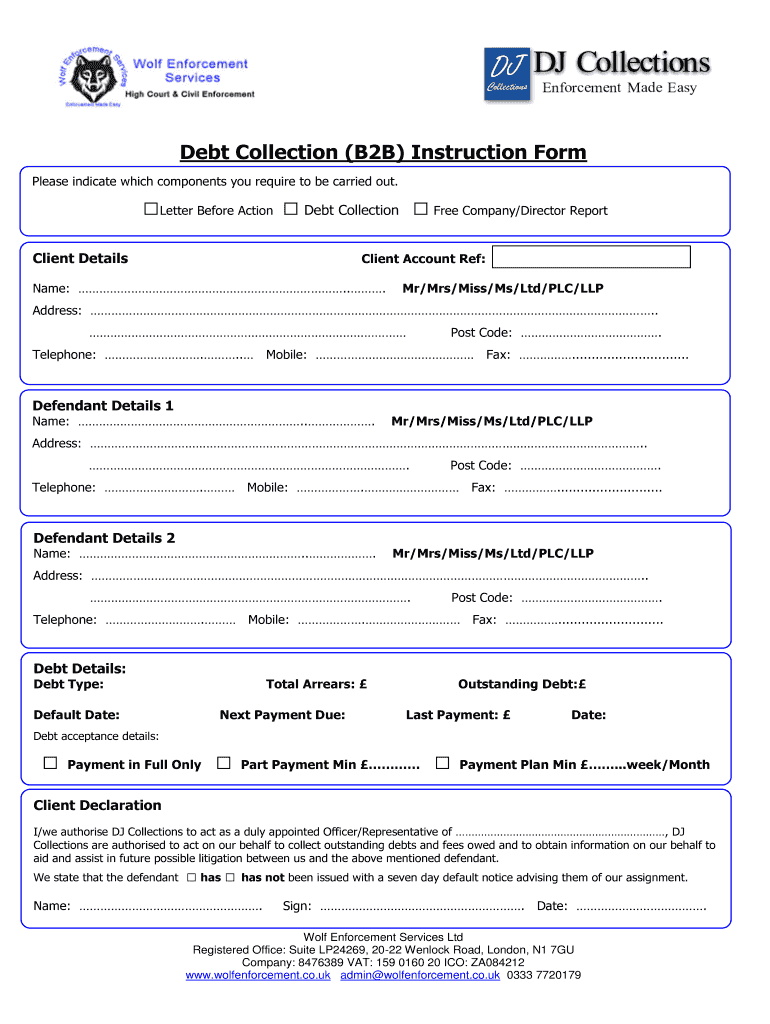

Debt Collection (B2B) Instruction Form Please indicate which components you require to be carried out. Letter Before Action Debt Collection Free Company×Director ReportClient DetailsClient Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt collection b2b instruction

Edit your debt collection b2b instruction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt collection b2b instruction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt collection b2b instruction online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debt collection b2b instruction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt collection b2b instruction

How to fill out debt collection b2b instruction:

01

Start by gathering all the necessary information related to the debt. This may include the debtor's name, address, contact information, outstanding balance, invoice details, and any relevant supporting documentation.

02

Clearly outline the purpose of the debt collection instruction. Specify the nature of the debt, the reason for pursuing collection, and any relevant deadlines or legal obligations.

03

Provide detailed instructions on how the debt collection process should be carried out. Include step-by-step guidelines on initiating contact with the debtor, sending demand letters or notices, and any legal actions that may need to be taken.

04

Make sure to include any specific policies or procedures that your organization follows when it comes to debt collection. This may include guidelines on acceptable communication methods, payment arrangements, or negotiation tactics.

05

Carefully review and proofread the instruction to ensure clarity and accuracy. Make sure all the necessary information is included and that there are no errors or omissions that could affect the effectiveness of the debt collection process.

Who needs debt collection b2b instruction:

01

Small businesses or companies that provide goods or services on credit may need debt collection b2b instruction. This is particularly relevant for organizations that frequently encounter overdue payments or non-payment from other businesses.

02

Financial institutions such as banks or credit unions that offer business loans or credit facilities may also require debt collection b2b instruction. Having a clear process in place can help them recover unpaid debts and protect their financial interests.

03

Any organization that regularly deals with business-to-business transactions and faces challenges related to debt recovery can benefit from debt collection b2b instruction. It is important to have proper guidance in order to effectively navigate the debt collection process and minimize losses.

Overall, debt collection b2b instruction is essential for any business or organization that deals with business debts and wants to ensure a structured and efficient approach to debt recovery.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the debt collection b2b instruction electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your debt collection b2b instruction in seconds.

How do I fill out debt collection b2b instruction using my mobile device?

Use the pdfFiller mobile app to fill out and sign debt collection b2b instruction. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit debt collection b2b instruction on an Android device?

You can make any changes to PDF files, such as debt collection b2b instruction, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your debt collection b2b instruction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Collection b2b Instruction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.