Get the free FORM L-32 SOLVENCY MARGIN - KT 3

Show details

This document provides details on the Available Solvency Margin and Solvency Ratio as at 30th June 2012 for Birla Sun Life Insurance Company Ltd.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form l-32 solvency margin

Edit your form l-32 solvency margin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form l-32 solvency margin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form l-32 solvency margin online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form l-32 solvency margin. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form l-32 solvency margin

How to fill out FORM L-32 SOLVENCY MARGIN - KT 3

01

Obtain FORM L-32 SOLVENCY MARGIN - KT 3 from the relevant regulatory agency or website.

02

Fill in your company's name and registration number at the top of the form.

03

Enter the reporting period for which you are calculating the solvency margin.

04

List all assets as per the guidelines provided in the form.

05

Provide a detailed breakdown of liabilities including incurred claims and reserves.

06

Calculate the solvency margin by deducting total liabilities from total assets.

07

Include any additional information requested, such as notes or supporting documents.

08

Review the completed form for accuracy and completeness.

09

Submit the form to the appropriate regulatory body by the specified deadline.

Who needs FORM L-32 SOLVENCY MARGIN - KT 3?

01

Insurance companies and financial institutions required to demonstrate financial stability.

02

Regulatory agencies requiring solvency margin information for oversight purposes.

03

Stakeholders and investors who need assurance of the company's solvency.

Fill

form

: Try Risk Free

People Also Ask about

What is a good solvency margin?

While all non-life insurers are required to follow the regulations, life insurance companies are expected to maintain a 150% solvency margin. All insurance companies have to pay claims to policy holders.

What is the solvency ratio 150?

As per IRDAI's Mandate, the ideal solvency ratio in insurance is 150% which means that the insurance has assets equal to 1.5 times its liabilities. That is. For every 100 rupees of liabilities, the insurance company should have 150 rupees in its assets.

Is it better to have high or low solvency?

Is a High Solvency Ratio Good? A high solvency ratio is usually good as it means the company is usually in better long-term health compared to companies with lower solvency ratios.

What does the solvency margin indicate?

Put simply, it indicates how solvent a company is, or how prepared it is to meet unforeseen exigencies. It is the extra capital that an insurance company is required to hold.

Is a 2.5 solvency ratio good?

For context, a ratio of 1 to 1.5 is too low to be considered favorable. Instead, you should aim to see 2 or 2.5 for this solvency ratio. Now, keep in mind that a high debt-to-equity ratio doesn't necessarily mean that a business can't pay off debt.

What is the solvency margin of HDFC Life?

Adequate capital position: HDFC Life maintains adequate capital position, which is reflected in healthy solvency margin of over 1.8 times maintained for the last 12 quarters. As on December 31, 2024, the company reported solvency margin of 1.88 times (1.87 times as on March 31, 2024).

What does a 1.5 solvency ratio mean?

The solvency ratio helps you know whether the company can manage its financial responsibilities effectively. As per the existing IRDAI mandate, all insurance companies need to maintain a solvency ratio of 1.5 or a solvency margin of 150%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

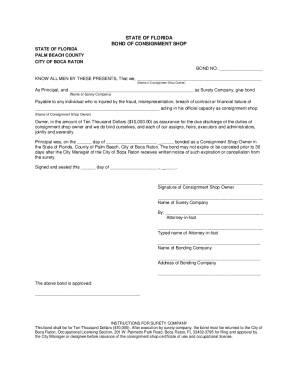

What is FORM L-32 SOLVENCY MARGIN - KT 3?

FORM L-32 SOLVENCY MARGIN - KT 3 is a regulatory document used by insurance companies to report their solvency margin, which is the excess of assets over liabilities. It ensures that insurers maintain adequate reserves to meet future policyholder claims.

Who is required to file FORM L-32 SOLVENCY MARGIN - KT 3?

All licensed insurance companies and insurers operating within the jurisdiction that require compliance with solvency margin regulations are mandated to file FORM L-32 SOLVENCY MARGIN - KT 3.

How to fill out FORM L-32 SOLVENCY MARGIN - KT 3?

To fill out FORM L-32 SOLVENCY MARGIN - KT 3, insurers must provide financial information regarding their assets, liabilities, and capital reserves as per the designated format. This typically includes calculations to demonstrate the solvency margin, along with supporting documentation.

What is the purpose of FORM L-32 SOLVENCY MARGIN - KT 3?

The purpose of FORM L-32 SOLVENCY MARGIN - KT 3 is to ensure that insurance companies maintain sufficient financial resources to cover their liabilities and protect policyholders, thereby promoting the stability of the insurance market.

What information must be reported on FORM L-32 SOLVENCY MARGIN - KT 3?

FORM L-32 SOLVENCY MARGIN - KT 3 requires reporting on total assets, total liabilities, solvency margin calculations, and any additional required financial metrics as specified by regulatory authorities.

Fill out your form l-32 solvency margin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form L-32 Solvency Margin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.