Get the free Non-Host Country Resident Personal Services Contract - files peacecorps

Show details

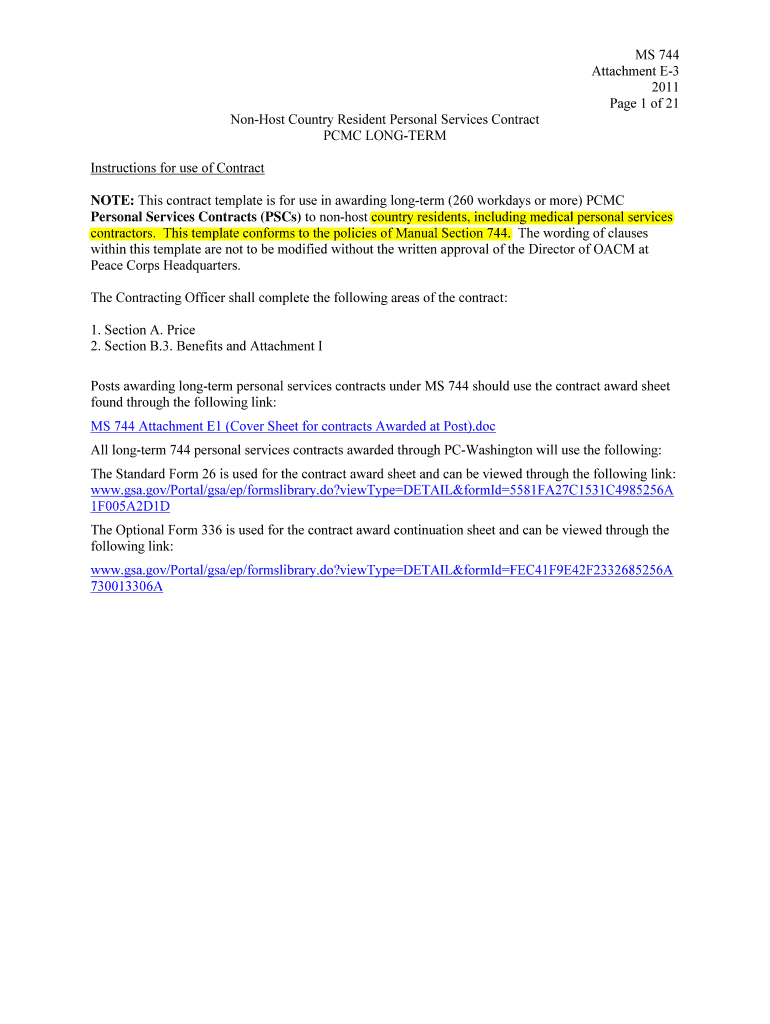

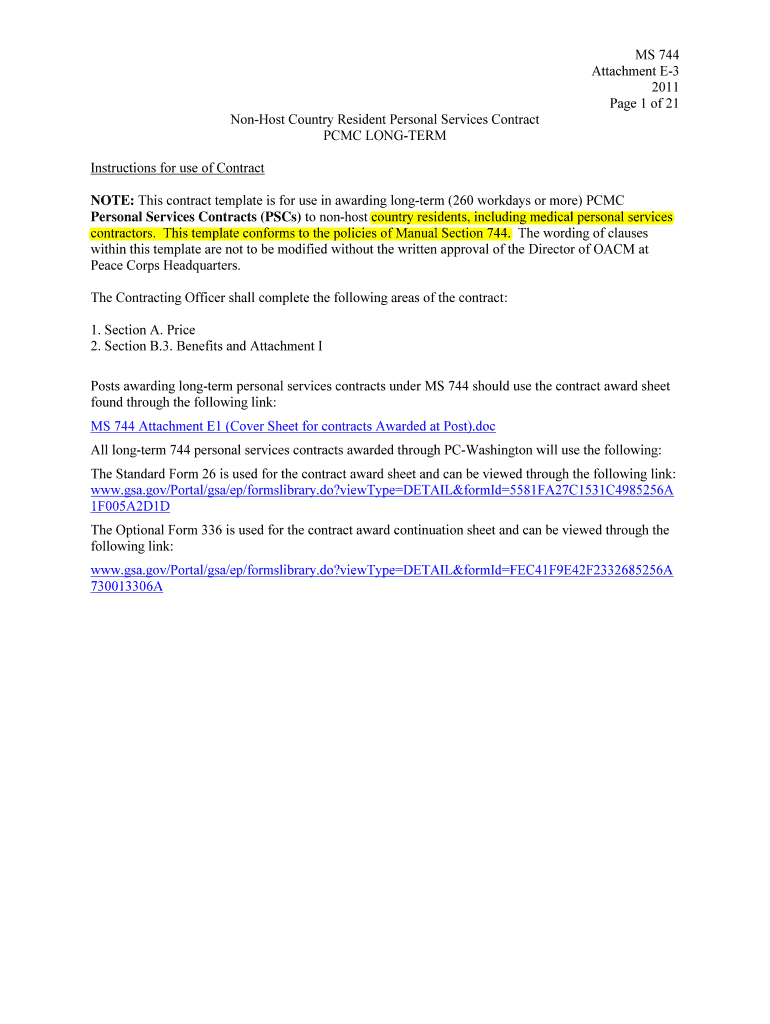

This document serves as a template for awarding long-term personal services contracts (PSCs) to non-host country residents including medical personal services contractors, conforming to Peace Corps

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-host country resident personal

Edit your non-host country resident personal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-host country resident personal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-host country resident personal online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit non-host country resident personal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-host country resident personal

How to fill out Non-Host Country Resident Personal Services Contract

01

Begin by gathering all necessary personal information, including your name, address, and identification number.

02

Identify the contracting party, typically an organization needing services, and provide their details.

03

Clearly define the scope of services you will provide in the contract.

04

Set the duration of the contract, including start and end dates.

05

Specify the payment terms, including the amount, frequency, and method of payment.

06

Include clauses regarding confidentiality and non-disclosure if required.

07

Ensure both parties agree on termination conditions and procedures.

08

Review all terms and conditions to ensure clarity and understanding.

09

Sign and date the contract, ensuring both parties retain a copy.

Who needs Non-Host Country Resident Personal Services Contract?

01

Individuals or companies offering personal services while residing in a country different from the one where the services are rendered.

02

Freelancers and consultants working for international organizations.

03

Professionals who require a formal agreement to outline the terms of their services for legal and payment purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the US PT Tax Treaty?

The U.S.-Portugal Tax Treaty prevents double taxation, reduces withholding tax rates on dividends, interest, and royalties, and defines tax jurisdiction for various income types.

What is compensation for dependent personal services performed in the United States?

Compensation for dependent personal services includes amounts paid as wages, salaries, fees, bonuses, commissions, compensatory scholarships, fellowship Income, and similar designations for amounts paid to an employee. Note.

What is personal services income in the USA?

Personal services include any activity performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health (including veterinary services), law firms, and the performing arts.

How to submit form 8233?

When the nonresident alien individual gives you Form 8233, review it to see if you are satisfied that the exemption from withholding is warranted. If you are satisfied, based on the facts presented, complete and sign the certification in Part IV. You can also fax Form 8233 to 877-824-9781 or 267-466-1365.

What is compensation for personal services?

Personal services income (PSI) is income produced mainly from an individual's personal skills or efforts.

What is compensation for dependent personal services?

Key characteristics of dependent personal services include: Employer-Employee Relationship: The individual works under the direction and control of an employer. Regular Remuneration: Income is typically received in the form of wages, salaries, or similar compensation.

What is the foreign income exclusion for nonresident aliens?

The FEIE allows qualifying individuals to exclude up to $130,000 of foreign-earned income for the 2025 tax year. To qualify for the foreign earned income tax exclusion, individuals must meet either the bona fide residence test or the physical presence test, and have a tax home in a foreign country.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Host Country Resident Personal Services Contract?

A Non-Host Country Resident Personal Services Contract is an agreement between a service provider who is not a resident of the host country and a client or organization in that country to provide specific personal services, typically involving specialized skills or knowledge.

Who is required to file Non-Host Country Resident Personal Services Contract?

Typically, individuals or entities that are providing services in a host country while being residents of another country are required to file the Non-Host Country Resident Personal Services Contract.

How to fill out Non-Host Country Resident Personal Services Contract?

To fill out a Non-Host Country Resident Personal Services Contract, one must provide detailed information about the service provider, including their personal details, the nature of the services being provided, the duration of the contract, compensation details, and any applicable legal requirements or signatures.

What is the purpose of Non-Host Country Resident Personal Services Contract?

The purpose of the Non-Host Country Resident Personal Services Contract is to outline the terms and conditions under which the non-resident service provider will deliver services, ensuring compliance with local laws and regulations while protecting the rights of both the provider and the client.

What information must be reported on Non-Host Country Resident Personal Services Contract?

The information that must be reported on a Non-Host Country Resident Personal Services Contract includes the names and addresses of both parties, a description of the services to be provided, duration of the contract, payment terms, and any relevant legal clauses pertaining to disputes or terminations.

Fill out your non-host country resident personal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Host Country Resident Personal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.