Get the free Transmittal Form for Late Fee Journal Entry - internationalservices rutgers

Show details

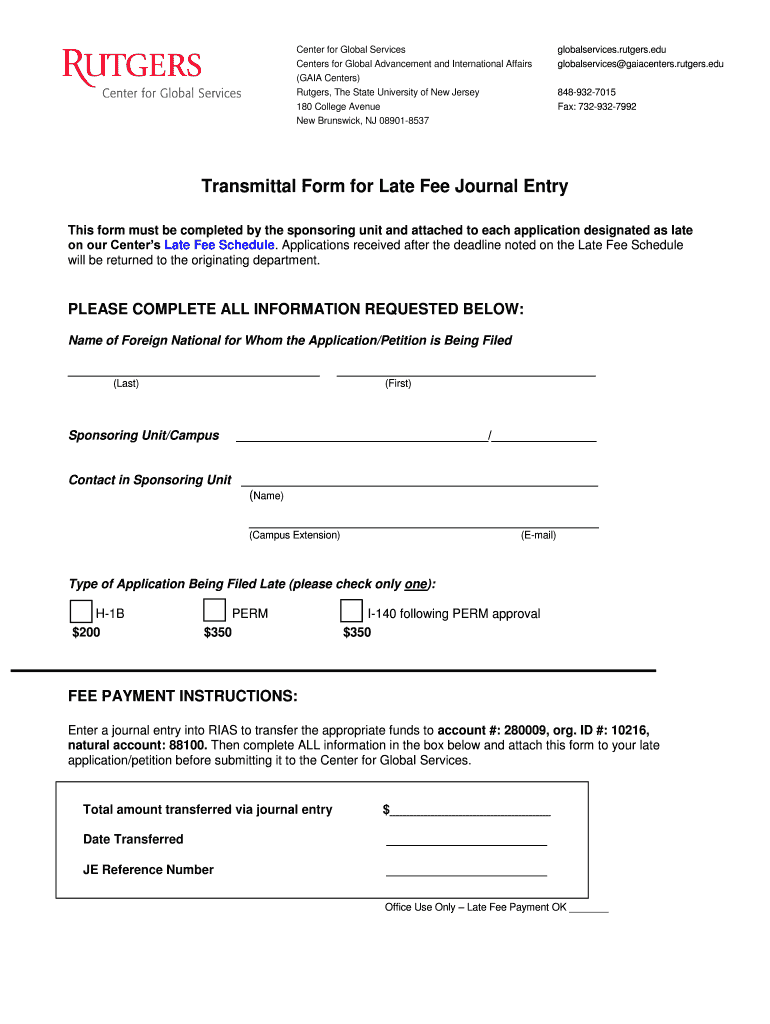

This form is used to submit applications that are filed late and include a late fee payment. It requires information about the foreign national, sponsoring unit, and the type of application being

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transmittal form for late

Edit your transmittal form for late form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transmittal form for late form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transmittal form for late online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit transmittal form for late. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transmittal form for late

How to fill out Transmittal Form for Late Fee Journal Entry

01

Obtain a copy of the Transmittal Form for Late Fee Journal Entry.

02

Fill in the date at the top of the form.

03

Provide the name of the department submitting the form.

04

Enter the reference number for the late fee journal entry.

05

List the names and identification numbers of any affected accounts.

06

Detail the amount of the late fee being assessed.

07

Include any pertinent notes or explanations regarding the late fee.

08

Attach supporting documentation, if required.

09

Sign and date the form at the bottom.

10

Submit the completed form to the designated authority.

Who needs Transmittal Form for Late Fee Journal Entry?

01

Accounting staff responsible for processing late fees.

02

Financial departments that manage billing and collections.

03

Any employee handling journal entries for financial records.

Fill

form

: Try Risk Free

People Also Ask about

How do I explain a late payment fee?

The invoice payment terms should detail when late fees are due and the rates applied. A simple example late fee phrase could be: “Invoice payment is due within 30 days. Please be advised that we will charge 1% interest per month on late invoices.”

How to write an application for late fee submission?

Key Points and Tips for Late Fee Applications Keep your letter brief, polite, and honest. Mention the specific reason for the delay. Avoid blaming others or using harsh language. If applying due to illness or financial crisis, attach proof if possible. Always mention your name, class, and roll number.

How to charge a late fee?

To add a late fee, you generally need prior agreement or a contract amendment accepted by both parties. Sending an additional invoice with a late fee without consent may lead to disputes. It's advisable to communicate clearly in writing, referencing the overdue amount and any agreed payment terms.

How to charge a late payment fee?

To charge a late payment fee, you need to include those payment expectations within your original sales agreement — it's not something you can add at the last minute. Additionally, when charging a late fee penalty, the original invoice should list both the payment due date and the late payment fee.

What is a late fee in accounting?

A late fee on your invoices If your client doesn't pay your invoice by the due date, you can charge a late fee. This is a fixed one-off charge, usually around 1-2% of the invoice amount. There might be rules in your country about how much you can charge, and it might also depend on the invoice amount.

How to word late payment fee on invoice?

A simple example late fee phrase could be: “Invoice payment is due within 30 days. Please be advised that we will charge 1% interest per month on late invoices.” If a customer is late paying an invoice, you can then follow up with a late fee letter.

How much should I charge for a late payment fee?

What Is A Reasonable Late Payment Fee? Typically, a low, percentage-based late fee is used when a payment is overdue on an invoice. Late fees usually range from 1% to 2% monthly interest rate, so staying near that range is the most reasonable approach.

How to charge late payment fees?

Late fees should be included in your payment terms. This is a section on the invoice that explains how the customer should make the payment and any other special conditions of the sale. The late fees should be easy to understand and within the legal amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transmittal Form for Late Fee Journal Entry?

The Transmittal Form for Late Fee Journal Entry is a document used to report and request approval for late fee adjustments in accounting records.

Who is required to file Transmittal Form for Late Fee Journal Entry?

Individuals or entities that have incurred late fees and wish to rectify their financial records are typically required to file the Transmittal Form for Late Fee Journal Entry.

How to fill out Transmittal Form for Late Fee Journal Entry?

To fill out the form, provide details such as the date of the transaction, the reason for the late fee, the amount being adjusted, and any supporting documentation.

What is the purpose of Transmittal Form for Late Fee Journal Entry?

The purpose is to document late fee charges, request their approval for adjustments, and maintain accurate financial accounting records.

What information must be reported on Transmittal Form for Late Fee Journal Entry?

The form must report the late fee amount, the account involved, the reason for the fee, relevant dates, and any necessary signatures or approval information.

Fill out your transmittal form for late online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transmittal Form For Late is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.