Get the free CALCULATE YOUR REBATE 8 - btomillerbbcomb

Show details

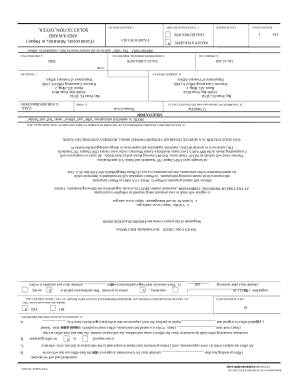

DECEMBER 1, 2014, THROUGH FEBRUARY 28, 2015. VALID PURCHASE DATES: MAIL COMPLETED FORM WITH PROOFS OF PURCHASE TO: SAVE UP TO $8 PER CASE on GOLD MEDAL MIXES (After Rebate) General Mills Food service

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calculate your rebate 8

Edit your calculate your rebate 8 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calculate your rebate 8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing calculate your rebate 8 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit calculate your rebate 8. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calculate your rebate 8

How to fill out calculate your rebate 8:

01

Start by gathering all the necessary information and documents needed to calculate your rebate. This may include receipts, invoices, and any other relevant financial information.

02

Next, access the calculate your rebate 8 tool either online or through a software program. Make sure you have a secure and stable internet connection or a reliable software application.

03

Provide the required input data into the calculate your rebate 8 tool. This may include entering the transaction amount, the applicable rebate rate, and any other specific details mentioned in the instructions.

04

Double-check all the entered information for accuracy and completeness. Even a small mistake can lead to incorrect calculations, so it's crucial to be thorough.

05

Once all the necessary information has been entered, click the calculate button or follow the prompts to obtain the calculated rebate amount.

06

Review the calculated rebate amount, ensuring it aligns with your expectations and meets any requirements or guidelines set forth by the issuing party.

07

If you are happy with the calculated rebate amount and confident in its accuracy, record the rebate information in your records and use it as needed for reporting or financial analysis purposes.

08

Seek professional advice or consult with a financial expert if you have any questions or uncertainties about the rebate or its calculation. They can provide guidance and support to ensure accuracy and compliance.

Who needs calculate your rebate 8:

01

Individuals who have made eligible purchases and are entitled to a rebate according to the terms and conditions set forth by the offering party.

02

Businesses or organizations that offer rebates as a promotional or incentive program to their customers or clients.

03

Finance or accounting professionals who are responsible for calculating and managing rebates as part of their job responsibilities.

04

Anyone wishing to track and analyze their spending habits and potential savings through rebates to make informed financial decisions.

05

Individuals or organizations involved in rebate programs, such as retailers, manufacturers, and service providers, who need to administer, track, and calculate rebates for their customers or clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my calculate your rebate 8 directly from Gmail?

calculate your rebate 8 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit calculate your rebate 8 in Chrome?

calculate your rebate 8 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out calculate your rebate 8 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign calculate your rebate 8 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is calculate your rebate 8?

Calculate your rebate 8 is a form used to determine the amount of rebate a person is eligible to receive.

Who is required to file calculate your rebate 8?

Individuals who have made qualifying purchases or met certain criteria set by the rebate program are required to file calculate your rebate 8.

How to fill out calculate your rebate 8?

Calculate your rebate 8 can be filled out by providing information about the qualifying purchases made and following the instructions provided on the form.

What is the purpose of calculate your rebate 8?

The purpose of calculate your rebate 8 is to calculate the amount of rebate a person is eligible to receive based on their qualifying purchases.

What information must be reported on calculate your rebate 8?

Information such as the date of purchase, item purchased, purchase amount, and any other relevant details must be reported on calculate your rebate 8.

Fill out your calculate your rebate 8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calculate Your Rebate 8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.