Get the free cogins maltese

Show details

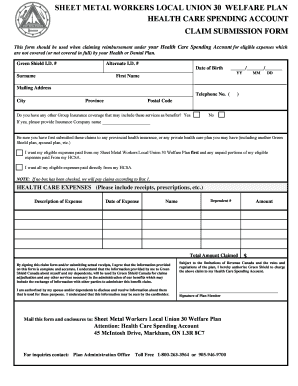

Vs tax Sales Agreement IN CONSIDERATION of the sum of $, received by Gina M. Evans & Cory J. Evans, Sr. (coginsmaltese.com×, (Seller) whose address is 3160 US HWY 6 E. Fremont, Ohio 43420 (Buyer)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cogins maltese form

Edit your cogins maltese form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cogins maltese form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cogins maltese form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cogins maltese form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cogins maltese form

How to fill out cogins maltese?

01

Start by gathering all necessary documents and information. This typically includes the horse's identifying information, such as name, age, breed, and color, as well as the owner's contact details and any other relevant information.

02

Fill out the owner section of the cogins maltese form. Provide your full name, address, phone number, and email address. Make sure to double-check the accuracy of the contact information.

03

Complete the horse section of the form. Provide the horse's name, age, breed, color, and any other requested details. If the horse has any specific markings or distinguishing features, be sure to include them as well.

04

Provide the necessary information regarding the horse's previous EIA test results, if applicable. This may include the date of the last test and the results obtained.

05

If the horse has previously tested positive for EIA, some additional information may be required. This can include the date of the positive test result, the actions taken to mitigate the risk, and any other relevant details.

06

Sign and date the cogins maltese form. By signing, you are confirming that the information provided is accurate and complete to the best of your knowledge.

Who needs cogins maltese?

01

Horse owners who plan on transporting their horses across state lines typically need cogins maltese. This document serves as proof of a negative Equine Infectious Anemia (EIA) test, which is required by many states to prevent the transmission of this contagious viral disease.

02

Event organizers or facilities that host horse-related activities, such as shows, races, or auctions, may also ask for cogins maltese to ensure that the participating horses are free from EIA and, therefore, reduce the risk of spreading the disease.

03

Veterinarians may require cogins maltese for routine bloodwork or in cases where there is a need to verify the EIA status of a horse.

In summary, filling out the cogins maltese involves providing accurate and complete information about the horse and owner, including any previous EIA test results. This document is needed by horse owners who plan on transporting their horses across state lines, as well as event organizers, facilities, and veterinarians who want to ensure a safe and disease-free environment for horses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cogins maltese form?

The editing procedure is simple with pdfFiller. Open your cogins maltese form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out cogins maltese form using my mobile device?

Use the pdfFiller mobile app to fill out and sign cogins maltese form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete cogins maltese form on an Android device?

Complete cogins maltese form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is cogins maltese?

Cogins Maltese is a tax form that must be filed by individuals who have income from sources in Malta.

Who is required to file cogins maltese?

Any individual who has income from sources in Malta is required to file Cogins Maltese.

How to fill out cogins maltese?

Cogins Maltese can be filled out online or on paper, and it requires the individual to report their income from Malta sources.

What is the purpose of cogins maltese?

The purpose of Cogins Maltese is to report income from sources in Malta and ensure individuals pay the correct amount of tax.

What information must be reported on cogins maltese?

The information that must be reported on Cogins Maltese includes income from Malta sources, deductions, and any taxes paid.

Fill out your cogins maltese form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cogins Maltese Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.